Posts Tagged ‘OddsMaker’

Optimizing Trade Strategies: A Step-by-Step Guide Using Trade Ideas

Trading in the stock market requires a well-defined strategy backed by robust analysis and optimization. Trade Ideas, a powerful trading platform, offers comprehensive tools to help traders refine their approach and improve their win rates. In this blog, we’ll walk through a step-by-step process of optimizing a trading strategy using Trade Ideas’ backtesting and optimization…

Read MoreThe Story of a Struggling Trader Becoming a Profitable One

Trade Ideas OddsMaker [Thanks to contributor Michael Nauss for this excellent article. Please visit his YouTube page (http://www.youtube.com/bonpara) to see more ways Michael uses Trade Ideas in his profitable practice.] – Ed Introduction I have been using Trade Ideas since 2006 where when in university I took a trainee trading position. Back then, when the…

Read MoreMake the Market Work for You

Counter Trend Trading: Inviting Your Ego to Trade Today while trading and discussing trading on Stocktwits, I came across a very interesting article written by Dr. Brett Steenbarger. This article discusses the compulsion some traders have to counter trend trade. Traders who counter trend trade are sometimes called contrarians. The reason I wanted to blog…

Read MoreSteenbarger Inspired Strategy: Trade the Transitions

Great strategies align themselves with vetted and observable themes in the market. Strategy comes from taking a stand based on what you perceive are demonstrative behaviors in the recent market and then submitting that position to the market’s cross examination – you’ll come out smelling like a rose or its fertilizer. The nice thing with…

Read MoreFibonacci Long 1st 30 Minutes = 88% Odds in Your Favor: TASC Trader’s Tip September

Traders’ Tips: September Issue “Now, you listen to me! I want it reopened right now. Get those brokers back in here! Turn those machines back on!” Mortimer Duke, Trading Places (1983) This month’s Traders’ Tips concerns pivot points. While researching an appropriate strategy for this month, we discovered a stock trading strategy based, in part,…

Read More200 Day SMA Good Support for a Swing Trade: August TAS&C Traders’ Tips

Traders’ Tips August Issue “It’s not being wrong that kills you, it’s staying wrong that kills you.” Jeff Macke, Trader For this month’s Traders’ Tips, we offer a stock trading strategy based, in part, on the position of a stock near its 200 day Moving Average. Specifically this strategy discovers that in today’s market the…

Read MoreTrailing Resistance & Support Stops: TAS&C July Traders’ Tips

Traders’ Tips July Issue of Technical Analysis of Stocks & Commodities “Eventually, luck runs out; skill does not.” Scalper68 (AlexD) In this month’s Traders’ Tips, Sylvain Vervoort offers a 3rd trailing stop method, called a trailing resistance & support stop, which evaluates price movements or ‘turning points’. This 3rd trailing stop method most closely resembles…

Read MoreShow Your Colors, Take Some Credit

With the recent website redesign comes a roll of new banners that hopefully convey the value we bring to the trade decision process. If you agree and one of these banners resonates with you, feel free to place them on your blog or social media outlet. They come in several shapes and forms. Anyone who…

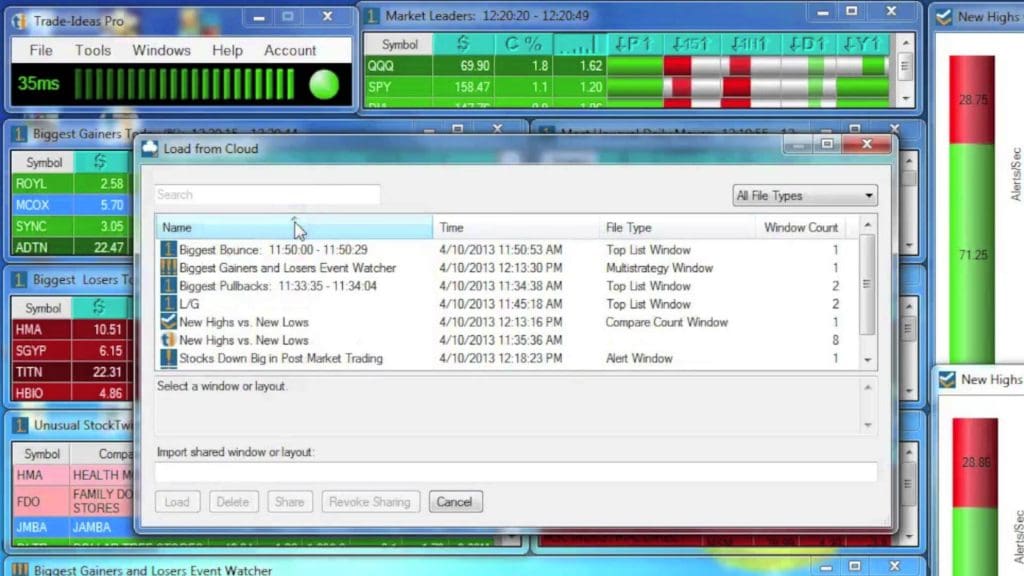

Read MoreMailbag: Bot Trading Manages Risk at the Open

The Open and its frenzied activity can reward as well as punish traders. The difference between these two groups comes down to experience certainly, but also the insight and quick decisions that new tools (especially automation) can bring to bear. From the Mailbag (Support Forum) came a question about such topics that I want to…

Read MoreThis Strategy’s Winners Are 5x Greater Than Its Losers – Explanation:

I gave a solid presentation to traders online in a DTI chat room this afternoon. DTI offers educational services across all instruments but specialize in equities, commodities, and futures. They are lead by the talented Tom Busby and Jeanette Sims. The format I used involved soliciting requests for favorite chart patterns ahead of my talk…

Read More