Why I’m Bearish on Commercial Real Estate: Navigating the Market with ETFs and Swing Trading Strategies

Why I’m Bearish on Commercial Real Estate: Navigating the Market with ETFs and Swing Trading Strategies

By Steve Gomez

Hey there, investors and traders! You might be wondering what’s got me skeptical about the future of commercial real estate. Well, I’ve got my reasons, and I bet some of you have noticed similar trends. Let’s break it down, shall we?

Office spaces are looking more like ghost towns these days, and shopping malls? Those are feeling the chill too. It seems like our brick-and-mortar buddies are taking quite the hit. Post-Covid expectations had many people believing we’d flock back to our cubicles, but, let’s be real here, who doesn’t love those cozy work-from-home vibes? So, that’s the backdrop of my story, my theory if you will: a bearish outlook on commercial real estate. It’s one thing to spin a story or conjure up a theory, but what really matters is if the hard data backs it up. Are the cold, hard charts giving a thumbs up to your financial fable? For this financial odyssey, let’s take a gander at the ETF everyone’s talking about: the IYR, or the iShares U.S. Real Estate ETF. With a hefty 9 million shares changing hands today, it’s clear there’s no shortage of action here. For those unfamiliar, this ETF is like a mirror reflecting the fortunes of real estate brokers, investment trusts, and other market players tied into real estate – and yes, we’re talking primarily about the commercial slice of that pie (office buildings, malls, etc.).

Apartment buildings are a different beast altogether, more on that another time. Fun fact: right around the corner, there’s a business park with about ten buildings, each half-deserted. Now wouldn’t that be a prime candidate for some nifty rezoning, making way for affordable housing? Food for thought, right? But hold on, let’s not drift too far from the charts. That’s where we confirm if our story holds water. And would you look at that, it does. We’ve got what I like to call the technical “armpit” — it’s like watching a basketball player poised to bounce the ball. That’s the convergence of the 20 SMA, the 50 SMA, and the ten, acting as a hefty barrier to any potential price rebound. There was a time when following the ten SMA was like catching a smooth ride up a mountain road. But when that ride ends, folks, it’s a wild fall down. Here’s a thought – and stick with me:

“If there are winds blowing the sails of your trading ship off course, you need a solid map to navigate through. The charts? They’re that map.”

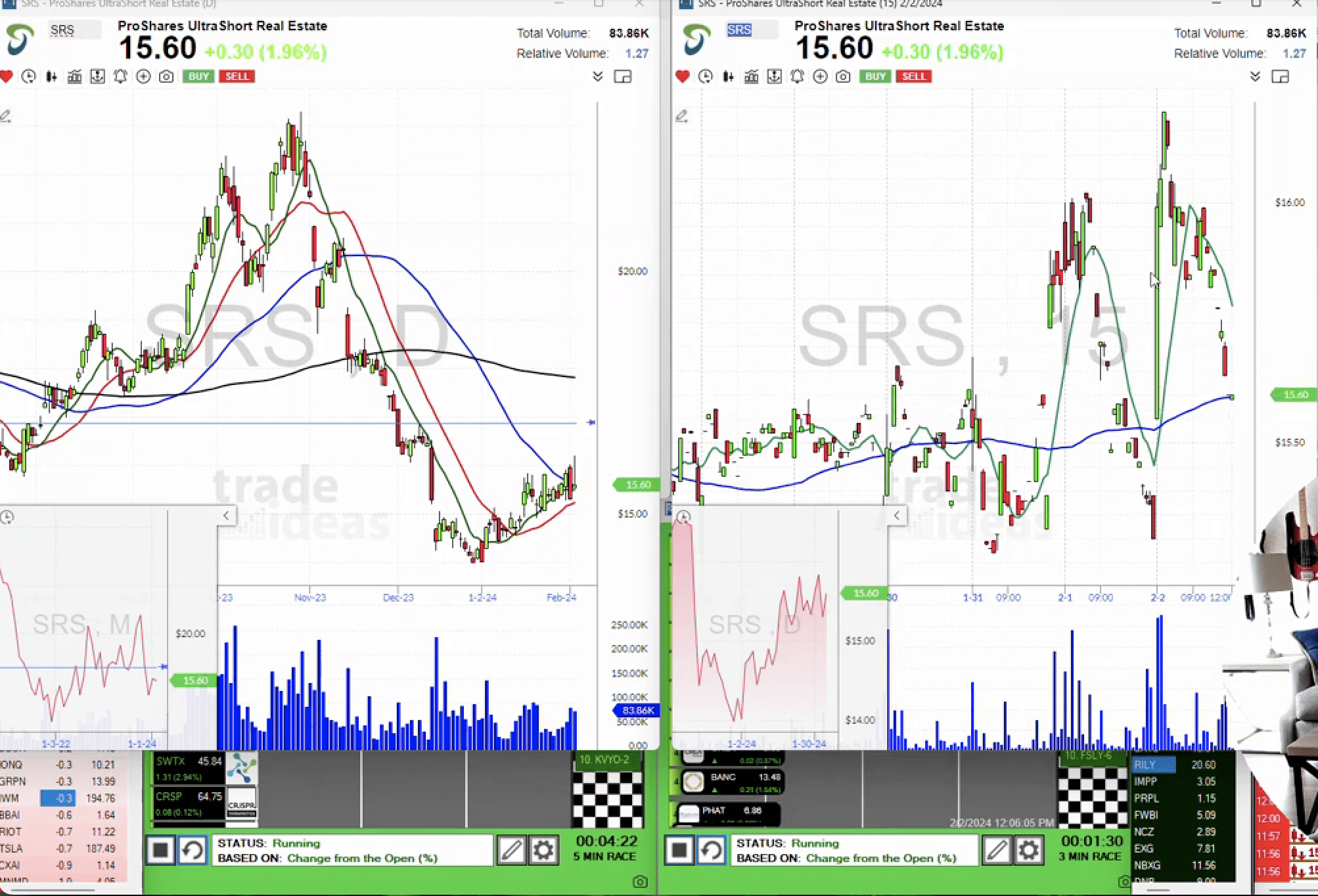

So, once we’ve etched our story in stone, how do we dive into trade? One approach could be to short IYR, but there’s more than one way to skin this cat. Say you’ve got a regular account, maybe a long-only IRA setup, what then? A bit of Googling led me to the inverse ETF for IYR, which goes by the ticker SRS. Let me tell you, SRS is like IYR’s photo-negative, low on liquidity but high on drama, mirroring IYR’s every move but in the opposite direction—and at double the speed, for better or for worse. There’s opportunity baked into this baby, so I went ahead and snagged a position below 16 today. If IYR keeps hugging that technical “armpit” close, SRS might just sprint up for a short-term gain. Check this out, a glance at the monthly thumbnails shows SRS lingering at the low edge of its trading range. Loads of potential there, don’t you think? And there we have it—my theory, the chart confirmation, and a little sneak peek into my trading playbook. I hope you find these insights valuable as you navigate the markets’ waves. Keep an eye on those charts, folks, and happy trading! — Remember to drop in your interpretations, and never trade based on sentiment alone. It’s the technicals that cut the noise and show you the real deal. Until next time, stay savvy and keep those trades sharp! If you are interested in trying Trade Ideas, apply promo code, STEVEG15 , for 15% off.

(P.S. – Always do your own research and consider consulting a financial advisor before making any investment decisions. Trade safe!) — (Disclaimer: The information provided in this blog post is for educational purposes only and does not constitute investment advice. Past performance is not indicative of future results. All investments involve risk.)