Mastering Your Trading Day Prep: A Proven Process for Identifying

Mastering Your Trading Day Prep: A Proven Process for Identifying

By Andy Lindloff

High-Quality Swing Trade Setups

Successful trading begins long before the market opens. Developing a consistent and effective trading day prep routine is essential for identifying high-quality setups and maximizing your chances of success. In this blog post, we’ll explore a proven preparation process for your trading day, focusing on swing trade setups and utilizing Trade Ideas’ powerful tools.

The Importance of a Trading Day Prep Routine

Having a structured trading day prep routine is crucial for several reasons:

- It allows you to approach the market with a clear plan and focus.

- It helps you identify the most promising trade setups before the market opens.

- It enables you to manage risk more effectively by setting straightforward entry and exit points.

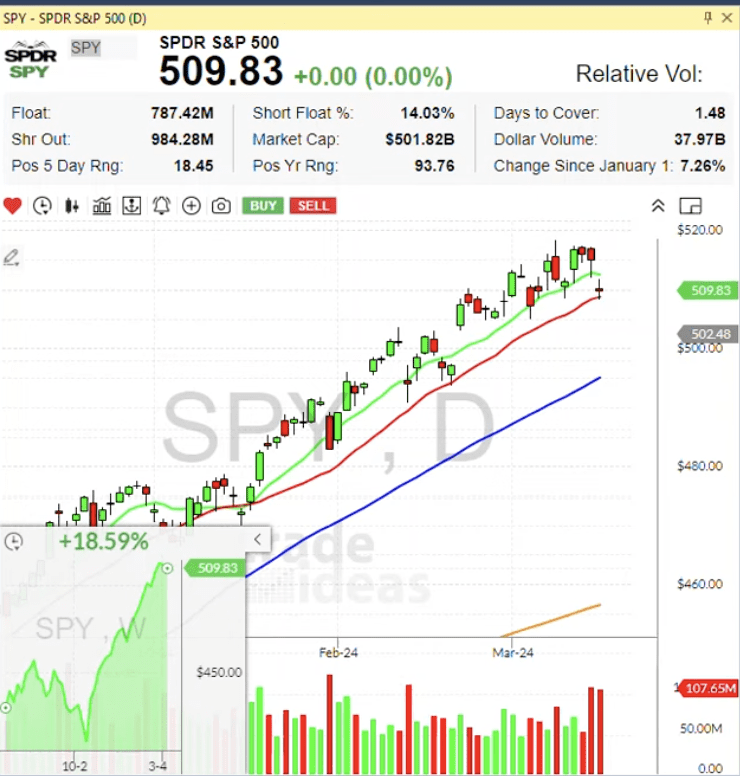

Scanning for High-Quality Setups with Trade Ideas

Trade Ideas offers a suite of powerful tools for scanning the market and identifying high-quality trade setups. One of the most effective ways to organize your scans is by creating a custom dock that houses all your favorite scans in one place.

To begin your trading day prep, open your custom dock and go through the symbols generated by each scan. As you analyze each symbol, look for the following characteristics of a high-quality swing trade setup:

- Clear chart patterns, such as breakouts, pullbacks, or trend continuations.

- Substantial relative volume, indicating increased interest in the stock.

- Well-defined support and resistance levels.

Setting Price Alerts and Managing Your Watchlist

As you identify potential trade setups, set price alerts at critical levels, such as breakout points or support/resistance zones. These alerts will notify you when a stock reaches your desired entry point, allowing you to react quickly and efficiently.

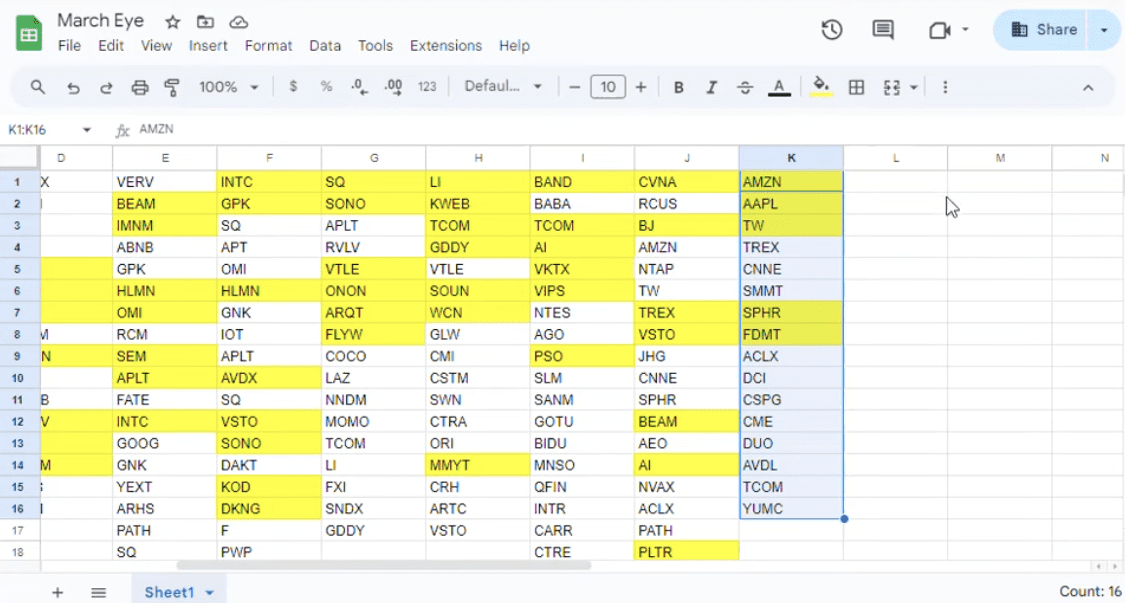

In addition to setting price alerts, create a spreadsheet or Google Doc to track the most promising setups. As you go through your scans, add the symbol and any relevant notes to your spreadsheet. This will help you stay organized and focused throughout your trading day.

After completing your initial analysis, you can select the best setups from your spreadsheet and add them to a dedicated watchlist within Trade Ideas. You can view your watchlist as a traditional top list or a visually appealing tree map.

Sharing Your Analysis with the Trading Community

One of Trade Ideas’ unique features is the ability to create and share global watchlists with other subscribers. By sharing your watchlist, you can collaborate with other traders, gain valuable insights, and contribute to the collective knowledge of the trading community.

To share your analysis more broadly, consider creating a short video highlighting your top setups for the day. Platforms like Twitter provide an excellent opportunity to connect with other traders and showcase your expertise.

Developing a consistent and effective trading day prep routine is a critical component of successful trading. By leveraging the powerful tools offered by Trade Ideas, you can efficiently scan the market, identify high-quality swing trade setups, and manage your risk more effectively.

Remember, the key to success is patience and discipline. Don’t feel pressured to rush into a trade just because a setup triggers your price alert. Swing trading often involves holding positions for several days or weeks, so waiting for the right entry point and having a clear plan for managing your trade is essential.

Following the process outlined in this blog post and continually refining your approach can elevate your trading game and increase your chances of long-term market success.