The Power of Critical Thinking: The Secret Weapon of Successful Traders and Investors

The Power of Critical Thinking: The Secret Weapon of Successful Traders and Investors

By: Katie Gomez

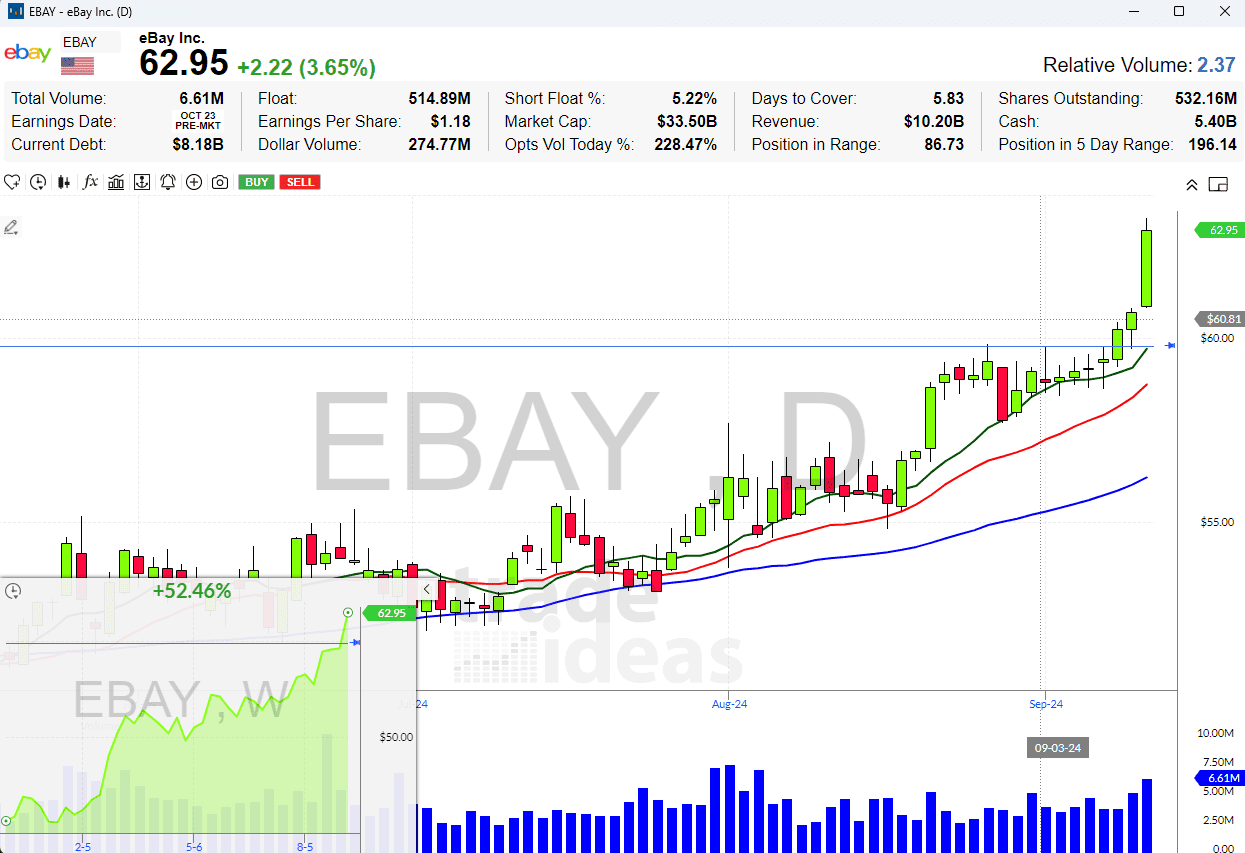

Picture this: You’re staring at your trading screen, a sea of red and green numbers flashing before your eyes. A promising stock has just announced unexpected news, and you have moments to decide whether to buy, sell, or hold. Your intuition screams one thing, but the data suggests another. In this crucial moment, what separates successful traders isn’t just quick reflexes or market knowledge—it’s the power of critical thinking.

While the trading world often glorifies intuition, patience, and split-second decision-making, a fundamental skill underpins all these: the ability to think critically. This overlooked superpower isn’t just another tool in a trader’s arsenal; it’s the foundation upon which all successful trading strategies are built. This article will explore why critical thinking is the secret weapon of top traders and investors, how it can transform your market approach, and practical ways to sharpen this essential skill. Prepare to discover how cultivating a critical mindset could be the game-changer your trading career needs.

How Critical Thinking Manifests Success

Critical thinking in trading and investing goes far beyond mere analysis of numbers and charts. It’s a multi-faceted skill that involves objectively analyzing information, questioning assumptions, and making logical, evidence-based decisions. In financial markets, critical thinking manifests as dissecting complex market data, evaluating information sources’ credibility, and synthesizing diverse viewpoints to form well-reasoned investment theses. It enables traders to look beyond surface-level trends and investigate the underlying factors driving market movements.

