Trading Insights for February 7th: A Dive into Potential Setups

Trading Insights for February 7th: A Dive into Potential Setups

Hello traders, it’s Andy bringing you some exciting trade ideas for February 7th. As the market continues its upward grind, let’s explore some promising setups for the day.

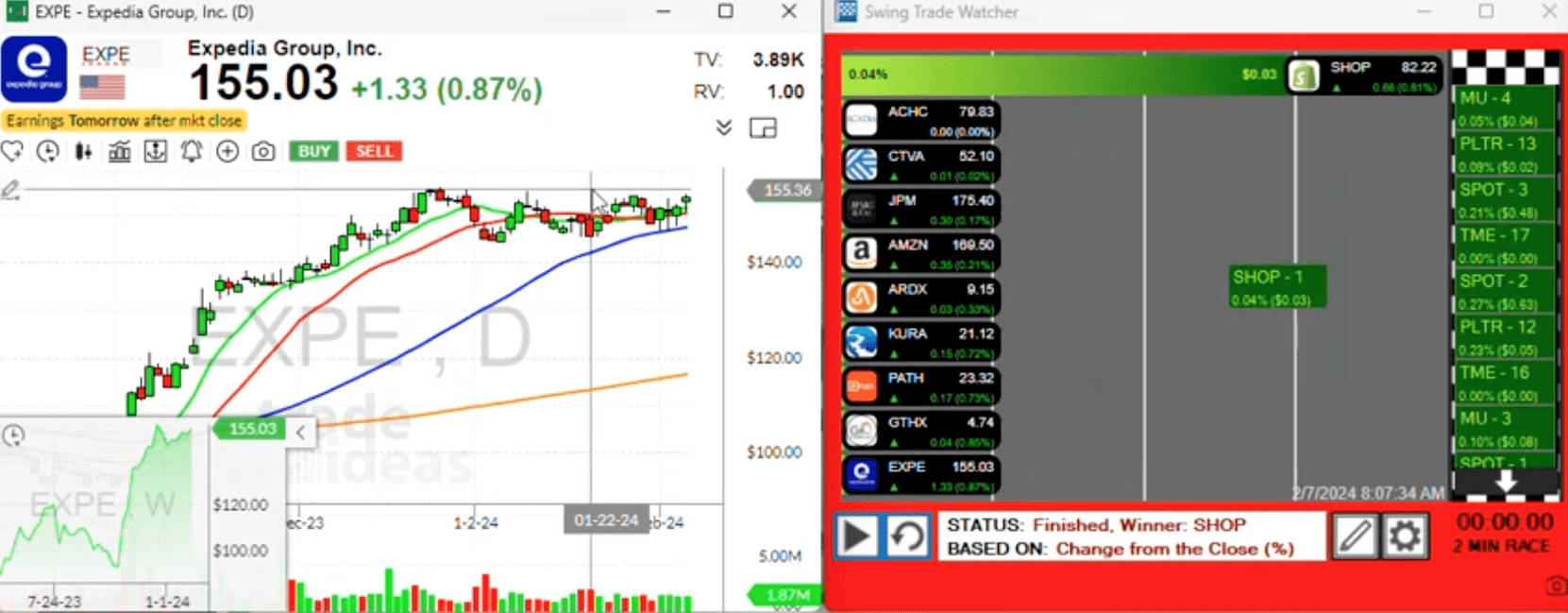

1. Expedia (EXPE):

Yesterday, I had my eye on Expedia, considering an entry but waiting for a decisive breakout above $155.50. The stock has been in a coiling pattern for almost two months, indicating potential for a significant move. However, a word of caution: keep an eye on earnings gap-ups, as they can lead to volatile and sloppy market conditions.

