The Last Trading Day of The Year: Trading Ideas for Traders, from a Trader

The Last Trading Day of The Year: Trading Ideas for Traders, from a Trader

Hello Traders, it’s Andy here with Trade Ideas. As we approach the end of this eventful year, we find ourselves on the last trading day of 2023. Let’s examine some crucial setups and potential trade opportunities in today’s unpredictable market, primarily focusing on SPY, ENVX, CEIN, and ORI.

SPY and the Elusive All-Time High

This year we’ve seen the SPY, or the S&P 500 ETF, consistently climbing upwards, or as I cheekily call, it “bleeding up”. Today being the last trading day, it seems SPY is vying to reach that all-time high. Whether or not it will muster the required momentum is something we’ll have to wait and see.

Nevertheless, such a bullish trend in the market creates good potential for lucrative setups.

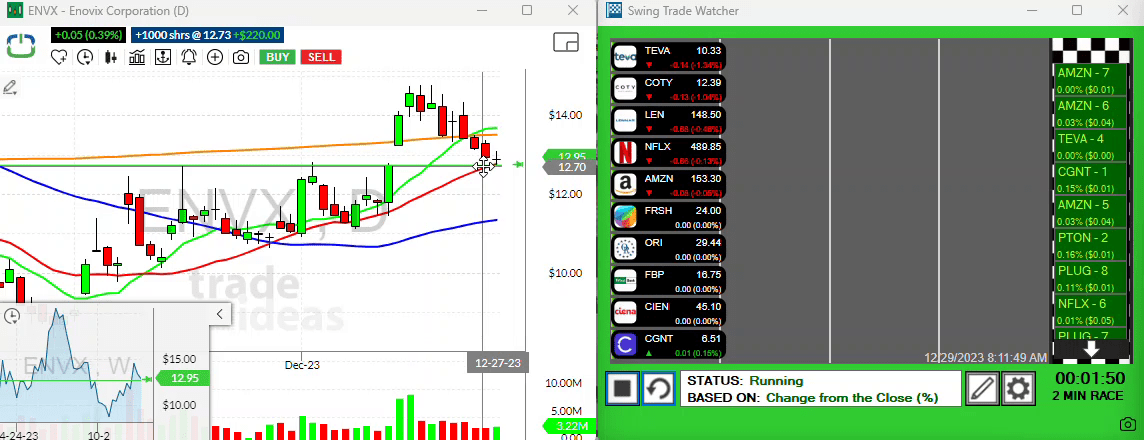

The Unexpected Contender – ENVX

First up is a bit of a wild card – ENVX. I recently bought some at 1273, right off its 20-period moving average, and here’s why.

ENVX has a great deal going for it – a gap fill from previous trading sessions, a strong support level, and a key moving average all aligning perfectly.

Given these factors, the strategy that I often employ is to “nibble” on the stock and later add to my position.

But be warned – like all wild cards, this might need monitoring to manage risks effectively.

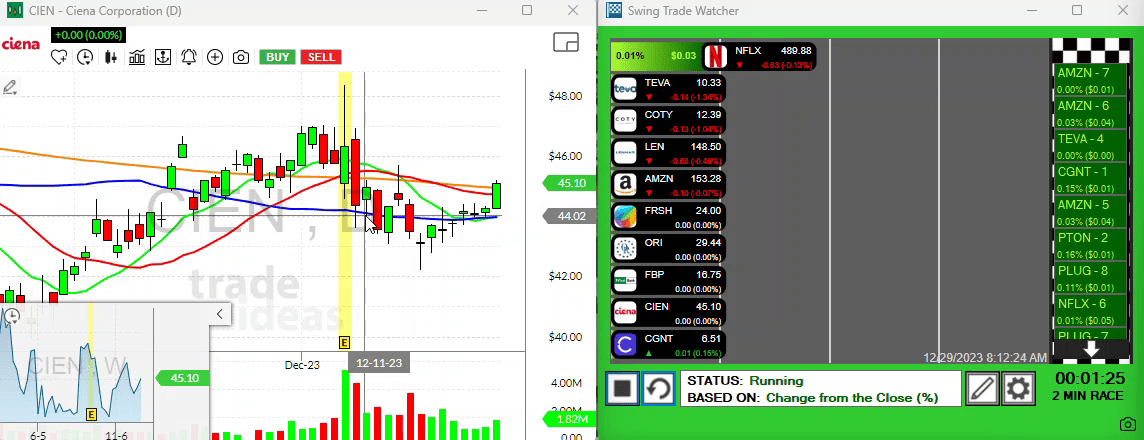

CEIN – A Late Bloomer with Volume Surge

Next on our radar is CEIN. Despite middling performance post its recent earnings release, where it seemed to just “bleed out”, an uptick in volume was observed at yesterday’s close.

On top of that, CEIN managed to climb back above some key moving averages – a useful signal to traders! Now, exactly where you want to take this is a bit subjective, but I have set a personal alert around 45.50 just to stay in the loop.

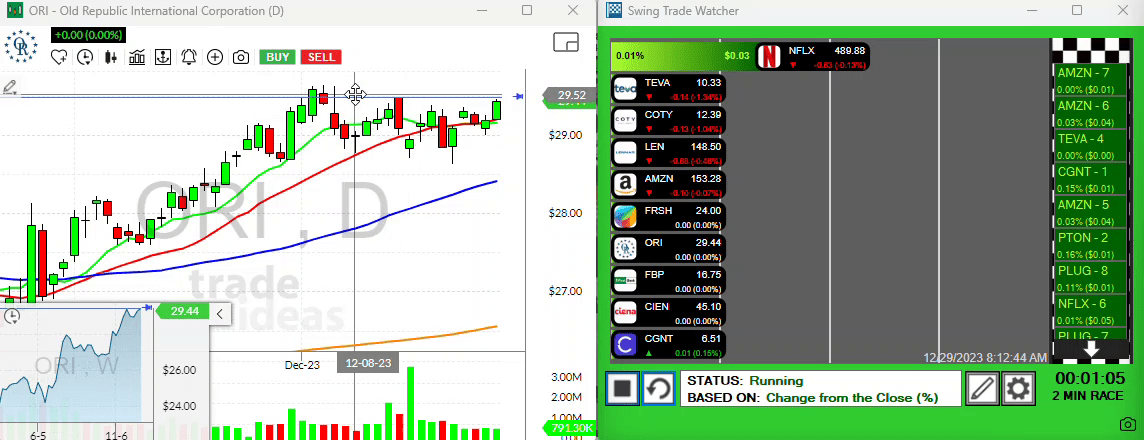

ORI – The Steady Climber

Last but not least, ORI is another stock on my watchlist. After several weeks on a somewhat sideways motion, it’s time to watch ORI carefully.

Why, you ask? Well, should ORI manage to break through its channel high, there’s a good chance it will surpass its all time high. I’ve set a price alert and will be keeping an eye on this one.

More to Trade, More to Come

While these give some idea of the available setups, the market is brimming with even more trading possibilities! It could prove daunting to decide which one to ride, but that’s precisely why having a list helps.

So there you have it – a quick rundown of what’s currently on my trading radar for the last day of 2023. Remember, trading is a delicate balance between risk and reward, and while these ideas serve as a starting point, they should not replace your comprehensive research and risk assessment.

I wish you all a fantastic trading day and a happy new year! Stay tuned for more insight and trade ideas from my end next year.

Until then, happy trading and stay safe! Bye.