Charting the Course: Trading Insights for January 11th

Charting the Course: Trading Insights for January 11th

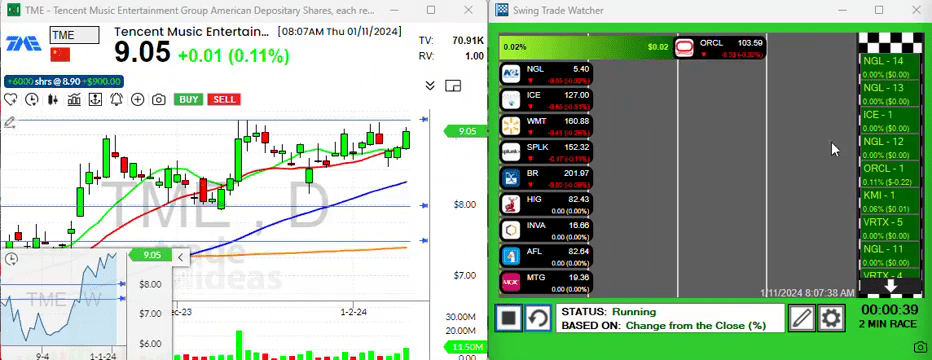

Welcome back, fellow traders! It’s Andy from Trade Ideas, bringing you the latest market setups and opportunities. It’s been a hot minute since my last video, having taken a brief respite to recharge my batteries. But as we jump into Thursday, January 11th, it’s clear there’s no rest for the markets. They’ve nudged their way back towards those dizzying all-time highs – a sight to see both on the SPYs and the QQQs.

Read on as I dissect some promising setups, highlight one old-school stock making moves, and attribute a China play that’s holding strong despite a volatile market backdrop. And remember, inserts for graphical sweetness are incoming!

High Tide for the Markets Again

Upon returning from my week of vacation, I was greeted by an almost triumphant stock market brushing up against all-time highs. There’s an undeniable buzz when the indices such as the S&P 500 ETF (SPY) and the NASDAQ 100 ETF (QQQ), show such strength. It sets the stage for us—avid market participants—to scout for individual names ready to ride the momentum wave.

Setups Stealing the Show

The property and casualty sector caught my eye with their textbook patterns paving the way for potentially profitable plays.

The Spotlight on ORI

First up on my radar is Old Republic International Corporation (ORI). A stellar example of resilience, this stock has been flirting with its 20-period moving average, consistently closing above the 10-period—which is our sweet spot for stability and potential upside.

Let’s get visual for a second:

A closer look at the charts reveals a tempting trade opportunity just over the horizon. A breakout above $29.68 could be our ticket to profits with ORI. As traders, we salivate over such bounces, so keep this one locked-in on your screens.

A China Plate With a Side of Caution

Next is a rather interesting China plate – which in trader lingo is a slang for a stock, not a dinner set. This one’s been in my portfolio for a stretch and continues to show remarkable tenacity. Relative to the overall Chinese market, it’s sturdy, holding up like a champ.

Should it shatter the $9.20 level, we could witness a bullish sprint. But, and this is a big but, don’t let FOMO lead you astray. Chasing isn’t our game, careful entry points are.

The Bounce-Back Candidate: Walmart

Now, how about an old-school bounce-back narrative starring none other than Walmart (WMT)? The chart tells a tale of a gap down—likely earnings-induced turbulence—but behold the recovery arc with a recent leap out of the established range.

Witnessing WMT bridge a near nine-point chasm is nothing short of impressive. As always, entry is more of an art than science here—judging the momentum and volume is key.

A Cool Customer: Intercontinental Exchange (ICE)

Rounding out today’s list, we’ve got Intercontinental Exchange (ICE) – a name that’s as intriguing as its services. ICE sits comfortably atop its 10-period moving average, a bullish omen if there ever was one.

We’re eyeing a pivot over the $129 level as a green light for action:

Wrapping Up Today’s Trades

So there you have it, folks. A few stocks shimmying into the limelight, ready for us to make our moves. Whether it’s a seasoned name like Walmart or a performance powerhouse like ICE, we’ve got our work cut out for us.

Remember, in the words of the legendary trader Jesse Livermore:

“The stock market is never obvious. It is designed to fool most of the people, most of the time.”

Stay nimble, stay smart, and let’s ride the market’s waves to prosperity.

That’s it for today’s rundown, but I’ll be back with more tidbits and trade talk. Until next time, keep those charts up, and let’s grab tomorrow by the candlesticks!

Signing off for now,

Andy from Trade Ideas