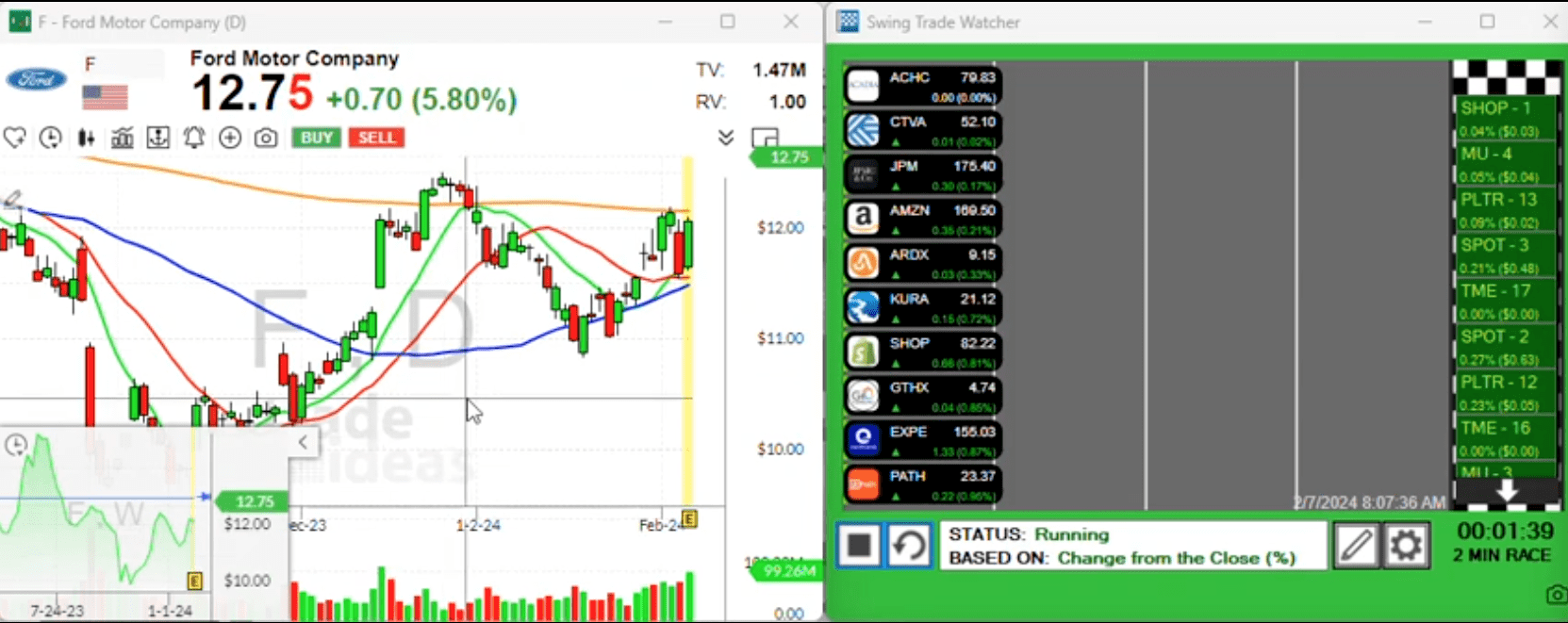

2. Ford (F):

Ford presents an interesting opportunity, particularly if it can surpass the key level around $4.87. A breakout here could set the stage for a rewarding swing trade. As always, vigilance is key in monitoring how the market reacts around this crucial level.

