Breakdown of Promising Trade Setups with Andy

Breakdown of Promising Trade Setups with Andy

Nov 6, 2023

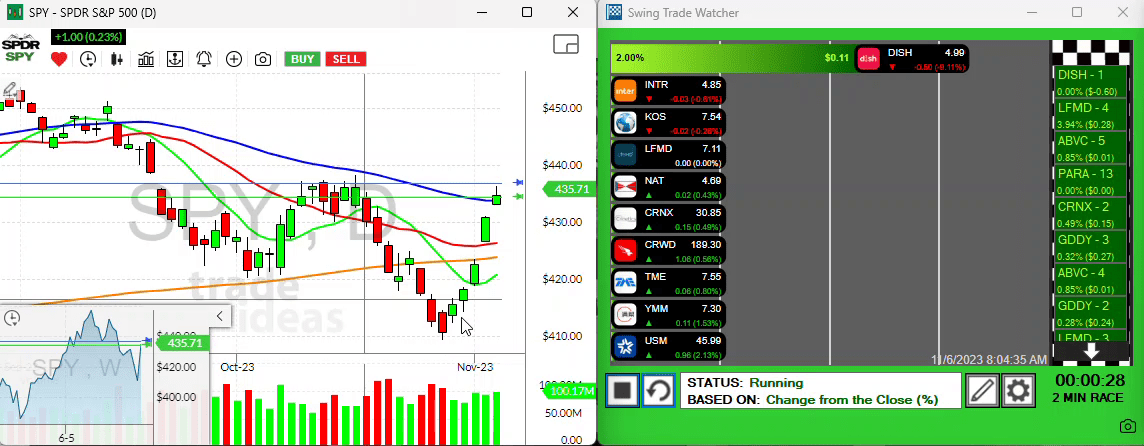

Hello traders! It’s Andy here, the eyes and ears of Trade Ideas, bringing you the inner workings of the market straight from the frontline. Today is Monday, November the 6th, and we’re excited to kick off our first test drive. Let’s dive into the day’s trading patterns and decipher what the market communicates to us.

A Look at the Current Market Trend

Over the past five trading days, we’ve witnessed a nice push; the market is showing strength by closing above our 50-day moving average. However, we face resistance levels in SPYs that we still need to tackle. Given the current scenario, I expect a short-term cooldown phase, perhaps a couple of rest days with the market either pulling back or trending sideways. My advice at this point is pretty straightforward – avoid chasing many stocks at this stage. Let’s be strategic and analyze a few promising setups instead.

Setting the Trend: BTDR

Starting with BTDR, it’s an intriguing pick that I’ve had my eye on for some time. Interestingly, it’s been attempting to breach the $4 mark. This stock falls into the category of bottom fisshers, which means it requires a cautious approach. However, the stock is gapping up a slight bit as the market opens today. If it manages to surpass the $4.20 threshold, we might be looking at an explosive potential.

NAT: Understated Excellence?

Moving on, the next stock on my radar is NAT. We’re segueing our focus from chasing green bar-studded landscapes to studying more subtle and strategic setups. NAT is a splendid example of such an understatement with a solid setup.

There lies a beautiful synchronization of a considerable volume-led movement which has now been marking time sideways, coupled with a ten-period moving average that could act as a catalyst for higher action.

Let’s place a price alert here for a proactive approach. A little head start doesn’t hurt, does it?

The Chinese Contenders: TME and MNSU

Next in line, we’ve got some Chinese fortes to get our hands on. A stroke of good news here – China is experiencing an encouraging gap up overnight! Let’s venture into a couple of Chinese blue chips.

TME or Tencent Music has been under my close watch for a few days now. I’ve invested in this one and the choice seems to be working quite well; it just recently broke above its 200-day moving average! Therefore, what we should be watching out for is some ensuing continuity in TME.

Another stock we should be mindful of is MNSU. I believe it’s currently in the preparatory phase for a potential move. While it still has quite a chiseling to work through before laying a clear trend, I find the setup appealing.

And that’s a wrap for now. You’re geared up to take on the market with this analysis. Remember, in the world of trading, patience and wisdom are the trump cards of success.

Until next time, happy trading and see you soon!