Trading Tips with Andy: Market Insights for Nov 16

Trading Tips with Andy: Market Insights for Nov 16

Hey there, traders. It’s your go-to-market maven, Andy. Trading on November 16, as we step into the throes of the earnings season, presents some interesting insights.

A General Snapshot: The SPY

The market grounds seem a bit long in the tooth this time. Flashbacking to SPY – our reliable S&P 500 ETF – the patterns are intriguing.

Consider the little spinning top that has come to the fold. It’s signalizing a profit-taking trend. And yes, we’ve got a topping tail to ponder upon too.

As of this instant, it appears as though we’re gapping just about flat on the circuit. But hey, a trader’s world is never that black and white, is it?

Keeping it Patient: My Adage

Though we’ll dive into potential setups, I urge caution, guys. We’re treading choppy waters, and it’s advisable to step back and wait for those pullbacks. The current market is not presenting quite as many opportunities as we might like – a lot of stocks are whoppingly overextended.

Putting the Earnings Hat On

In times like this, focusing on earnings plays has proven useful. Here, we plunge into jackpot prospect stocks that you should not miss out on.

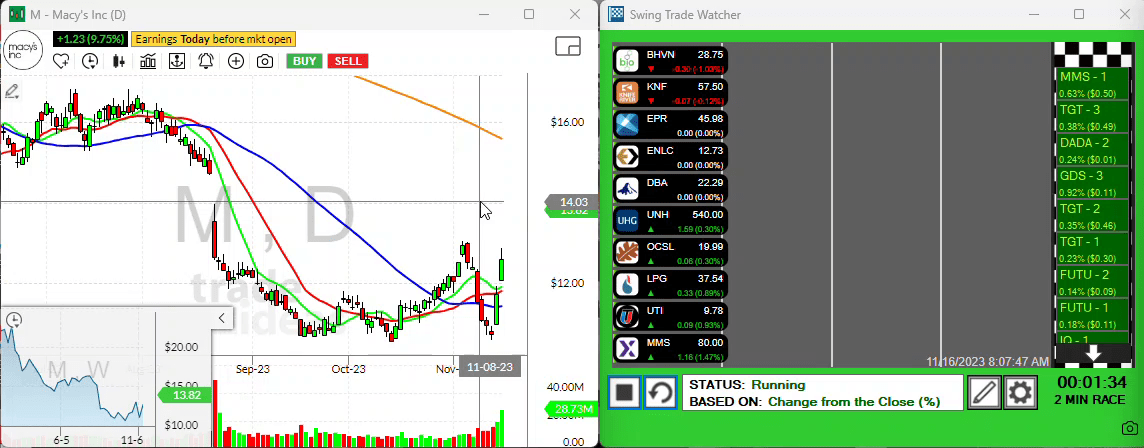

Macy’s: A Spunky Option

The first on my radar today is Macy’s. It’s loaded with potential, showing signs of gapping up. Where lies the ace? It might just attempt to fill this gap over here.

But remember, the game is tricky – that extra dollar surge could ensue within the opening jiffy, so handle with care.

VNET: The China Trigger

For those bullish on the Chinese economy, we have VNET on our list. A serious drop at the start is likely on the horizon. For investors like me, already invested in some China stocks, it might be a bumpy ride initially.

However, the chart hints towards a potential cup and handle pattern. That’s our cue. Be on the lookout for VNET to pull closer to the 380 level – a breakout could be in the offing.

Arco: Timing the Earnings

Arco too is on my checklist. This time, it’s an earnings play, and it offers an intriguing position. Currently, gapping up precariously close to its all-time high is a call for attention.

A swift instance of ‘gap and go’ could be on the cards – stay tuned.

SLV: Striking Silver

Finally, for those not deterred by the precious metals segment, here’s a nugget of gold – or rather, silver. SLV, the widely followed silver trust, is breaking out of its range, shooting towards a two-month high.

To all gold and silver enthusiasts: your moment has arrived!

Wrapping Up: Your Trading Mantra

As any seasoned trader knows, patience is the name of the game.

“Wait for your pitch – that solid, juicy opportunity.”

I’ll be off for a day, but will be back greasing the wheels of the trade amidst you all on Monday.

Until then, keep trading and keep winning. Catch you soon!