Unlike gut instinct, which relies on subconscious pattern recognition and can be influenced by cognitive biases, critical thinking is a deliberate, structured approach to decision-making. It involves systematically examining evidence, considering alternative explanations, and rigorously testing hypotheses before taking action. While intuition has its place in trading, critical thinking provides a robust framework for validating or challenging those instinctive impulses, helping traders navigate the fine line between insight and illusion in the ever-changing landscape of financial markets.

The Benefits of Critical Thinking for Traders and Investors

The benefits of critical thinking for traders and investors are numerous and significant. First and foremost, it dramatically improves decision-making processes by encouraging a more thorough and objective analysis of market conditions. This leads to better risk management as traders become more adept at identifying potential pitfalls and accurately assessing risk-reward ratios. Critical thinking also enhances one’s ability to analyze complex market data, allowing for a deeper understanding of market dynamics and identifying opportunities others might miss. Perhaps most importantly, it fosters increased emotional control and discipline, enabling traders to make rational decisions even in high-pressure situations rather than succumbing to fear or greed.

Critical thinking is all about seeing things from multiple angles. Since anxiety and fear stem from the lack of control, paranoia, and attachment to our trading decisions, traders must learn to see things from every angle. Harnessing this more skeptical mindset means imagining every possible series of events in your mind happening all at once. When traders live this way, nothing will surprise them. Skeptical thinking has saved countless investors from market pitfalls, such as those who critically examined the claims of companies like Theranos or Enron and avoided significant losses. Renowned investors like Warren Buffett and Ray Dalio are celebrated for their critical thinking skills, which have allowed them to consistently outperform the market over long periods by questioning conventional wisdom and making decisions based on thorough analysis rather than popular sentiment.

Developing critical thinking skills for trading and investing is an ongoing process that requires dedication and practice. Techniques to enhance analytical abilities include regularly challenging one’s assumptions, seeking diverse perspectives, and recognizing and mitigating cognitive biases.

Tools and resources such as financial modeling software, market analysis platforms, and educational courses can significantly improve one’s capacity for in-depth market analysis.

However, perhaps the most crucial aspect of developing critical thinking skills is the commitment to continuous learning and self-reflection. Successful traders and investors consistently review their decisions, learn from successes and failures, and remain open to new ideas and strategies. By cultivating a mindset of perpetual growth and self-improvement, traders can continually refine their critical thinking skills and adapt to the ever-changing landscape of financial markets.

What hinders our critical thinking?

The following common cognitive biases tend to weaken our critical thinking skills as traders/investors:

- Confirmation Bias:

- Tendency to seek out information that confirms existing beliefs

- Ignoring or downplaying contradictory evidence

- Can lead to overlooking important market signals

- Herd Mentality:

- Following the crowd without independent analysis

- Can result in buying at market peaks or selling at lows

- Often driven by fear of missing out (FOMO)

- Overconfidence Bias:

- Overestimating one’s own abilities or knowledge

- Can lead to excessive risk-taking or ignoring warning signs

- Often results in poor position sizing or lack of diversification

Strategies to Overcome These Biases:

- Implement a systematic approach to decision-making

- Regularly review and analyze past trades (wins and losses)

- Practice humility and acknowledge the limits of one’s knowledge

- Use quantitative data/analysis to balance qualitative judgments

- Engage in peer discussion or join trading communities to challenge opinions

- Implement strict risk management rules to counteract emotional decision-making

- Use paper trading or small position sizes to test strategies before full implementation

In conclusion, the journey to trading success is paved with more than just market knowledge and quick reflexes. As we’ve explored, critical thinking is the cornerstone of effective trading and investing strategies. It’s the vital link between raw information and profitable decisions, enabling traders to navigate the complex, often emotionally charged world of financial markets with clarity and precision. Critical thinking doesn’t exist in isolation; it works harmoniously with emotional intelligence, creating a powerful synergy that can elevate a trader’s performance.

As you reflect on your trading journey, assess your critical thinking skills honestly. Are you questioning your assumptions? Are you seeking out diverse perspectives? Are you learning from both your successes and failures? These are the habits that cultivate robust critical thinking. The path to improving your critical thinking in trading is ongoing but starts with conscious effort. Consider keeping a trading journal to track your decision-making processes, engage in regular market analysis exercises, or join our community of traders here at Trade Ideas to challenge and refine your thinking. Remember, every great trader was once a beginner, and developing critical thinking skills is a journey, not a destination.

Critical thinking isn’t just an advantage in the ever-changing landscape of financial markets but a necessity. Embrace it, cultivate it, and watch as it transforms not just your trading but your approach to challenges in all aspects of life. Your future success in the markets may very well depend on the critical thinking skills you develop today.