Analyzing Today’s Trading Opportunities with Andy from Trade Ideas

Analyzing Today’s Trading Opportunities with Andy from Trade Ideas

Hello trading aficionados, it’s Andy from Trade Ideas here. It’s a bright Wednesday on December 6th and the stock market is livelier than ever. In today’s blog, we’ll revisit a market summary, check out some hot trading setups, and I’ll offer some personal investing insights that you could just find useful.

Resilience in the S&P 500 (SPY)

Yesterday may have seemed like a potential sell-off for the SPY as it broke the ten-period moving average, but defying expectations, it managed to bounce back and closed above this marker. Adding a cherry on top, we’re now even seeing some gapping up close to the tantalizing 460 level.

However, this isn’t an invitation to lower your guard. As traders, we should be wary of shorting this market. The strength within the current market is palpable, and caution is advised! Each trade holds its own risks and potential, so it’s key to note trends but not to fleece them blindly.

Patience: The Virtue of Trade

The trading game isn’t always about instant decisions. Sometimes, it’s about being patient and diligent. Take Meta (formerly known as Facebook) and Nvidia, for instance. Both these stocks have been on my watchlist for the last couple of days. With a little patience, I managed to snag both at a decent price, close to the 50-point marker. Practice creates mastering traders, and patience is a key element to our success.

Quote: “In the world of investments, it is important to remember that patience is a virtue and impulsive decisions may lead one to regrettable outcomes.”

The Top Setups to Watch

Now let’s take a look at some intriguing setups that might just catch your fancy.

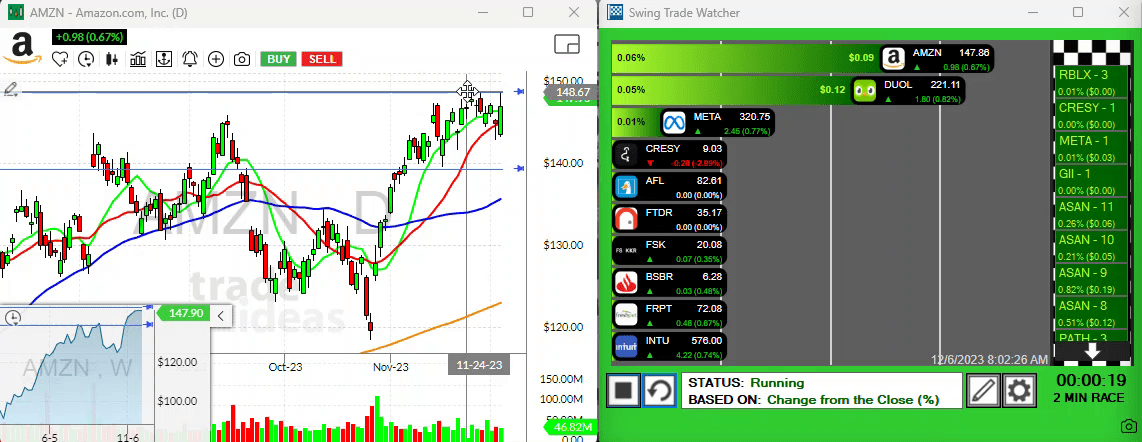

Amazon (AMZN)

Yes, it’s hovering around its monthly high, but that doesn’t mean AMZN is off-limits. The relative strength we observed yesterday is noteworthy, and an exciting update is on the horizon for Amazon. Keep an eye out for a break above the 149 level. But remember, if it doesn’t pan out, exit stage left quickly to mitigate any potential losses.

Aflac (AFL)

Who knew the insurance company with the iconic duck could make for such an interesting play? AFL’s performance continues to impress, backed by strong volume bars. A break above the 83.40 level could be highly rewarding.

Banco Santander Brasil SA (BSBR)

This lesser-known, smaller cap stock is garnering some attention. Given the high volume observed over the last three days, a break above the 6.35 level could pave the way to some potentially exciting moves.

Freshpet (FRPT)

This one was on the list yesterday too. Keep an eye on this given its recent earnings day highs. A breakthrough above that 74 level could mean some significant profits.

Closing Thoughts on Today’s Trading

That wraps up our rundown of today’s market nuances and potential setups. As we explore the world of trading, let’s remember to keep our strategies tight and our approach flexible. Trade safe, and we’ll see you back here tomorrow for more insights, updates, and potential opportunities in the world of trading! Until then, have a great day everyone!

Remember, the key to successful trading does not lie in getting rich quickly but in preserving wealth steadily.

Happy Trading!