Running Up (intermediate)

Table of Contents

- Understanding the Running Up Intermediate Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

Understanding the Running Up Intermediate Alert

This offers a middle ground between the volume confirmed versions of the running alerts and faster versions. Watching the confirmed running alerts, or any of the volume confirmed alerts we offer, is similar to watching a week's worth of 15 minute candles. Watching the faster running alerts is similar to watching 90 seconds worth of data on a tick chart. Watching the intermediate running alerts is similar to watching 25 minutes of 30 second candles. Of course, we continuously monitor the tick data, not candles, but this gives you an idea of the time frame for each alert.

Like the other types of running alerts, this alert points out stocks that are moving more quickly and more consistently than normal. Normal is defined by the intraday volatility over the past two weeks. At a high level, the three pairs of alerts are all looking for the same thing. In practice we need different algorithms to work on each time scale.

In some ways the intermediate alerts are more closely related to the volume confirmed alerts than to the faster running alerts.

-

The intermediate and volume confirmed versions of the alerts smooth the data out before commenting on the trend. This prevents any one unusual print from causing an alert, no matter how unusual it is. The cost of this extra filtering is that it can take longer to report a valid change to the trend. This is analogous to watching a moving average, rather than the current price.

-

The intermediate and volume confirmed alerts look at different time scales within their field of view. The price does not have to go up consistently for a whole week to generate a volume confirmed running up alert and it does not have to go up consistently for 25 minutes to generate an intermediate running up alert. The price can go up for a shorter period of time, but it will have to go up more quickly to generate the alert. It takes a combination of speed (in pennies per second) and consistency to generate these alerts; more of one can compensate for less of the other.

-

The alert specific filters associated with the intermediate and volume confirmed running alerts are more precise than the corresponding filters for the faster running alerts. Because the faster alerts try to report on a move as soon as it happens, they can't say as precisely how big it will be. By waiting a little longer, the server can give a more precise description of the trend.

In some ways the intermediate alerts are more closely related to the faster running alerts than to the volume confirmed running alerts.

-

The intermediate and faster alerts are very sensitive to time and pay relatively little attention to volume. The timescale of the volume confirmed alert changes when volume is low. Volume confirmed alerts might trigger more slowly, or not at all, if the volume is too low. The others will always trigger at about the same speed, with little regard to volume.

-

The intermediate and faster alerts pay close attention to the inside market. Before judging the strength of the move, these alerts subtract the size of the spread from the size of the move. Prints trading above and below the inside market don't count toward the trend. We use the inside market as type of confirmation which is weaker yet faster than volume confirmation.

The intermediate running alerts include a model for how much a stock normally moves in a given amount of time, based on that stock's volatility. This is similar to the models used by the other running alerts. The stock price must move at least twice as far as expected in the given time period or no alert will be generated.

Default Settings

By default, the 'Running Up (intermediate)' alert will appear when the stock price moves up at least twice as far as expected in the given time period. The user can require a higher standard, as described below.

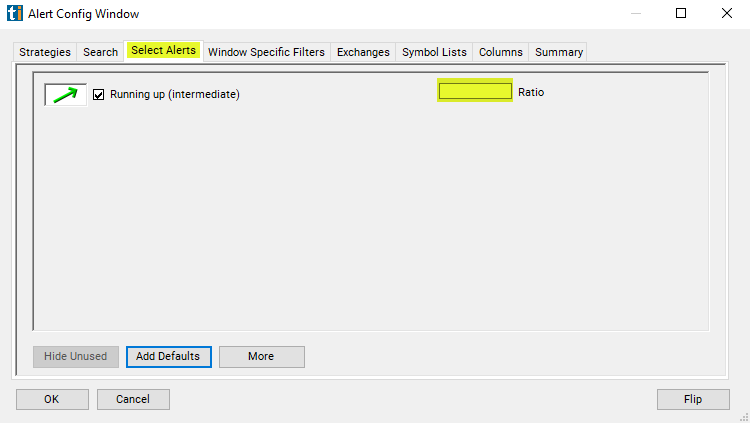

Custom Settings

For 'Running Up (intermediate)' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive. This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'Running Up (intermediate)', the user can set minimum standards, above those built into the alerts server. Each time the server reports an alert, it divides the current value of the property by the historical value for the property. The user can specify a minimum value for this ratio.

Roughly 30% of these alerts represent stocks moving at less than 2.4 times the expected rate. Roughly 40% are for stocks trading 2.6 times the expected rate. 50% represent stocks at 2.9 times expectations. 60%, 3.2 times expectations. 70%, 3.7 times expectations. 90%, 6.6 times expectations.

These numbers can vary from one day to the next based on what the market is doing that day. However, if you set the minimum to 6.6, you will see only about 10% of the alerts that you would see if you did not set a value for the filter. You will see only the most active stocks. If you set the filter to 3.2, you will see about 40% of the alerts that are available.

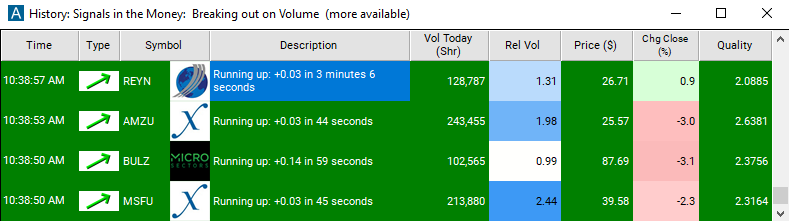

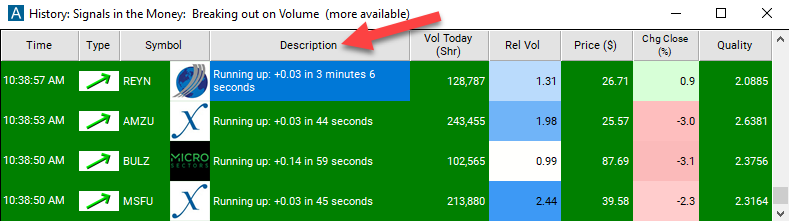

Description Column

The description of the alert will report how much the price has run up in how many seconds.

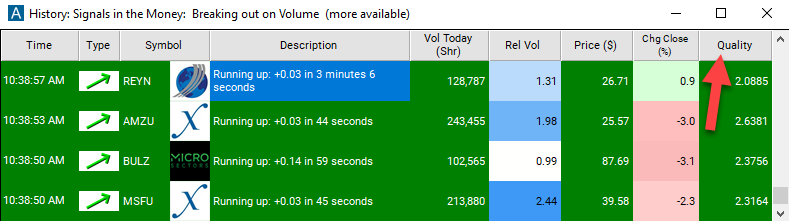

Quality Column

The quality value on a scan using the 'Running Up (intermediate)' alert represents the ratio between how fast we expected it to move versus how fast it actually moved. While the displayed value can exceed 10, this column represents the quality of upward movement based upon historical baselines. For example, a value of 6.6 means this alert falls within the top 10% of moves. If you set the filter to 3.2, you will see about 40% of the alerts that are available and a value of 10 provides you the top 1% of moves.

Alert Info for Running Up (intermediate) [RUI]

- description = Running up (intermediate)

- direction = +

- keywords = Price vs Time

- flip_code =

Running down (intermediate) [RDI]

Running down (intermediate) [RDI] - parent_code =