Trade Of The Week RIOT

Trade Of The Week RIOT

By Steve Gomez

In the fast-paced world of stock trading, even the most well-crafted plans can sometimes take an unexpected turn. As traders, it’s crucial to have a solid strategy for managing trades that differ from what was anticipated. Today, we’ll dive into a real-world example of a trade gone wrong and explore the steps you can take to minimize losses and maintain a disciplined approach to trading.

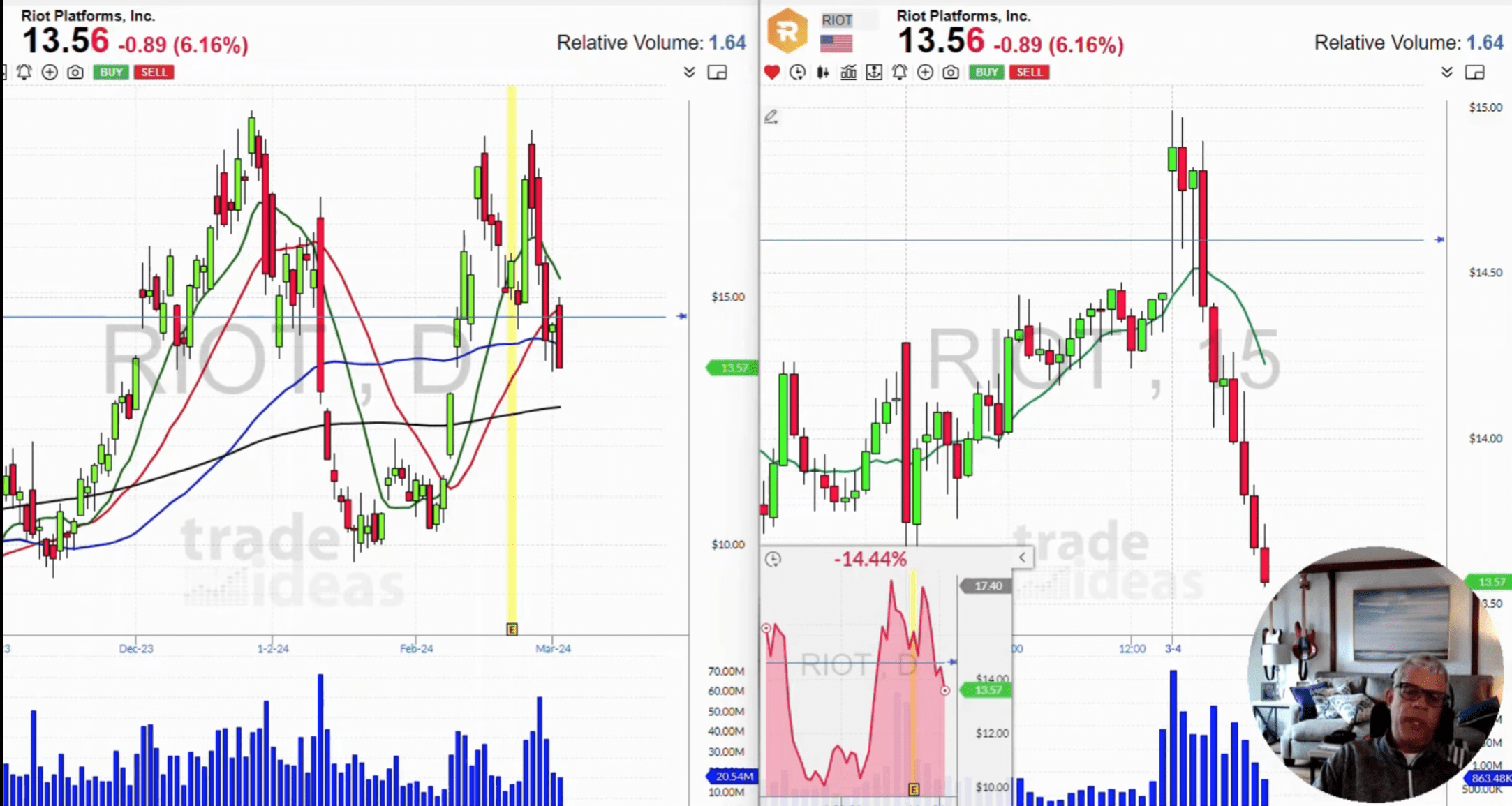

Our week’s trade focused on RIOT, a prominent Bitcoin mining stock. With Bitcoin prices soaring near all-time highs, the expectation was that mining stocks like RIOT would follow suit. The plan was to enter a long position at the $14.60 trigger price, riding the bullish momentum in the Bitcoin mining sector.

Before entering any trade, it’s essential to establish a downside risk level or stop loss. The stop was $13.50, a fundamental support level from the previous day’s low. By defining this risk level upfront, traders can limit their potential losses and avoid letting a losing trade spiral out of control.

Recognizing When the Narrative Shifts

Despite the promising setup, RIOT’s price action began to diverge from the bullish Bitcoin mining narrative shortly after the market opened. Within an hour of trading, RIOT’s price broke below the 10-period simple moving average (SMA) on the 15-minute chart, signaling a loss of momentum. Confirmation of this shift came from MARA, another prominent Bitcoin mining stock, which exhibited similar bearish price action.

The Role of Algorithms and Quants

In today’s market, algorithms and quants like Citadel and Virtu significantly drive price action. These entities operate as AI programs and algorithms, making real-time decisions based on market data. When a stock approaches a critical level, such as RIOT’s $13.50 stop loss, these algorithms often test that level to gauge market psychology and determine whether buyers or sellers will prevail.

Managing the Trade: Defensive Mode

The trade entered defensive mode as RIOT approached the $13.50 stop-loss level. While there’s always a possibility of an intraday bounce, it’s crucial not to let losing trades drift too far away from the predefined risk level. In this case, the daily support level at the 50-day moving average had already been breached, confirming the breakdown on multiple timeframes.