Getting Ahead of the Next Big Short Squeeze: Predicting Viral Stocks Before They Go Viral

Getting Ahead of the Next Big Short Squeeze: Predicting Viral Stocks Before They Go Viral

By Katie Gomez

Short squeezes have become a widespread phenomenon in recent years. The surge in meme stocks and viral short squeezes, exemplified by instances like Gamestop and AMC, underscores the significant influence of social media platforms. Social media has played a pivotal role in targeting heavily shorted stocks, igniting massive market rallies and swiftly driving stock prices. However, GME and AMC were not isolated incidents; they represent the initial sparks of a much larger fire, providing traders with a new perspective on the market. The reality is that identifying the conditions and mania for potential short squeezes early is crucial for reaping massive profits. Furthermore, even more explosive opportunities can arise by developing a formula to screen for various fundamental and technical indicators.

The influence of social media and the rise of retail investors are continually expanding. We find ourselves in an unprecedented era where small traders possess substantial power, capable of generating significant market ripples in the future. In light of this, history has demonstrated that staying ahead of the hype can yield unimaginable returns. However, the challenge lies in capitalizing on these short squeezes before they make headlines, ensuring we don’t miss our window of opportunity.

This article will examine how to dissect previous short squeezes to extract patterns and metrics thresholds. Historical case studies underpin the formation of a defined short squeeze that can systematically uncover new opportunities. Additionally, it will provide tips for efficiently acting on trades while managing inherent risks through programs like Trade Ideas.

Case Studies and Analysis

By examining past epic short squeezes alongside current opportunities displaying similar characteristics, traders can identify common predictive patterns. Leveraging these insights allows them to get ahead of subsequent viral stock frenzies.

The remarkable rallies in GameStop, AMC, and other meme stocks highlight the life-changing profit potential of betting on early short squeezes. Fortunes can be made by identifying the conditions for manias before they erupt and having the conviction to take a speculative position. For instance, allocating just $10,000 to GameStop call options in December 2020 could have resulted in over $10 million in profits during the ensuing gamma and short squeezes!

Retrospective Analysis – GameStop

- Trade Ideas short interest scanner flashed a signal months before the squeeze

- Reddit chatter and Google search volume rose in early January

- Short % float surged to 140%, short ratio hit 9 days (S3 Partners data)

- Fundamentals lined up – P/S ratio 0.08x vs specialty retail avg of 0.5x

- Traders could have bought call options like March $40 contracts, up 100,000%

Current Opportunity – Bed Bath & Beyond

- Recent earnings beat and share buyback catalyzed a 100% spike

- Short float sits at 50%, short ratio of 6 days currently (MarketBeat)

- Google trends and Reddit mentions have exploded over the past month

- Valuation reasonable at 0.18 P/S vs. specialty retail avg 0.5x

Comparing Historical Patterns

- Short % float consistently over 30-40%

- -Share price under a longer-term trendline

- -Recent positive news or earnings catalyst

The goal is to empower independent investors with the tools and perspective needed to profit from inevitable future short-crunching manias. By bleeding deep quantitative analysis with a real-time gauge of social sentiment, traders can confidently set themselves up for exponential returns during the next short squeeze. GME and AMC short squeezes could have been taken advantage of by more traders if they had the right tools and knew the right places to look.

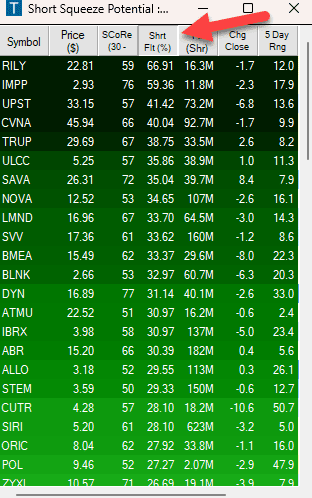

How Trade Ideas Can Help

Trade Ideas is an invaluable tool for predicting short squeezes by retail traders. Specifically, our scanners can prove extremely helpful for predicting and capitalizing on lucrative short-squeeze opportunities. Real-time data that the naked eye often misses. One of the traders’ most significant obstacles is their oversight; finding and analyzing every suspicious short float percentage is impossible, which is where AI comes in. Our scanner helps you decipher stock charts in a fraction of the time and energy.

Social sentiment scanner

Trade Ideas’ social sentiment scanners offer sentiment analysis provided by AI programming to scan social media platforms for spikes that could foreshadow organized buying efforts. It scans numerous popular platforms, including Reddit, Twitter, and StockTwits, to identify any rising hype and chatter on specific stocks before it fully goes viral and the major news outlets pick it up.

Short interest scanner

Our short interest scanner scans the entire market for stocks with a very high and increasing short interest, having over 20-30% float shorted signals potential for a squeeze. This way, traders are more equipped to get in on the action and not relive the regret of missing out on previous squeezes like GME.

Squeeze Triggers Scanner

This scanner hunts for events that may catalyze a squeeze, like positive earnings surprises, analyst upgrades, or news events. Our squeeze trigger scanner leaves no stone unturned, scanning the web and noting any moment or piece of information that could potentially trigger a short squeeze.

Backtester Module

This allows testing of custom short squeeze criteria on historical data. This module can optimize the quantitative formula for maximum returns.

Automated alerts

Our automated alert windows set up real-time notifications so traders never miss one of these potential trigger moments. These precision-focused alert notifications are based on the proprietary squeeze model, so traders do not have to practice manual screening.

Technical Analysis Support

Finally, Trade Ideas also aid traders in executing the necessary technical Analysis to time entry and exit, offering formulas combining various indicators. Timing entry and exit is crucial to avoid taking unnecessarily higher risks by staying in too long or even selling before the squeeze occurs.

It can prove challenging to predict virality, so conducting technical Analysis is always recommended; traders should avoid following blind hype. In conclusion, this article outlines the difficulty behind early identifying short squeezes, from vigilant monitoring for spikes in hype or fundamental catalysts to extensive technical Analysis to time entries and exits.

Fortunately, traders can leverage tools like Trade Ideas to automate much of the identification process through customized scans and alerts. By coding the short squeeze criteria into a custom AI bot, traders can have an algorithm scour the entire market for emerging opportunities 24/7.

The software also equips traders to backtest ideas, instantly visualize technical patterns, and employ robust risk management strategies. Additionally, Trade Ideas harnesses the power of data science and machine learning to optimize strategy performance automatically over time.

Armed with these advantages, the ability for individual traders to capitalize on short squeezes levels the playing field versus institutional investors. Despite potential risks around volatility and timing, the rewards outweigh the downsides if armed with the right tools. By partnering with Trade Ideas to uncover the following heavily shorted stock, picking up traction among retail traders, life-altering returns await. That search can now begin on autopilot with the guidelines provided in this article.