Staying Ahead in the Trade Game

Staying Ahead in the Trade Game

Greetings, traders! It’s your good old trading pal, Andy here, and I’m back again with Trade Ideas. We woke up to a marvelous Tuesday morning on November 14th and were met with an unforeseen gap up in the SPY off the CPI numbers. As a seasoned trader, I know today is going to be a serious challenge in unearthing those sweet setups.

Chasing Not My Game

Allow me to clarify my stance. I’m not exactly the kind to chase. Fortunately, I was already invested in a dozen or so stocks, from which I’m aiming to reap some rather tasty profits on the open. I’d love to share a few that I’m currently invested in, and you might just be able to snag a few before they offshoot.

Following the Path

This path I’ve been treading on has been in my conversations and thoughts quite consistently lately. It’s paid its dues after several days of holding on, finally leading to a rewarding gap up out of this range. Not too shabby, I’d say. Maybe a pullback this morning is on the horizon, but it’s all tricky amidst the significant gap up we’re observing today.

Being a successful trader is not about the destination – it’s about the journey of becoming. ~ Andy

Exploring Further Options

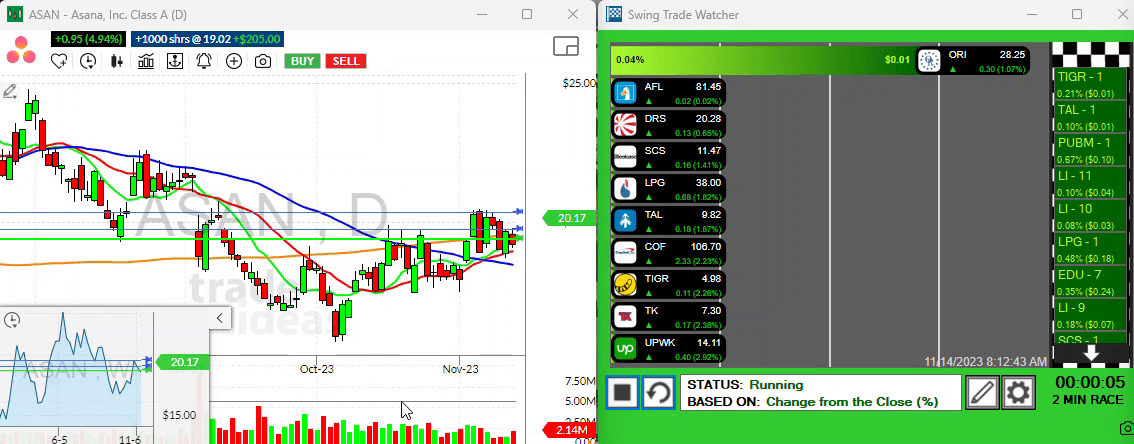

Another lingering thought includes Asan. My experience with this one has been rather underwhelming, sort of hovering around in the doldrums, not doing much. Nevertheless, you could potentially swoop in there and set a price alert at that monthly high in Asan.

TAL and Tiger T-I-G-R: The Promising China Plays

Our China Plays, Tal, and Tiger T-I-G-R, still make the cut for noteworthy mentions. I find myself drawn to the setup of Tal, which brims with promise. It’s ahead of all its moving averages. Yes, it sees a bit of a gap up, but the overall structure of the chart remains quite constructive.

A similar feeling washes over me regarding Tiger T-I-G-R. All I’m trying to do is identify those rare gems that aren’t gapping up by 2% or something in that ballpark, or even better, something I can get ahead of.

Encouraging Growth in ARC Stocks

Predictably, a number of ARC stocks are gathering momentum and are expected to perform well today. Wait up! I just remembered another one you could keep your focus on – Upwink.

Spotlight on Upwink

I’ve been invested in Upwink for around three days now. Admittedly, it’s on the upswing, breaking above its five-day level. I still hold onto the belief that it might reach that high, tracing back after earnings. So keep an eye on Upwink as well.

Looking Ahead

As my parting piece of advice, I urge you all to be patient. If you’re looking to buy, it might be worth your while to await pullbacks. Today could turn out to be a gap up and then crap. Who knows, right? But stay optimistic, and brace yourself for a possibly great trading day. I’ll touch base with you tomorrow. Have an awesome day, folks, and stay tuned for more trading tips and insights. Bye for now!