eBay Defies Market Gravity: Why This E-Commerce Giant Is Soaring While Others Stumble

eBay Defies Market Gravity: Why This E-Commerce Giant Is Soaring While Others Stumble

By: Katie Gomez

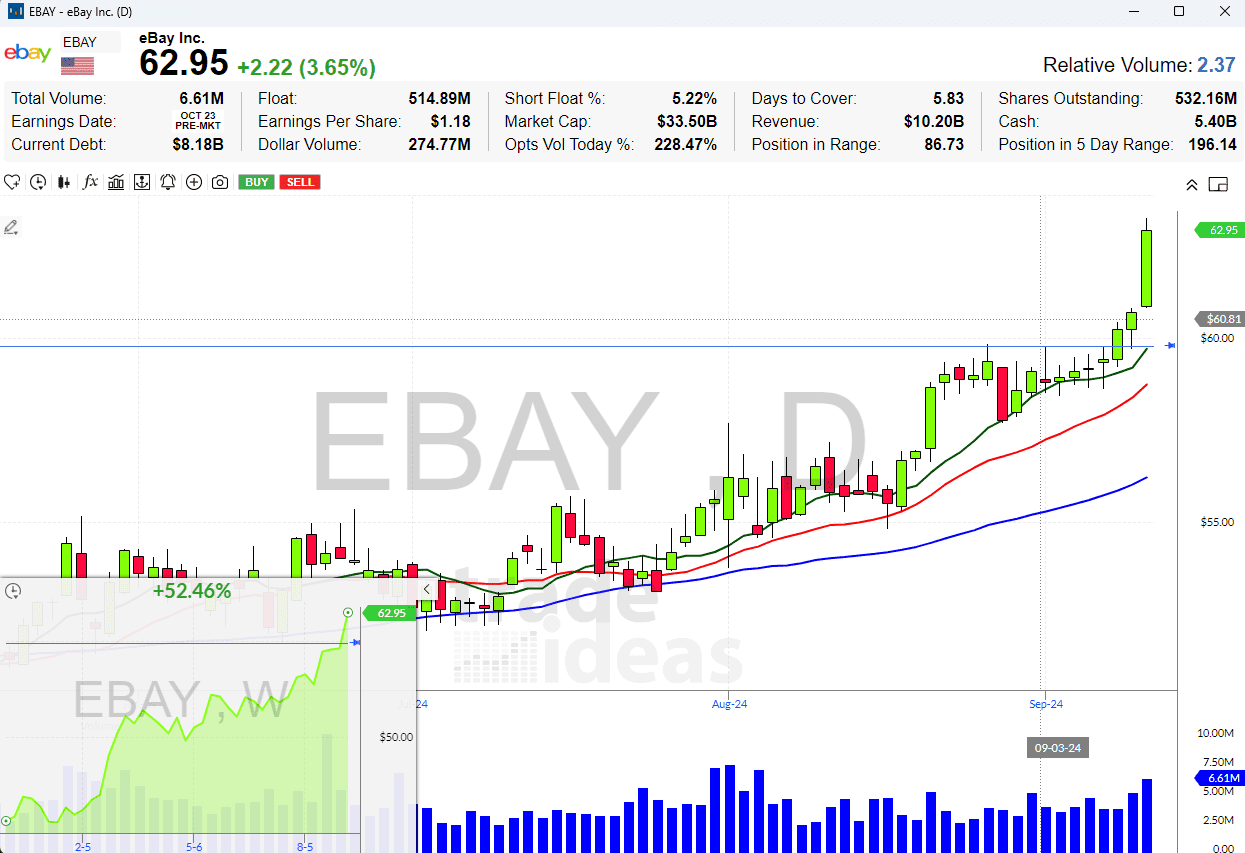

In a week marked by market volatility and economic uncertainty, eBay has emerged as a beacon of resilience, earning its spot as our Chart of the Week at Trade Ideas. This e-commerce giant has demonstrated remarkable relative strength, a key indicator that measures a stock’s performance against the broader market. While major indices and the financial sector grapple with turbulence, eBay’s stock has not only held steady but surged to new 52-week highs. This impressive performance amid widespread market weakness signals more than just a temporary uptick; it potentially reveals eBay’s recession-proof qualities. As inflation concerns mount and recession fears loom, eBay’s business model appears uniquely positioned to thrive in challenging economic conditions. By examining eBay’s chart patterns, fundamental drivers, and macroeconomic factors, we’ll uncover why this platform might telegraph broader economic shifts and how it could become a safe harbor for investors navigating stormy market waters.