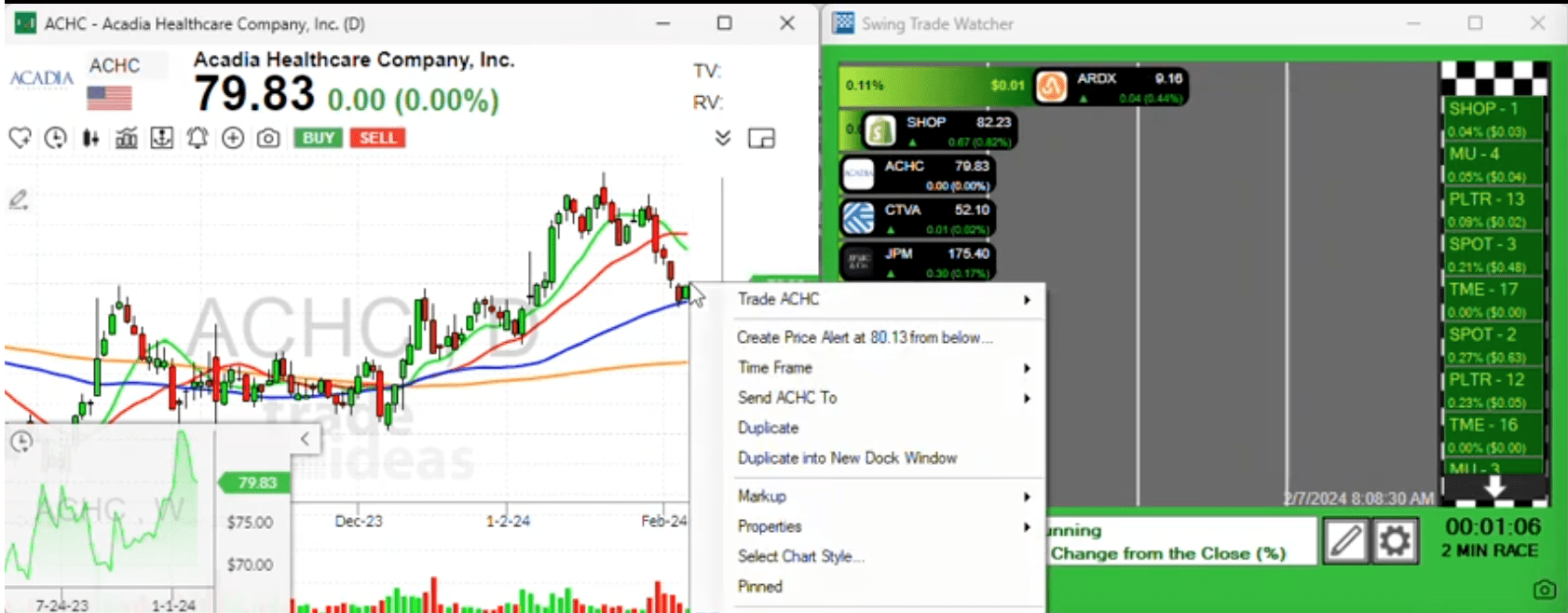

3. Achillion Pharmaceuticals (ACHC):

Taking a slightly different approach, ACHC has pulled back to the 50-period moving average, coupled with a support level. Consider setting a price alert just above the two-day high to catch potential upward momentum.

