Navigating the Ups and Downs of Swing Trading: A Case Study of Slumber J (SLB)

Navigating the Ups and Downs of Swing Trading: A Case Study of Slumber J (SLB)

Swing trading can be an exhilarating and challenging endeavor, as demonstrated by the recent trade of the week featuring Slumber J (SLB). In this blog post, we’ll dive into the thought process behind the trade, the importance of patience and perspective, and the lessons that can be learned from this experience.

The trade was initiated on Monday, April 8th, with a trigger price of $55.50. The stock opened above this level, briefly traded higher, but then pulled back. This price action can frustrate traders, as hoping for an immediate move in the desired direction is natural.

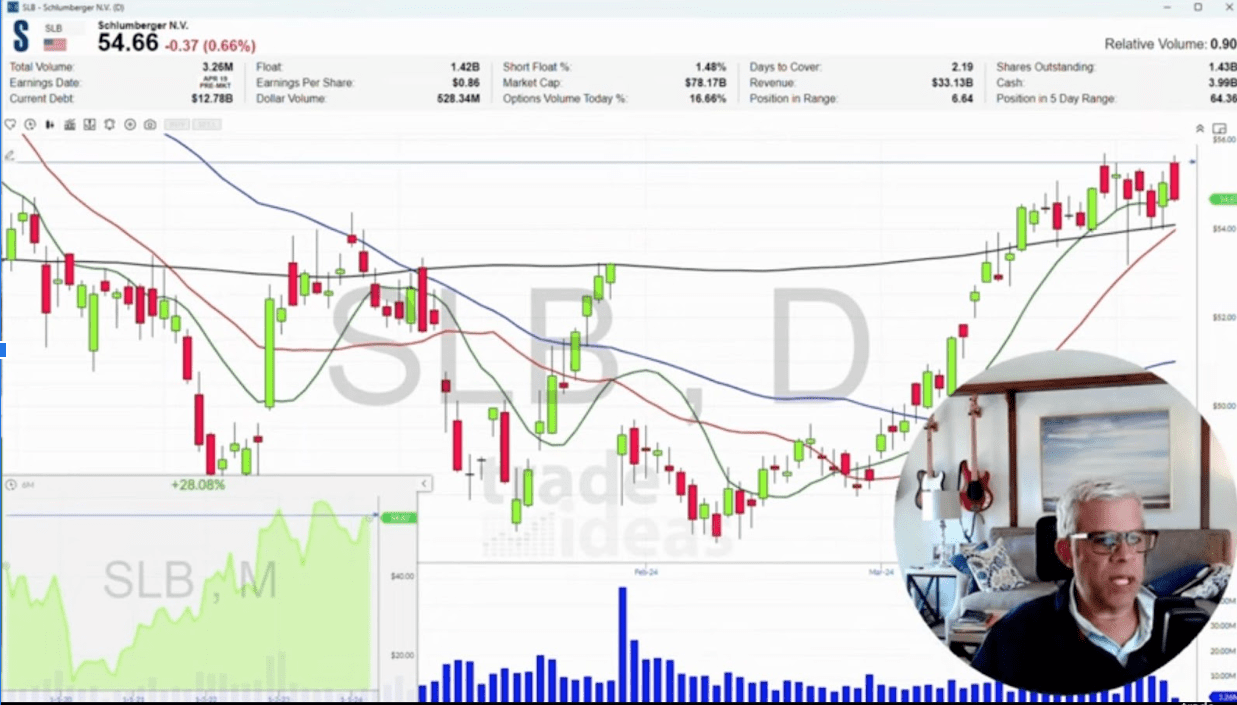

However, it’s crucial to maintain a swing trading mindset and keep the bigger picture in perspective. By zooming out to the daily chart, we can see that SLB has been consolidating above its 200-day moving average, with the 20-day moving average on the verge of crossing above it. This suggests a potentially bullish setup, as the stock has been building a base while other stocks in the sector, such as those in the OIH ETF, have been moving higher.

To better understand the current price action in SLB, it’s helpful to use the analogy of a hiker or climber building a new base camp. Just as a climber needs to acclimate to the weather conditions before pushing for the summit, a stock may need to consolidate and build a foundation before making a significant move higher.

In the case of SLB, the “weather” is favorable, as there are no major moving averages above the current price acting as resistance. This suggests that if the stock can break out of its current range, there is potential for a nice move into the high $50s or even $60s.

One of the critical lessons from this trade is the importance of patience and not chasing stocks that are already moving higher. While it can be tempting to jump on a stock already in motion, it’s often better to find opportunities to take their time to build a base and consolidate.

By identifying stocks setting up for a potential move rather than those already making it, traders can position themselves for better risk-reward scenarios. In the case of SLB, the clear support level at $54, based on the 200-day moving average and the rising 20-day moving average, provides a well-defined risk point. If the stock were to close below $53.50, it would invalidate the bullish setup, and the trade would be exited.

Swing trading requires patience, discipline, and the ability to keep the bigger picture in perspective. The trade of the week in SLB highlights the importance of these qualities and the value of identifying stocks that are building a base rather than chasing those that have already made their move.

By understanding the thought process behind the trade, the analogy of the climber building a base camp, and the lesson of patience, traders can better navigate the ups and downs of swing trading. As always, it’s essential to have a well-defined plan, including straightforward entry and exit points, and to be prepared for the possibility that not every trade will work out perfectly.