3 Top Dividend Aristocrats Now

3 Top Dividend Aristocrats Now

By: Shane Neagle

Dividend Aristocrats are a group of 66 stocks in the S&P 500 Index that have grown their dividends for at least 25 consecutive years.

Most of these companies have achieved such long dividend growth streaks thanks to their strong business models, which are characterized by a meaningful business moat and resilience to recessions.

The following 3 Dividend Aristocrats are excellent considerations for income investors, based on their high dividend yields, attractive valuations, and long-term growth potential.

Archer-Daniels Midland (ADM)

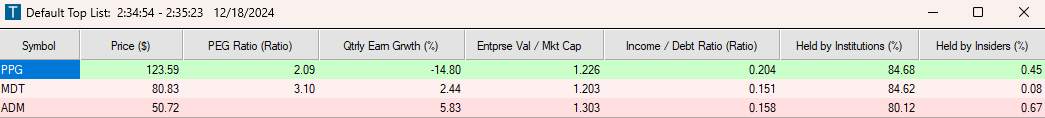

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. The company, founded in 1902, trades with a market capitalization of $25.2 billion. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

In the 2024 third quarter, the company reported adjusted net earnings of $530 million and adjusted EPS of $1.09, both down from the prior year due to a $461 million non-cash charge related to its Wilmar equity investment. Consolidated cash flows year-to-date reached $2.34 billion, reflecting strong operations despite market challenges.

The company also filed restated fiscal year 2023 reports, confirming no impact on consolidated results for 2023 or the first half of 2024. Looking ahead, ADM maintains its full-year adjusted EPS guidance of $4.50 to $5.00.

The acquisition of Ziegler Group and the establishment of a nutrition flavor research and customer center are expected to contribute to improved growth prospects. This positive outlook leads us to anticipate a feasible growth rate of approximately 3.0% for the future.

Another appealing facet of ADM’s business model is that it is recession-resistant, since the demand for food products is not cyclical. Archer Daniels-Midland is one of the most significant players in its industry and has competitive advantages due to its scale and geographical reach.

As a result of these competitive advantages, the company has a long history of dividend growth. The company has been increasing its dividend for 51 consecutive years and has a 5-year dividend growth rate of 7.4%.

The dividend payout ratio is not high, at only 25% based on 2023 earnings. Also, because the company’s profits performed well during the last recession, which saw earnings grow from $2.84 in 2008 to $3.06 in 2009, we believe that the dividend is relatively safe.

Medtronic plc (MDT)

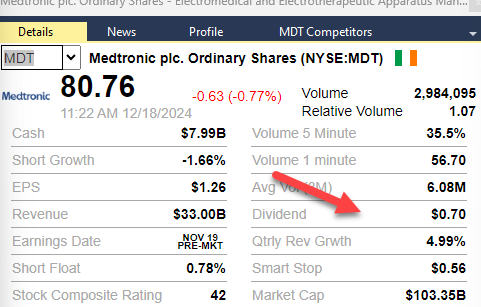

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 95,000 employees. Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. The company generated $32 billion in revenue in its last fiscal year.

In mid-November, Medtronic reported results for the fiscal-second quarter of fiscal 2025. Organic revenue grew 5% over the prior year’s quarter thanks to broad-based growth in all the four segments. Earnings-per-share grew 1%, from $1.25 to $1.26, and exceeded the analysts’ consensus by $0.01.

Since performance was slightly better than expected in the most recent quarter, the company raised its guidance for fiscal 2025. It expects 4.75%-5.0% organic revenue growth and raised its guidance for earnings-per-share to $5.44-$5.50. Notably, Medtronic has beaten the analysts’ estimates in 23 of the last 26 quarters.

Medtronic has grown its earnings-per-share by only 2.2% per year on average over the last nine years. This is a low growth rate but it has partly resulted from temporary headwinds, such as high inflation of raw materials costs, and supply chain issues. We expect MDT to grow its earnings-per-share by 7% per year over the next five years.

Share buybacks will add to EPS growth. The company has reduced its share count by roughly -1% per year on average over the last nine years. Moving forward, we anticipate that share repurchases will continue to aid bottom line growth to a small degree. In addition, Medtronic’s pipeline in new treatments could lead to further market share gains.

Medtronic has an exceptional dividend growth record, with 47 consecutive years of dividend growth. It has grown its dividend by 9.4% per year on average over the last decade and by 6.7% per year on average over the last 5 years.

Medtronic’s most compelling competitive advantage is its intellectual leadership in a complicated industry within the healthcare sector. Medtronic also has a strong product pipeline that should drive its growth for the foreseeable future.

MDT stock currently yields 3.3%.

PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin Williams and Dutch paint company Akzo Nobel. Today the company has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

With more than five decades of consecutive dividend increases, PPG Industries is a member of the Dividend Aristocrats and the Dividend Kings. The company generates annual revenues of more than $18 billion.

In the 2024 third quarter, revenue fell 1.5% to $4.57 billion. Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year.

Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Continuing a trend from prior periods, Aerospace demand was robust, with the business seeing record quarterly sales. Protective and Marine coatings and Automotive refinish were both higher for the period.

Shares are a continued catalyst for earnings-per-share growth. PPG Industries repurchased ~$200 million worth of shares during the quarter, bringing the year-to-date total to ~$500 million. For 2024, the company expects organic sales to be flat and adjusted earnings-per-share in a range of $8.15 to $8.30.

PPG Industries’ key advantage is that it is one of the most well-known and respected companies in the paints and coatings space. The company is also one of just three similarly-sized companies in this industry, which limits PPG Industries’ competitors. This gives PPG Industries size and scale and the ability to increase prices.

Even after more than five decades of dividend growth, PPG Industries has a very low payout ratio. The only time the company’s dividend payout ratio was above 50% for the year in the relatively recent past was 2009. The average payout ratio since then is just 34%, which leaves plenty of room for continued dividend growth.