8 Period SMA Crossed Above 20 Period SMA (5 Minute)

Table of Contents

- Understanding the 8 Period SMA Crossed Above 20 Period SMA 5 Minute Alert

- Default Settings

- Description Column

Understanding the 8 Period SMA Crossed Above 20 Period SMA 5 Minute Alert

These alerts report when one intraday SMA crosses another. The server is constantly monitoring for an 8 period SMA crossing a 20 period SMA.

When a shorter term SMA crossed above a longer term SMA, most people call that a bullish signal. We report that case in green.

The server watches for these alerts in the 2, 5, and 15 minute time frames. Notice the large green number in each icon. This is the number of minutes in the time frame.

The short term SMAs (8 vs. 20) are usually used to describe shorter trends.

Like all analytics based on intra-day candles, the exact values of these formulas can vary from one person to the next. However, SMAs are naturally very stable. If the alert server reports a crossing, it is safe to say that the two SMAs are touching or at least very close. This alert condition will be easier to see on a chart if the stock is moving quickly; the SMAs for slower moving stocks often seem to overlap for a long time on a chart.

The server always reports crossings at the end of one candle and the start of the next.

The "8 Period SMA Crossed Above 20 Period SMA" alert in stock trading provides traders with several potential benefits:

Trend Reversal Signal: The crossover of the shorter-term 8-period SMA above the longer-term 20-period SMA is often interpreted as a bullish signal. It can suggest a potential reversal or shift in the overall trend, signaling the beginning of an upward price movement.

Early Entry Point: Traders using this alert may see it as an opportunity to enter a position early in a potential uptrend. Early identification of trend reversals allows traders to capture price movements at the beginning of a new trend, potentially maximizing profit potential.

Confirmation of Bullish Momentum: The crossover of shorter-term SMA above the longer-term SMA may be seen as confirmation of bullish momentum in the market. It suggests that recent price movements are strong enough to influence the short-term trend positively.

Simple Trend Following: Moving average crossovers, including the 8/20 SMA crossover, provide a straightforward and easy-to-understand approach to trend following. Traders who prefer simplicity in their analysis find these alerts valuable for identifying trend changes.

Objective Trading Signal: The alert is generated based on specific criteria (the crossover of two moving averages), providing an objective signal to traders. Objective signals can help reduce emotional decision-making and provide a systematic approach to trading.

Useful in Various Timeframes: This type of alert is applicable across different timeframes, allowing traders to adapt it to their preferred trading styles, whether they are day traders focusing on short-term movements or swing traders with a longer time horizon.

Default Settings

By default, this alert is triggered when the 8 period SMA crosses above the 20 period SMA in a 5 minute timeframe. To align with each alert, it's essential to utilize the corresponding time frame on the chart. For instance, this 80/20 crossover alert is visualized on the 5-minute candlestick chart.

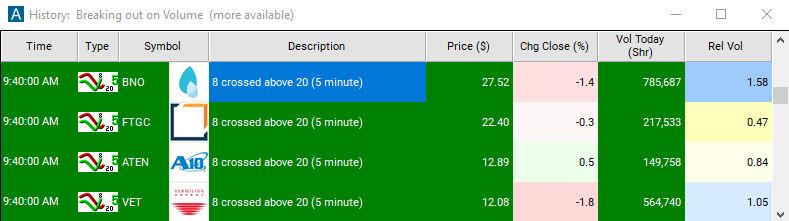

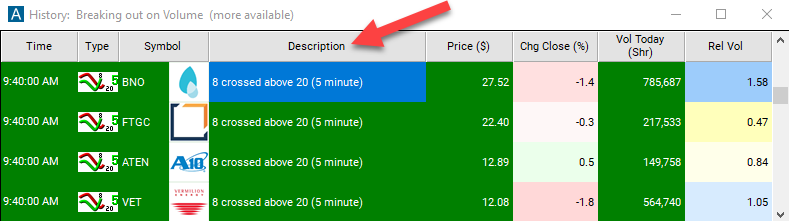

Description Column

The description column of this scan will display "8 Period SMA Crossed Above 20 Period SMA (5 Minute)", providing you with a clear indication of the specific alert that has been triggered.

Alert Info for 8 Period SMA Crossed Above 20 Period SMA (5 Minute) [ECAY5]

- description = 8 period SMA crossed above 20 period SMA (5 minute)

- direction = +

- keywords = End Of Candle Moving Average Fixed Time Frame

- flip_code =

8 period SMA crossed below 20 period SMA (5 minute) [ECBY5]

8 period SMA crossed below 20 period SMA (5 minute) [ECBY5] - parent_code = X5A8_1