Navigating the November 10th Market: Doji Amplifications, Break Levels and More

Navigating the November 10th Market: Doji Amplifications, Break Levels and More

Nov 10, 2023

Hello, traders! It’s Andy from Trade Ideas, and it’s a happy Friday indeed – November 10th, to be exact.

In this post, I’ll dive into the current market situation, explore outcomes of various movements, highlight setups to watch, and hopefully shed some light on what’s happening in trading.

Experiencing the Market Rollercoaster

Yesterday wasn’t exactly what we’d call a bull market leap. It caught me by surprise as well, resulting in a good chunk of my portfolio – about half, to be exact – hitting stop-loss points. Traders, old and fresh, know how incredibly essential it is to have stop-loss points to safeguard your investments, so breathe easy knowing that the mechanisms did their job.

When it comes to specifics, I am currently invested in a few securities, but let’s not divert our attention.

From a technical standpoint, yesterday it represented quite an ominous phase. We saw what one might refer to as a ‘dark cloud cover’, a bearish reversal pattern that warns of potential price drops. Not the most encouraging sign, especially when dealing with the unpredictability of markets.

Divine the Gap

Following yesterday’s downturn, we’re riding on an unexpected positive wave this morning – we’re gapped up. What does that mean? Well, in trader lingo, this implies that a day’s opening price is significantly higher than its closing price of the previous day. In our case, we’re gapping up around midway through yesterday’s range.

Investor’s tip: A “gap up” mightn’t always indicate an upward trend. Be sure to keep an eye on market trends and investor sentiment before making a decision to buy/sell.

Setups To Watch: Key Players in The Game

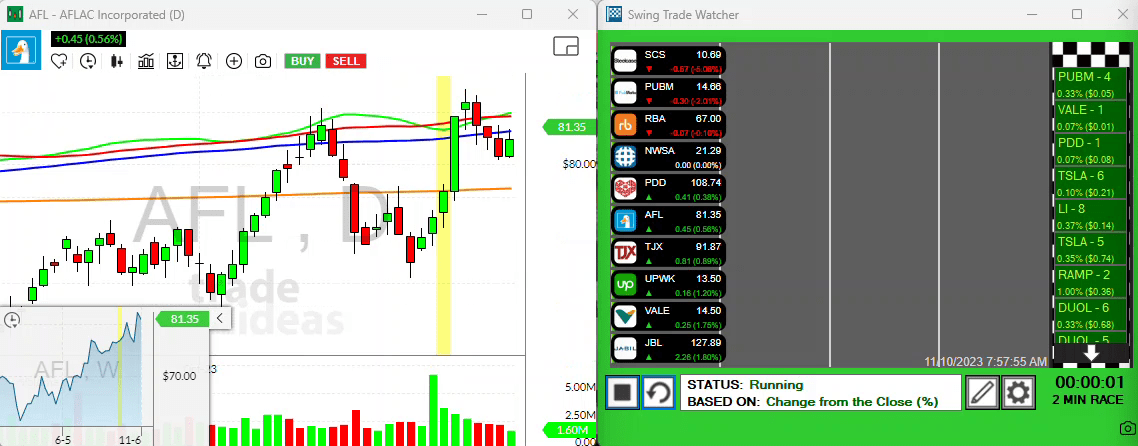

Plunge directly into the heat of the trading floor; it’s time to highlight some setups on my radar:

- Upwink (UPWK): An interesting entity indeed. A position I’ve held for a couple of days. What prompted my interest? It closed flat in spite of the shifty market performance yesterday. The fact that it managed to maintain such stability offers an encouraging sign to its holders. A doji standing its ground, will we see a reverse off the bar and break yesterday’s high? Keep a vigilant eye on UPWK.

- SCS: On the record, I’ve mentioned this before. Barring the ambiguity over a potential bad tick, (which may certainly be the case as no significant events such as earnings announcements were reported), we need to continue looking for a break above its current 1150 level.

- Jabil (JBL): Another one to possibly earmark for the rundown, but it’s one that requires patience. Sporting an intriguing wedge, a break above the 229 level may be on the horizon. These are purely anticipatory at best, but keep a finger on the pulse of JBL’s movements.

In addition to these potential market breakouts, I see Aflac Insurance Company presenting a promising setup. Experiencing a pullback over three bars, it could potentially be heading towards a reversal and eventually cement a three-day high position.

A word of caution: There’s a repertoire of earnings plays surfacing on indices at the moment and while they can be quite appealing, bear in mind, they’re also rather unpredictable.

That’s about the gist of it, traders! Have a splendid weekend and stay tuned for more insightful trade ideas on Monday. Hoping for a bullish weekend ahead for you all, trade safe and remember, your worst enemy in trading is impatience.

Goodbye, until next time.