Taking Stock: A Close Look at the Current Trade Scene

Taking Stock: A Close Look at the Current Trade Scene

Hey, traders! Andy here with your latest fix on trade ideas. I hope your new year has kicked off to a stellar start and you’re ready to dive back into the market, which since New Year hasn’t exactly been a nonstop party. It’s the third day of January – a dull Wednesday like any other. Let’s take a look at the action thus far.

Market Watch: Average Moves and Important Levels

First and foremost, we have to talk about some noteworthy moves we’ve been seeing lately. Remember that ten period moving average we’ve been keeping in check? For the first time in a couple of months, we have closed below it. This is a significant indicator that we need to keep an eye on.

Compounding this is the fact that we’re gapping down today at the 20-period moving average. Furthermore, we’ve also noticed considerable support around the 469 mark; I’d suggest keeping a close watch on this pivotal benchmark. Any dips below this could potentially set us off on a downward trajectory towards the 460 level.

Therefore, now’s not the time to be overzealous or hasty – it’s more of a waiting game at this point. The market is more or less at a standstill currently.

Spotlight on Setups: A Few Picks for the Day

While we observe the slowing pace of general market activity, that doesn’t mean there aren’t opportunities to seize. Certain sectors, notably the biotechnology industry, have shown robust performance. Let’s get into the details and look at a few picks I have shortlisted for you today.

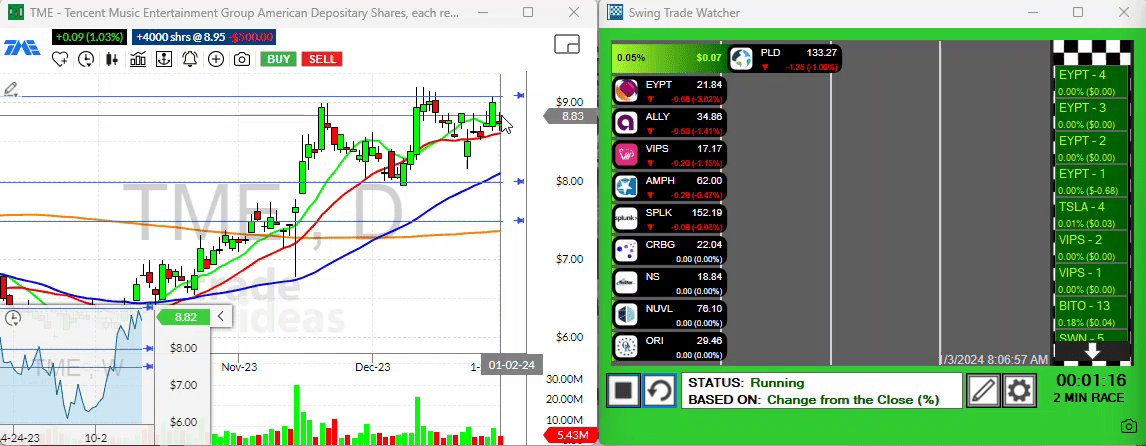

First in line is a China-based play called Tencent Music. This certain stock caught my eye and held quite well making it our “trade of the week”.

The key level to watch for Tencent Music is a bit tricky to determine. However, if you’re the early bird type, you could potentially utilize the high from yesterday as your trigger point. I took this route and bought this stock yesterday. The outcome? I’m just as curious as you are.

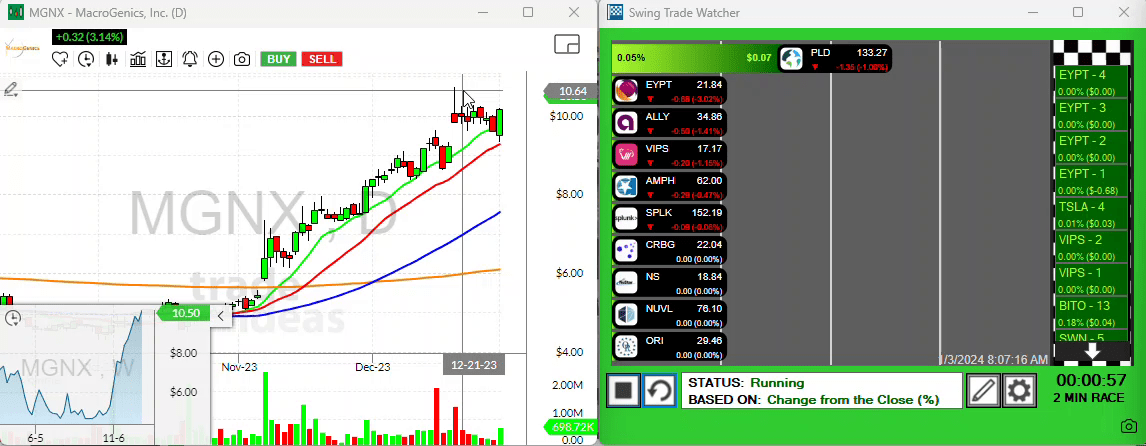

Secondly, let’s shift our focus to a couple of biotechs that have been creating buzz – MGNX and Vertex. MGNX managed to recover quite well from a sell-off and ended yesterday on a high. It even shows prospects of gapping up a little today. Look out for the high around the 1070 mark. Set a price alert, if you will.

On the other hand, Vertex, although a bit on the pricy side is showing promising signs of breaking out of the 413 levels.

Lastly, we have a stock you might find intriguing – Amph, yet another biotech firm. Its performance is quite commendable, countering a sell-off attempt yesterday with a nice bottoming tail. Watch for level movements possibly above the 63.50 mark.

There are few more tantalizing options on my list, but let’s leave a few puzzles for another day.

As I wrap up today’s piece, just a friendly reminder that I’ll be MIA next week, kicking back on a much-needed vacation. This might induce a slowdown in my video updates, but I assure you keeps tabs and give you a thorough catch-up once I’m back.

Until then, happy trading, and I’ll see you next week. Bye for now!