Riding the Market’s Highs and Lows: A Trader’s Guide to Current Setups

Riding the Market’s Highs and Lows: A Trader’s Guide to Current Setups

The Trader’s Sentiment: Seeking Highs Amidst the Breakout Blues

Howdy, fellow traders! It’s Andy here with your dose of trade whispers. As we gear up this Friday, January 19th, we can’t help but fix our gaze on the ever-elusive SPY high, hovering like a mirage around the 480 mark. Will it be our reality or just a fleeting dream? As certain stocks tease with breakout promises only to falter, we are left pondering their fates. But let’s not dwell on maybes; instead, we’ve got a roster of setups worth your attention.

Stock Setups on the Radar

Infinera (INFN)

Recently spotlighted, Infinera, has been on my list, and I advised on this piece of the market yesterday. Here’s why I’d rather get cozy with a setup than chase the winds: you now sit snug in a decent position with INFN, fingers crossed for continued glory.

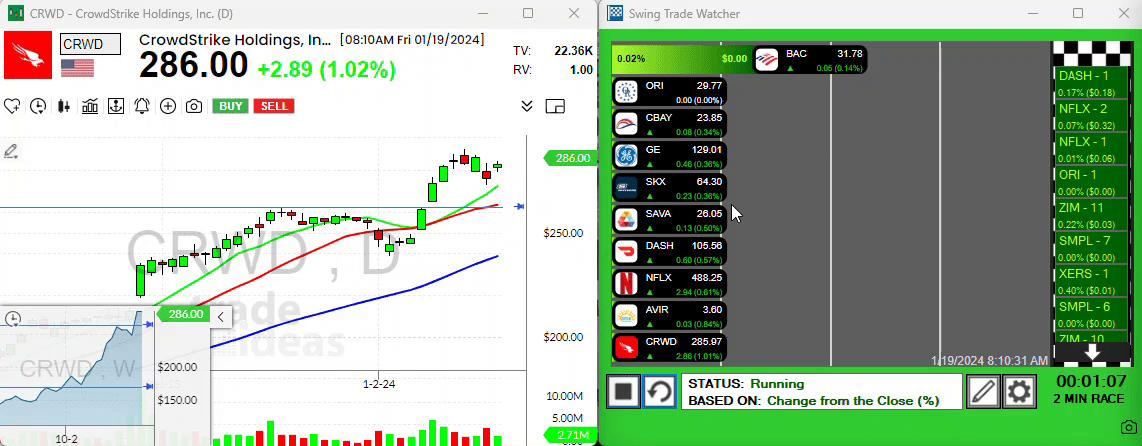

Crowdstrike (CRWD)

Keep your eye on Crowdstrike — it’s beaming with relative strength. After a charismatic uptick and a modest three-day retreat, watch for an ascent that could redefine altitude.

Netflix (NFLX)

Netflix is stirring, and I must say, I adore the layout of this story. Following a commendable monthly peak and a strategic pullback, there’s a sense of an imminent upturn. Should the shares sprint past that recent three-day pinnacle, we could witness a notable move, potentially right when the market bell tolls, so tread lightly here.

Bank of America (BAC)

Venturing slightly off the beaten path with Bank of America. It’s been flirting with its 50-day moving average, which might not set every trader’s heart aflutter, but there’s merit in consistency. Look out for a decisive surge above $32.

“Sometimes, the best treasures are found just outside the box.” - AndyCassava Sciences (SAVA)

In the biotech realm, enthusiasm wanes, but Cassava Sciences isn’t bowing out just yet. Despite a challenging entry marked by past price action, I’d wager on it if it can outshine those recent peaks.

Strategize and Thrive

As the Friday rhythm takes us into the weekend, keep your plays calculated and precise. Remember, this isn’t about pulling rabbits out of hats; it’s about thoughtful entries, exits, and the wisdom to know the difference. While the thrill of the chase can be invigorating, understanding the setups and knowing when to make your move is crucial to your trading success.

And if these ideas have lit a spark, then may the trade winds be at your back. Have a splendid weekend, traders, and we’ll reconnect on the flip side. If you’ve managed to catch hold of some trade ideas of your own, latch on to them, and let’s chat next time.

Until the next chapter of our market saga, take care—this is Andy, signing off.