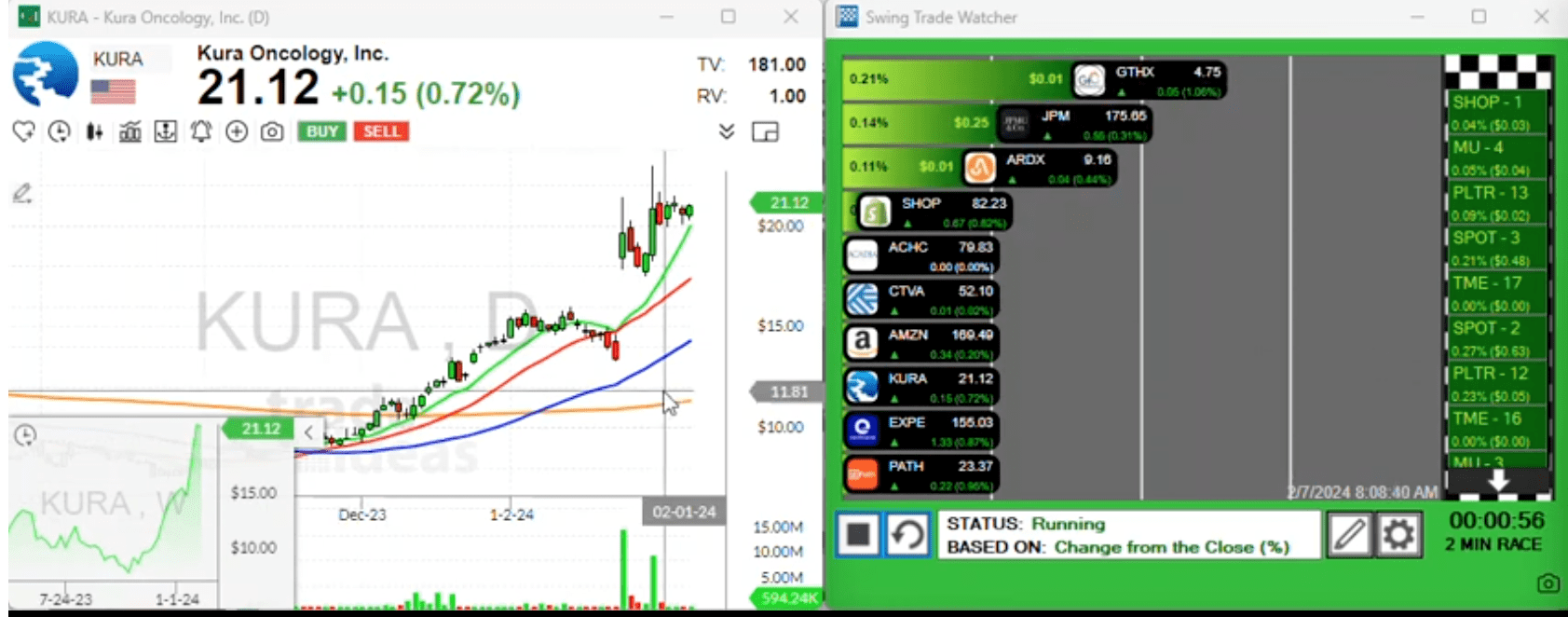

4. Kura :

Kura stands out despite its volatility, boasting a float of 49 million. Look for a trade opportunity in the vicinity of $40.21 to $40.40, keeping in mind the stock’s potential for rapid price movements.

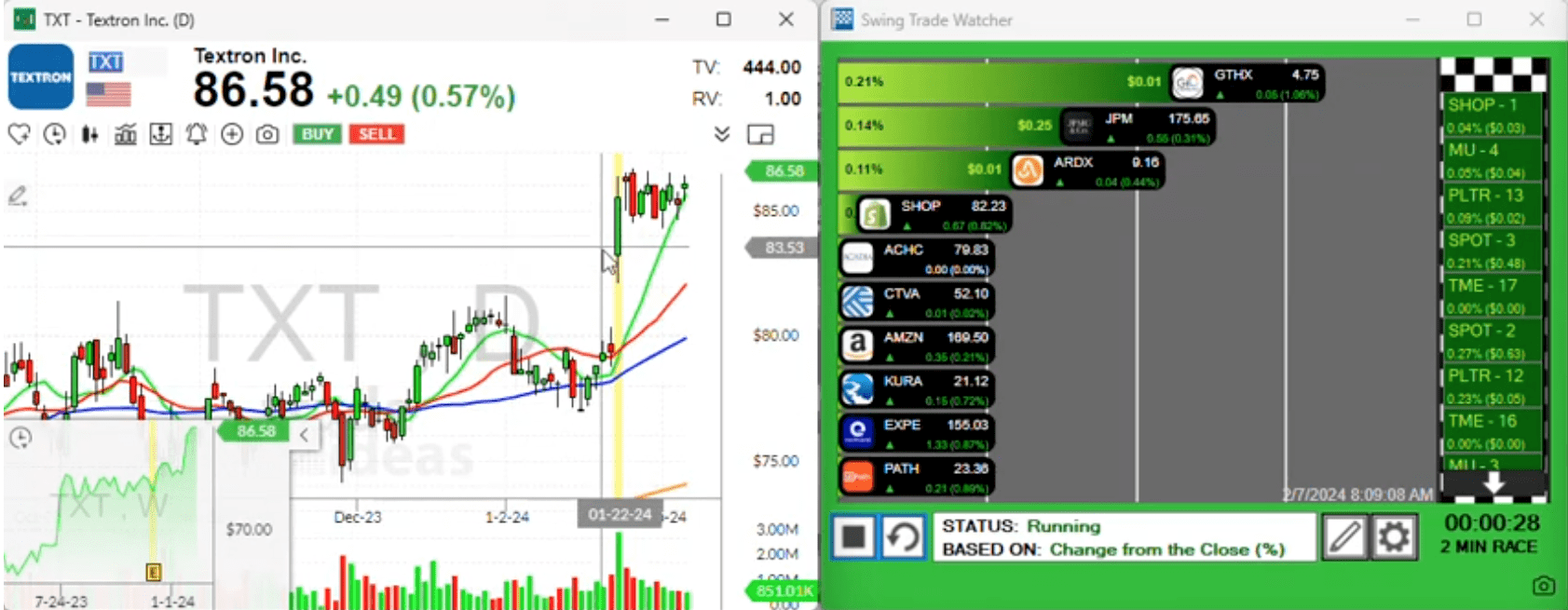

5. (TXT):

TXT is showing post-earnings volatility. Exercise caution due to the stock’s unpredictable nature, but consider a trade if it breaks above $46.57.

Remember, trading always involves risk, and it’s essential to have a well-thought-out strategy. Keep a close eye on these setups, set tight risk management parameters, and adapt to market conditions accordingly.

Stay informed, stay disciplined, and I’ll be back with more insights tomorrow. Happy trading!