Successful Trading Strategies: Understanding the Market Momentum

Successful Trading Strategies: Understanding the Market Momentum

Welcome back, trading enthusiasts! This is Andy from Trade Ideas. You’re joining me for a recap of this week on the market, specifically looking at Friday, November the third. You wouldn’t believe what an exciting ride it’s been these past four days! Plus, we are prepping for trading opportunities that the new week may bring.

The Market’s Game of Ups and Downs

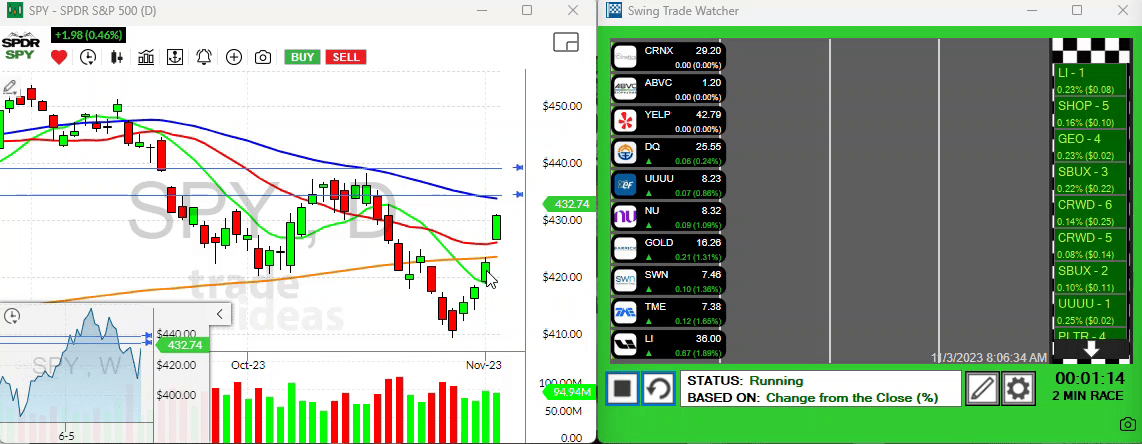

Surprisingly, despite negative news on jobs numbers – remember, as counterintuitive as it sounds, bad news can often imply good prospects in the trading world – the market has been responding positively. Many traders are now hoping that this downturn will cool off the market somewhat, possibly leading to a dip in interest rates.

However, as always, it’s crucial not to base our decisions on speculation, but instead to follow the price action. As traders, we’re always keeping our eyes on the 50-period moving average. This week, we’re closing in on it. While this might spur excitement, try to avoid being swept up in the wave.

Chasing the Market: Caution Required

Seeing the market running can be thrilling, but remember, after a significant rally, it’s not always wise to chase. Keep a lookout for setups and possible pullbacks instead. With several geopolitical factors at play and the weekend closing in, it’s a good idea to play it safe, minimizing exposure where possible.

Spotlight on Setups

Let’s delve into some setups I spotted. First off, SWN. I mentioned this one earlier due to its impressive setup pre-earnings. Well, it turns out, it experienced a positive move and a gap-up on the earnings results, which arrived after the bell. Keep an eye on a potential break above the 750 level in SWN.

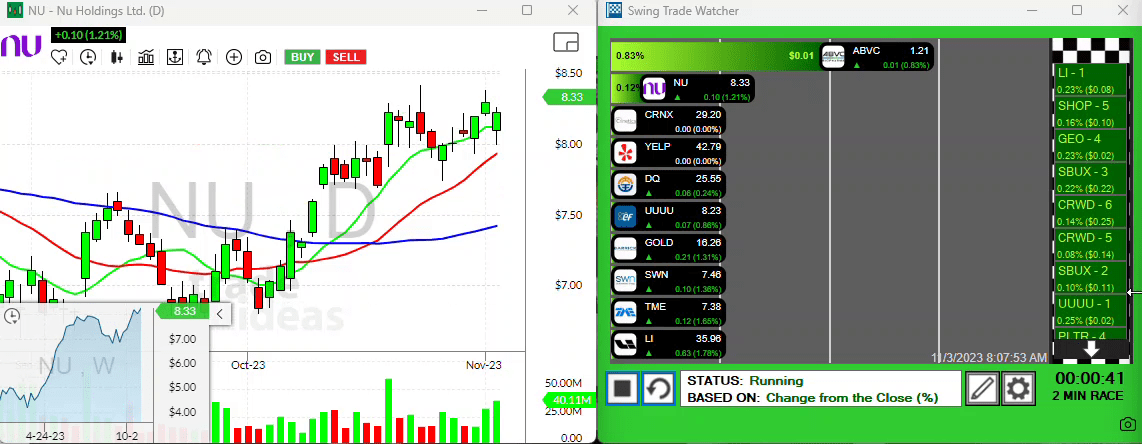

Next up, NU. Taking a look at the NU’s chart, it shows promise. After a move upwards, it has managed to close above its ten-period moving average since then. I’m definitely interested in this one if it surpasses the 840 eleven level.

Prepping for an Interesting Week Ahead

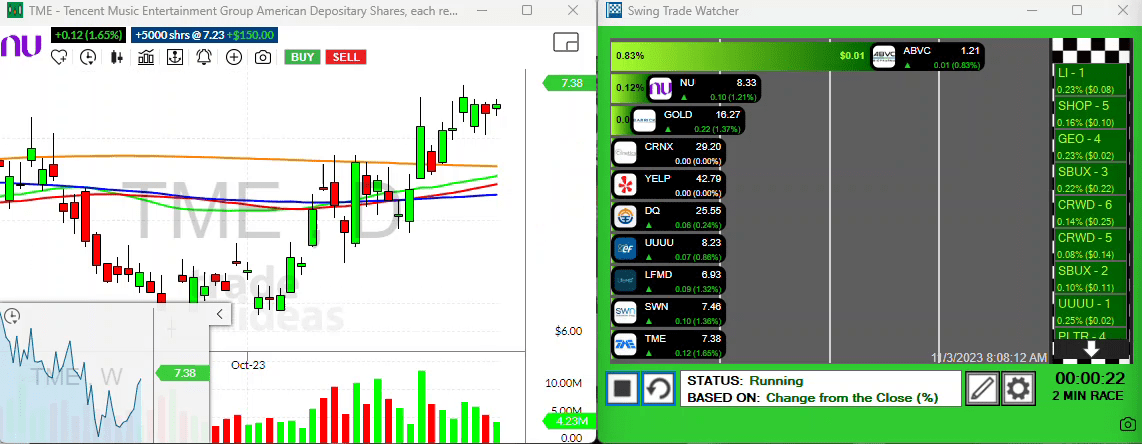

Lastly, one stock that I’ve discussed over several days and that I have invested in is Tencent Music (TME), a play of China’s music industry. It’s held up well and shows a gap up in the morning. This stock offers an appealing setup, and as such, I may make additional investments at the market open.

As we move into the weekend, I want to stress again how important it is to remain vigilant and flexible in your strategies, especially considering the various geopolitical factors bubbling in the background.

Remember to keep it tight and enjoy your weekend! Tune in again on Monday for a fresh trading day and some new ideas. Until next time, happy trading!