Key Trading Setups to Kick Off 2024

Key Trading Setups to Kick Off 2024

Hello, traders! Andy here from Trade Ideas wishing you a Happy New Year filled with successful and fruitful trades. It’s the second day of January, undoubtedly an exciting time as we look into the horizon and ponder on the trading trends that might unfold this year.

Predicting Market Volatility

Over the past few days, we’ve seen some incredible gains in the SPY chart, specifically in its weekly chart. As thrilling as it might be, don’t be caught off guard seeing a gap down today. Why, you might ask? It’s not unusual for people to postpone selling towards the end of the year to evade the strain of tax consequences.

Top tip for swing traders out there: Being a swing trader provides you with the luxury of patience. Feel at ease entering the New Year, and don’t rush into trading in the first few days. Instead, let it unroll a bit, watching for potential setups to form.

“As a trader, patience is not just a virtue – it’s an absolute pre-requisite.”

Market Setups to Watch

That said, it’s time to delve into some setups for today. But, always bear in mind that these setups are largely at the mercy of the market.

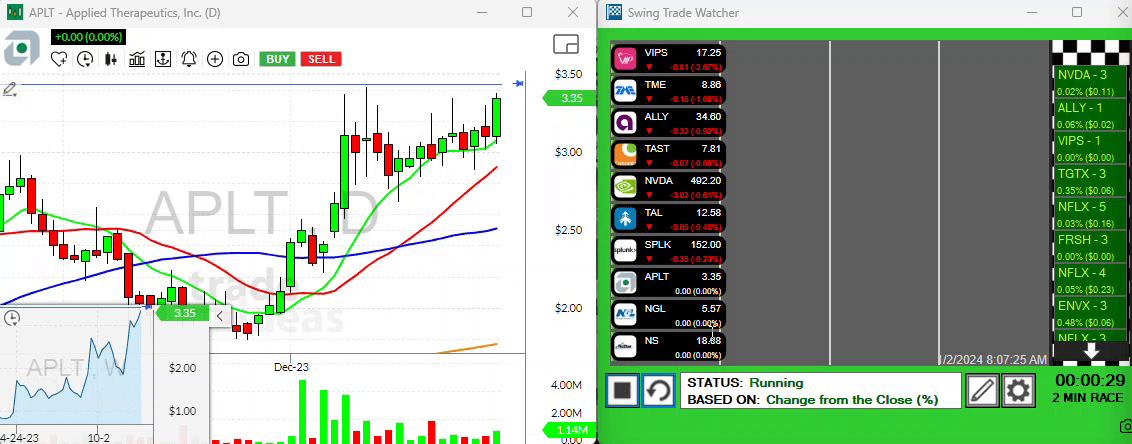

APLT: A Potential Entry Point?

First up, let’s take a look at APLT. Seeming quite promising lately, this stock showed significant volume as it approached the $350 mark. It tried to pull back, but it’s currently maintaining a solid ten-period moving average. As with any stock, be cautious. The break of the high going back to December could make for an attractive entry point for APLT.

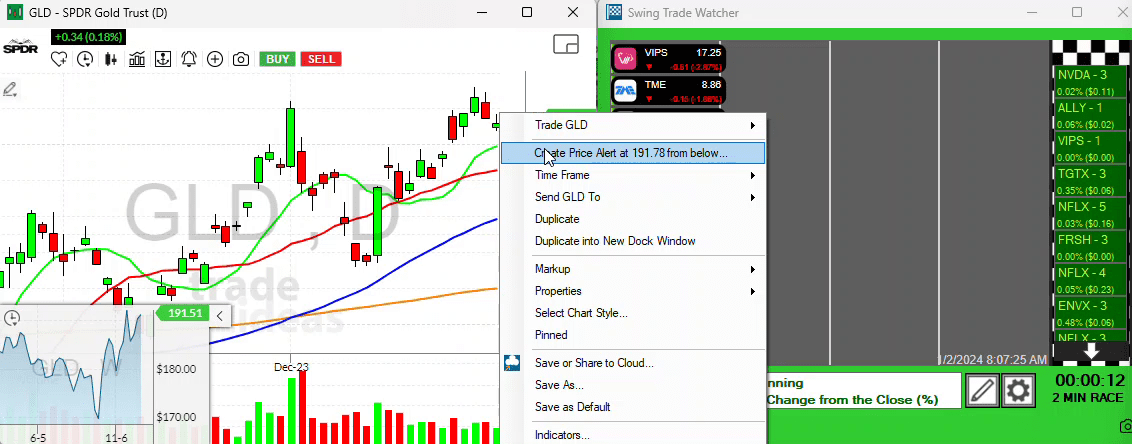

GLD: Heading Back to All-Time Highs?

Our next setup is Gold. Unlike other stocks, Gold may not be affected by the movement we’re currently seeing in futures, especially SPYs and Q’s. This precious commodity shows a solid setup and is approaching its all-time highs. Keep an eye out for a potential bar reversal where it could make a return to those all-time highs in GLD.

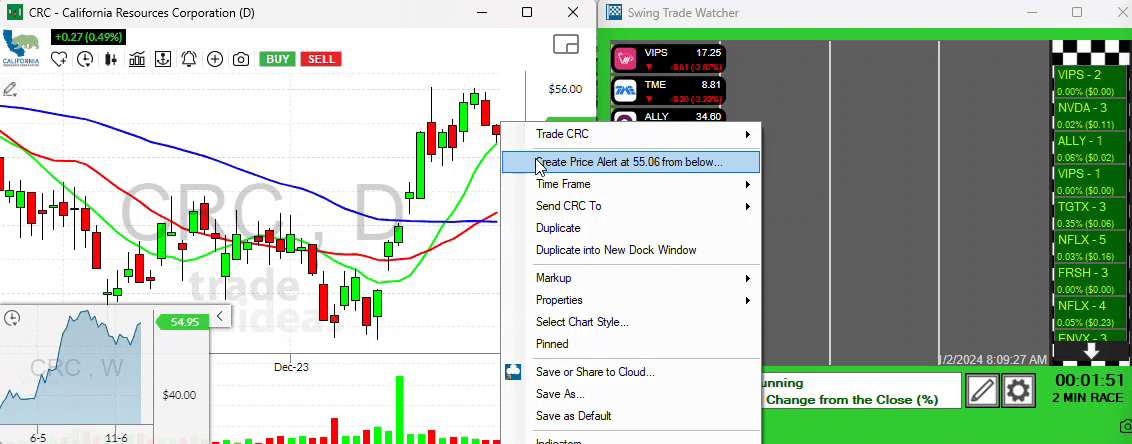

Oil Stocks: CRC & KMI

Entering the energy sector, there are a few oil stocks that have caught my attention. CRC or California Resources, for example, has shown strength over the past few weeks, only to pull back to a ten-period moving average later. If the oil commodities hold strong, we might spot a bar reversal in this stock as well.

Lastly, keep an eye on Kinder Morgan Inc. (KMI). Mark a price alert for this monthly high going back to December.

2024 Trading Mantra: Patience. Analysis. Timely Action.

That’s all for today! Stay tuned for more fruitful discussions and updates in the near future. Happy Trading!