Earnings Play Breakdown: Birkenstock’s Trade Moves Explained

Earnings Play Breakdown: Birkenstock’s Trade Moves Explained

Jan 18, 2024

Hey there, fellow traders and stock aficionados! It’s Barrie Einarson from Trade Ideas, back at it with another edition of “What Makes This Trade Great.” Today, we’re diving into a brand we all know and have probably slipped our feet into at some point – Birkenstock. But this isn’t about comfort and style; it’s about their numbers because we’re getting into the nitty-gritty of earnings play.

To Subscribe: https://go.trade-ideas.com/SHQ

Use Promo Code BARRIE15 for 15% off

Birkenstock’s IPO and the Earnings Release Frenzy

Remember last year when Birkenstock decided to enter the big league with its IPO? That was a move that caught everyone’s attention. Now, they’ve just dropped what might be their first or second earnings release post-IPO. And let me tell you, this sort of event is a day trader’s buffet – it’s where the action happens.

Trading Ideas AI: Spotting the Short Opportunity

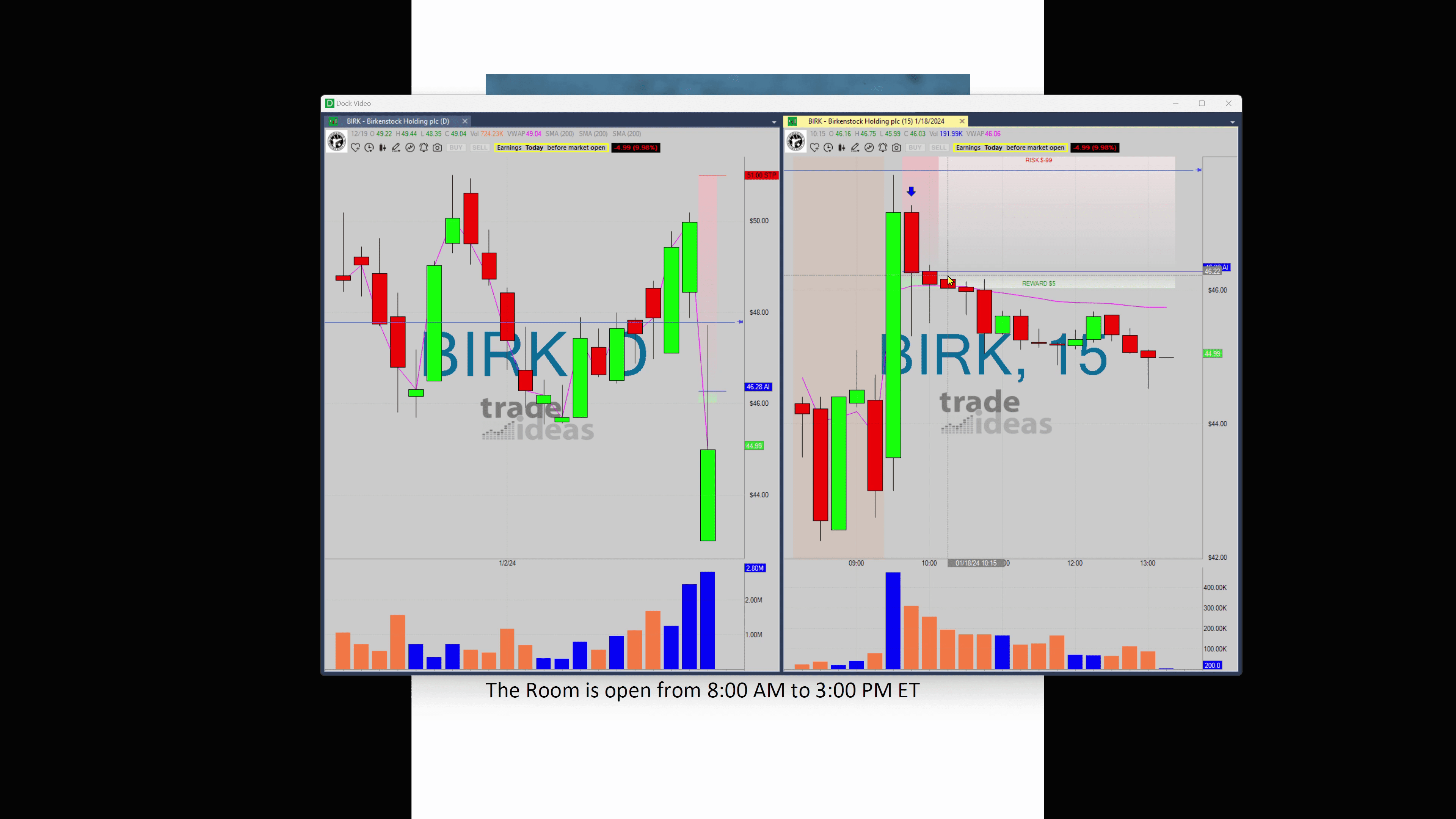

Our AI, the heart, and soul of Trade Ideas technology, flagged up Birkenstock at $46.28. In our trading room, we saw the indication in blue—a clear suggestion to short. Did you catch the down arrow?

That’s when things got interesting. Birkenstock’s stock played a little tug-of-war, dipping after the arrow and then clawing its way back up, which might’ve made you think it was in recovery mode. But here’s the kicker: it rose just enough to $46.75 and then – bam – the sell-off hit.

Timing is Everything

Missed that initial drop? No need to sweat it. Markets love to give second chances. You could’ve grabbed a coffee, waited 30 minutes, and then jumped on that short opportunity. The descent that followed was like a leisurely ride down a gentle slope.

But let’s talk strategy. When that slight nudge upwards occurred, that’s where I’d say, “It’s time to take some off the table.” Lock in some profits, keep a portion active, and let’s see where it goes.

And oh, did it go – down to the low of $44.52 from $46.28. Now, that’s what we call a “nice little percentage move.” As for where it headed for the rest of the day? Well, that’s the million-dollar question.

Birkenstock’s Downward Spiral

As it stood, Birkenstock took a nearly 10% nosedive which, in the trading world, is quite the big deal. Changes like these are what makes or breaks a trader’s day, and staying ahead of such moves is what we strive for in the room.

“Seize the opportunity when it first presents itself, because sometimes, waiting for the second chance can be just as profitable.”

Alright, folks, that’s a wrap for this stock tale. I highly encourage you to saunter back into the trading room and keep those eyes peeled for our next move – because in trading, the action never stops. Have a fantastic evening, and let’s gear up to do it all over again tomorrow. Take care and happy trading!

The content of this blog ensures a casual, yet informative tone, matching the original transcript above. It incorporates blog-friendly formatting elements, allowing for an engaging and easy-to-follow read. The blog post covers the focal points of the original transcript and ensures the content is suitable for a platform like Substack.