Pushing Through: A Trader’s Insight into a Surging Market

Pushing Through: A Trader’s Insight into a Surging Market

Hello traders, Andy here with Trade Ideas, with a fresh take on the market activity for December 19th. I begin with a word of caution, as it’s essential not to sound like a broken record, yet notice that the market continues to maintain an upward trend. You could say we’re kicking it up a notch!

Despite the sideways movement of the SPI (S&P 500 Index) over the past three days, the bullish behavior persists. But remember, as enticing as the upward momentum is, don’t get carried away by it. Instead, we encourage you to look for stocks setting up nicely without necessarily chasing them.

Stock Analysis & Insights

1. Toast (TOAST)

First on the list is Toast. A stock I’ve been observing for a while now, it still has room or “ketchup” to grow, if you will. Its current standing in the lower 10% of its all-time range further bolsters this position.

This makes it an appealing prospect for adding above its three-day high. My price alert right at it ensures I don’t let this opportunity slip by.

2. Path (PATH)

Next is Path, yet another stock on my radar. In my view, this stock holds considerable promise. My strategy here is to wait for it to break its two-day high. Restrain from chasing all the way up to that wick. Instead, aim to add on a break of the three-day or two-day high.

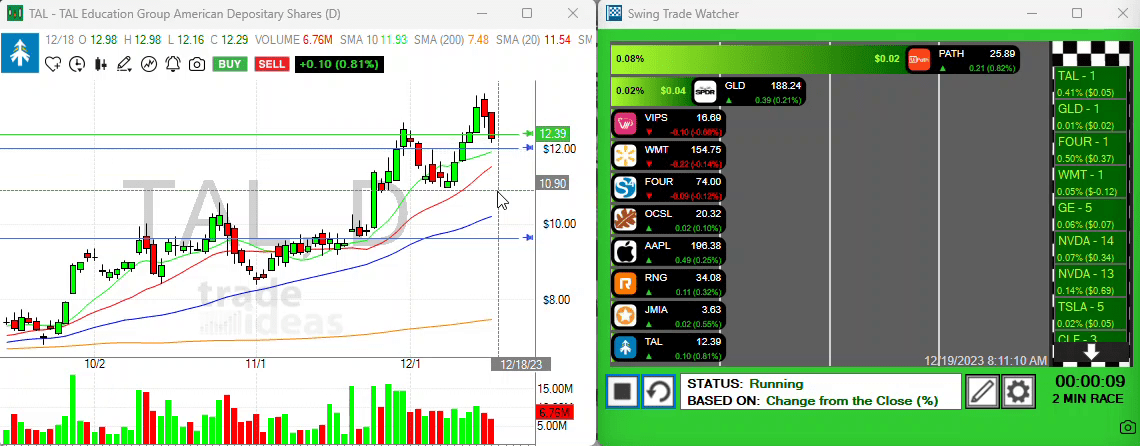

3. TAL Education Group (TAL)

Switching to a different gear, we have TAL—an intriguing Chinese play with a potent stock chart. After a few days of pullback, I’m anticipating a drive-down this morning. I plan to bid in around the 1290 or 1295 mark, keeping it half size for the initial position.

Despite the inherent risks, I’m a firm believer in the potential this chart holds. After all, trading is all about calculated risks, and I’m willing to take one here.

4. Upwork (UPWK)

Lastly, we discuss Upwork—a stock I’ve been involved with before. Despite a somewhat chaotic trading history (as reflected by its numerous differently-colored candlesticks), there’s something intriguing about its chart.

Zoom out, and an impressive level emerges around the 16 level. Here, I’m looking for a push above 16 in Upwork, pointing towards a promising outlook for this stock.

Wrapping Up

“In trading, the best offense is a good defense. Keep it tight and strategic, and the market will unveil its opportunities.”

This concludes today’s market analysis. Through careful monitoring and patient waiting, astute traders can uncover profitable opportunities even amid continuous market ascendance. I hope these observations inspire you on your trading journey.

So, have a great day in the market. Remember, don’t chase—let the perfect stocks come to you. Until tomorrow, happy trading and bye for now!