Options Volume Today

Table of Contents

- Understanding the Options Volume Today in Contracts Filter

- Options Volume Today in Contracts Filter Settings

- Using the Options Volume Today in Contracts Filter in Trading

- FAQs about Options Volume Today in Contracts

Understanding the Options Volume Today in Contracts Filter

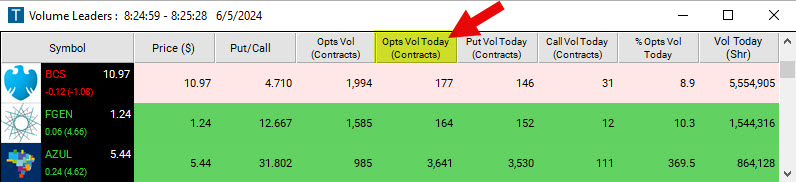

The Options Volume Today (Contracts) Filter enables traders to find stocks based on the number of options traded so far today. It measures the number of options contracts, both puts and calls.

Options Volume Today in Contracts Filter Settings

Activating the Options Volume Today (Contracts) Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that have already traded at least 7,000 option contracts today, add the Options Volume Today (Contracts) Filter to your scan and enter 7000 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that have traded no more than 50,000 puts and calls today, add the Options Volume Today (Contracts) Filter to your scan and enter 50000 in the maximum field in the Windows Specific Filters Tab.

-

To find stocks that have already traded between 75,000 and 200,000 option contracts today, add the Options Volume Filter to your scan and enter 75000 in the minimum field and 200000 in the maximum field in the Windows Specific Filters Tab.

Using the Options Volume Today in Contracts Filter in Trading

The Options Volume Today (Contracts) Filter gives traders a snapshot of the current day's option activity. It can serve as an essential piece of a multifaceted scanning strategy when combined with other filters. Here's how traders could use it:

-

Liquidity Check: For intraday traders, understanding the day's options volume provides an immediate sense of liquidity. A higher number of contracts traded can imply tighter bid-ask spreads, facilitating smoother entry and exit points.

-

Integrating with Price Action Filters: If a trader's scan involves looking for stocks with specific price action—like breakouts or pullbacks—adding the current options volume can further refine the list. For instance, among stocks showing a bullish breakout, those with a high number of option contracts for the day might be receiving heightened attention and could offer more reliable entry points.

-

Complementing Sentiment Indicators: While the volume doesn't differentiate between puts and calls, when combined with the Put Volume Today Filter and Call Volume Today Filter, traders can get a clearer picture of the market's sentiment. A stock showing bullish technical indicators, paired with high options volume, could strengthen a trader's bullish bias.

-

Refining Other Volume Indicators: When combined with stock trading volume filters, this options filter can help highlight stocks where not only the shares but also the options are in demand. This dual-volume interest can sometimes signal increased institutional interest or forthcoming volatility.

-

Supporting News or Event-Based Scans: If a trader is scanning for stocks reacting to the day's news or specific market events, the Options Volume Today filter can help identify which of those stocks also have a notable options activity. This can be a sign that the news or event has a tangible impact on trader sentiment.

-

Enhancing Sector-specific Scans: For traders focusing on specific sectors, this filter can help shortlist stocks within that sector receiving the most options attention on that day. This can be particularly useful during sector rotations or when external factors (like regulatory news) affect a sector.

FAQs about Options Volume Today in Contracts

If I'm only interested in stocks with very active options trading, how can I use this filter?

You can set a high minimum value, say 100,000 contracts, to only see stocks with heavy options trading activity for that day.

Is there a way to differentiate between puts and calls with this filter?

No, this filter collectively counts both puts and calls. To differentiate, use the Put Volume Today Filter and the Call Volume Today Filter.

How can I determine if the options volume for a stock is unusual or noteworthy?

On its own, this filter only provides the day's option volume without historical context. To understand if the volume is unusual, you'd use the Options Volume Today % Filter.

Can I combine the Options Volume Today (Contracts) Filter with other filters for more refined results?

Absolutely. This filter is especially useful when combined with other criteria like price action indicators, sentiment measures, stock trading volume, or sector-specific filters. By doing so, you can obtain a more comprehensive and targeted list of potential trading opportunities.

Is the Options Volume Today (Contracts) Filter useful for long-term investors or only for day traders?

While intraday traders might use it more frequently to gauge daily liquidity and interest, long-term investors can also find it beneficial, especially during specific events or when assessing options strategies like covered calls.

How does the Options Volume Today (Contracts) Filter help in understanding liquidity?

A higher options volume implies more trading activity and, often, tighter bid-ask spreads. This can indicate that there's ample interest in the stock's options, making it easier for traders to initiate or close positions without significant price slippage.

If I see a stock with high options volume but no significant price movement, what could it imply?

High options activity without a corresponding price change might suggest anticipation. Traders could be positioning for an expected move, possibly based on upcoming events, news, earnings, or other speculations.

Does a higher options volume necessarily mean a bullish sentiment for the stock?

No, a higher options volume does not inherently suggest a bullish or bearish sentiment. It only indicates heightened activity. The volume could be from either call options (typically bullish) or put options (typically bearish), or a mix of both. To ascertain sentiment, one would need to look at the volume of puts versus calls, which you can do by using the Put Volume Today Filter and the Call Volume Today Filter.

How does the options volume impact the implied volatility of options?

While options volume itself doesn't directly affect implied volatility (IV), a surge in options trading can be a reaction to increased IV or anticipated events. In scenarios where there's a substantial increase in demand for options (especially out-of-the-money ones), it might push IV higher, making those options more expensive.

What are the potential pitfalls or limitations of relying too heavily on this filter?

Using only the Options Volume Today (Contracts) Filter might provide an incomplete picture as it doesn't differentiate between puts and calls or offer historical context. It's crucial to use it in conjunction with other analysis tools and filters to avoid making decisions based solely on the day's options activity. Use our additional option filters, likethe Options Volume Today % Filter, the Put Volume Today Filter, the Call Volume Today Filter and the Put/Call Ratio Filter to get a more comprehensive picture.

Filter Info for Options Volume Today [PCTV]

- description = Options Volume Today

- keywords =

- units = Contracts

- format = 0

- toplistable = 1

- parent_code =

Options Volume Today [PCPV]

Options Volume Today [PCPV]