Relative Strength

eBay exhibits remarkable relative strength in a market where many stocks are faltering. While banks and the broader financial sector grapple with extreme volatility and weakness, and as numerous stocks begin to plummet, this e-commerce giant is bucking the trend with an impressive upward trajectory. eBay’s chart tells a compelling story: the stock trades above all key moving averages, a bullish technical indicator. After two weeks of sideways consolidation, eBay broke out decisively on Tuesday, establishing itself as one of the strongest charts in the market. This breakout wasn’t just a minor move; it propelled eBay to new 52-week highs, further underlining its exceptional performance relative to its peers and the broader market. Such strength amid widespread market weakness raises intriguing questions about eBay’s resilience and the factors driving its impressive run.

eBay’s recent market performance offers a striking example of relative strength, particularly compared to the broader market index. While major indices like the S&P 500 and Nasdaq have experienced volatility and downward pressure.eBay’s stock has consistently pushed higher, defying the general market trend.

eBay’s ability to maintain its upward trajectory amid such headwinds is noteworthy. Several factors contribute to this relative strength: eBay’s business model appears well-suited to both inflationary and recessionary environments, its platform benefits from increased consumer focus on value and secondary markets, and its revenue streams are diversified across various product categories. Additionally, eBay’s strong balance sheet and cash flow provide a buffer against economic turbulence. This combination of factors has allowed eBay to withstand market pressures and thrive, positioning it as a potential haven for investors seeking stability in an uncertain economic landscape. In other words, the chart confirms the story! (hyperlink to the previous blog)

The story of eBay: Potential Recession Stock?

The story behind eBay’s recent rise is deeply rooted in the current economic climate. As inflation squeezes household budgets, everyone is trying to tighten their belts, and consumer behavior is shifting dramatically. On one side, we’re seeing an increase in individuals looking to liquidate assets, digging through closets and garages for items of value to sell.

On the other, budget-conscious buyers are increasingly turning to platforms like eBay in search of deals on both new and used goods. This dual trend creates a perfect storm for eBay’s business model, which profits from facilitating these transactions. The platform’s vast marketplace caters to sellers seeking to monetize their possessions and buyers hunting for bargains, positioning eBay to benefit regardless of which side of the transaction is driving activity.

eBay’s potential as both an inflationary and recession-resistant stock is becoming increasingly apparent. EBay benefits from increased transaction volumes in inflationary environments as consumers seek alternative income sources and more affordable purchasing options. This trend often intensifies during recessions, with job losses and economic uncertainty driving more people to sell items and seek out deals.

Historically, companies that facilitate value-oriented transactions have shown resilience during economic downturns. eBay’s performance echoes that of discount retailers and pawn shops during past recessions, but with the added advantage of a global digital platform. This unique positioning suggests that eBay could weather an economic storm and potentially thrive, making it an attractive option for investors looking to hedge against market volatility and financial uncertainty.

Meme stocks vs eBay

Unlike meme stocks like GME or AMC, which often ride waves of media hype and herd mentality, eBay’s current rise is backed by solid fundamentals and clear technical indicators. The chart tells a compelling story, visible to any observant investor. eBay’s strength is rooted in the current economic reality of inflation and potential recession. This buyer and seller market synergy fuels eBay’s growth, increasing sales volume and commission revenue.

eBay is positioning itself as both an inflationary hedge and a potential recession-proof stock, as the more they sell, the more commission they make, driving up the value of the stock. With economic volatility on the horizon and the looming uncertainty of an upcoming election, eBay’s performance may be telegraphing broader economic shifts. Should a recession hit, triggering layoffs and intensified penny-pinching, eBay stands to benefit even further as more people turn to the platform out of necessity. This isn’t just market speculation; it’s a trend reflected in eBay’s robust chart performance.

What else will people be moving toward if this recession happens?

Defensive sectors such as consumer staples, healthcare, and utilities have historically shown resilience during recessions. Discount retailers, like Dollar General or Walmart, often see increased traffic as consumers become more price-conscious.

Similarly, companies offering affordable entertainment, such as Netflix or gaming companies, might benefit as people seek low-cost leisure activities. The rise of gig economy platforms like Uber or Fiverr could also accelerate as people seek supplemental income. eBay’s success might signal strength in other e-commerce and online marketplace stocks, particularly those facilitating secondhand sales or offering competitive pricing. Additionally, companies focused on debt collection, pawn shops, and payday lenders often see increased activity during economic hardships.

In conclusion, eBay’s remarkable performance amidst market volatility offers valuable insights for seasoned investors and newcomers to trading. As our Trade of the Week, eBay exemplifies the power of combining technical analysis with fundamental understanding. Its chart clearly illustrates the concept of relative strength, breaking out to new highs while many other stocks struggle. This strength isn’t just a technical anomaly; it’s backed by solid fundamentals rooted in eBay’s unique position to thrive in both inflationary and potentially recessionary environments.

For newer traders, eBay’s story underscores the importance of looking beyond headlines and hype to identify stocks with genuine growth potential based on economic trends and consumer behavior. It also highlights the value of tools to help spot these opportunities early. As we navigate uncertain financial waters, keeping an eye on platforms like eBay can provide crucial insights into broader market trends. We encourage you to explore the advanced scanning and analysis tools Trade Ideas offers to stay ahead of these market movements and identify similar opportunities. Our platform is designed to help traders of all levels spot potential winners like eBay before they make headlines, giving you the edge needed to make informed decisions in any market condition.