Trading Insights and Ideas: Looking at the Market, Strategies, and Trends

Trading Insights and Ideas: Looking at the Market, Strategies, and Trends

Hello, traders! This is Andy, your go-to source for insightful trading insights and ideas. It’s Friday, December 15th, and the market landscape is buzzing with activity. With the current market climate near record-breaking highs and numerous dynamic shifts occurring, there’s plenty to discuss today.

A Closer Look at the Market

We can’t overlook yesterday’s subtle doji candlestick in the market, backed by a substantial volume bar. You might consider whether this is a sign of a potential downward gap looming or the beginning of a pullback. However, the future is somewhat unclear, considering the market’s variegated comportment over the past few days.

“Traders, it’s essential to approach this window with caution as today marks quadruple witching, the usually tumultuous seasonal market phase accompanied by an index rebalance.”

Examining Trending Setups

Even amidst the potential uncertainty, attractive investment setups retain my attention, and here are some worth examining:

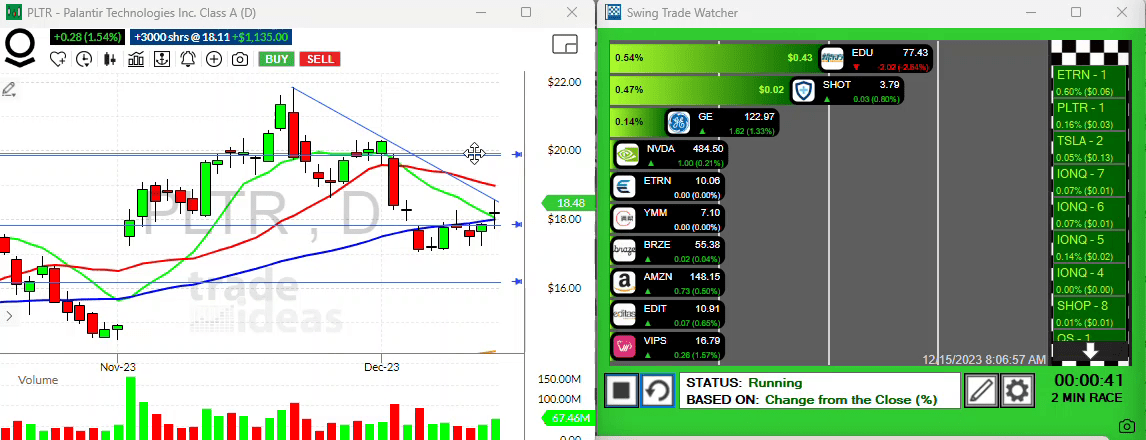

Palantir Technologies (PLTR)

PLTR stands out with its ongoing downtrend that dates back to the previous month. However, its position is promising if it surpasses yesterday’s high and finally breaks away from this downtrend – something to keep an eye on. This trend has been especially noteworthy when considering other industry peers such as AI and Ionq, who made impressive moves just yesterday.

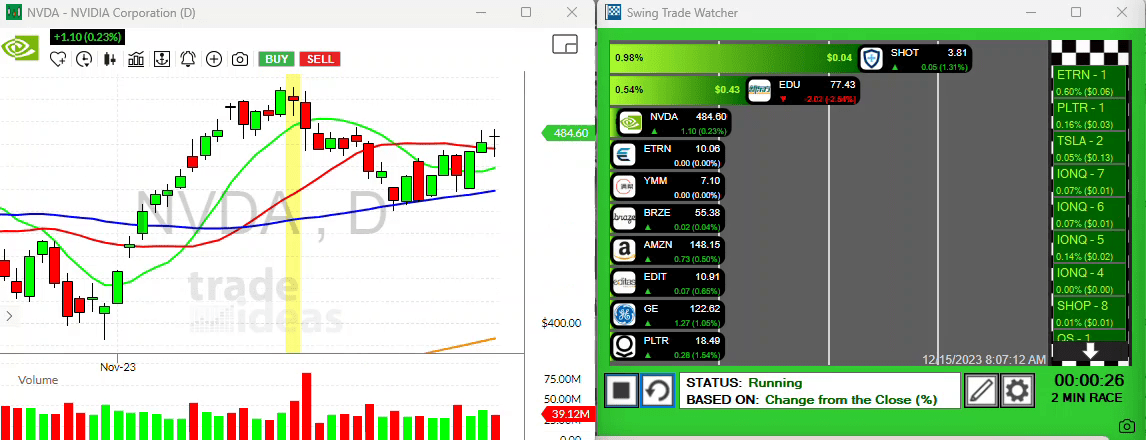

Nvidia (NVDA)

Despite the overall market’s recent surges, big tech stocks like Nvidia have disappointingly lagged. Yet, I can’t help but be intrigued by Nvidia’s current setup and potential. If it can break through the recent three-week high, it could signal an advantageous turn for investors.

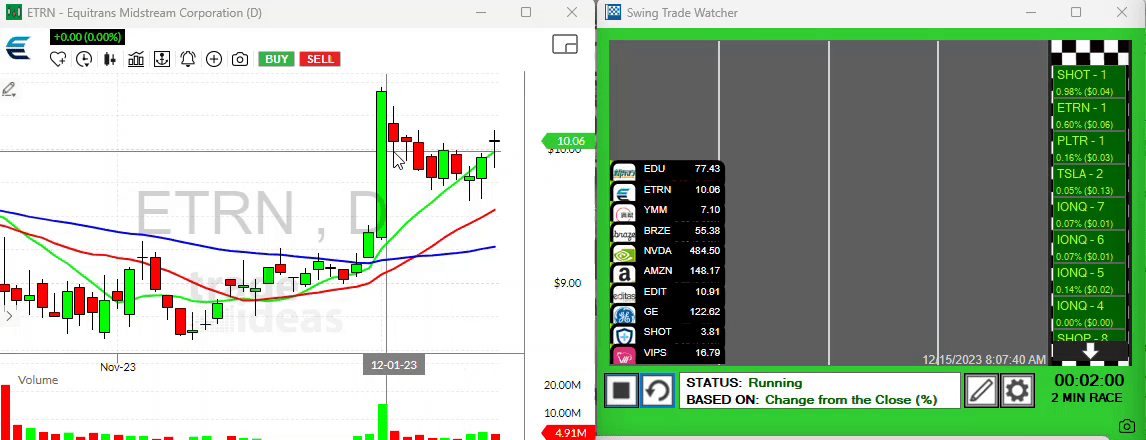

Equitrans Midstream Corporation (ETRN)

A closer look at Etrn reveals a rather commendable performance yesterday. It held its ten-period moving average firmly, rendering it as a potential investment opportunity worth considering. Specifically, if it surpasses yesterday’s high, that could serve as a beneficial trigger point.

Vipshop (VIPS)

VIPShop (VIPS) is another stock that has been making moves recently. Posting a strong performance yesterday, it’s tried to break through a critical level around $16.75.

Finally, let’s not forget China’s stocks. Although I hold positions in several of them, their recent attempt at a market rebound calls for your attention. Make sure to check out the full list of stocks in my daily round-up.

To Conclude

Whether you’re a novice trader or a seasoned market player, navigating the dynamic economic landscape throws unique challenges at everyone. However, “forewarned is forearmed”, and staying updated on the market trends not only helps you mitigate risks but also opens doors to new opportunities.

Have a great weekend, everyone, and let’s resume these fruitful discussions on Monday!