Trading Tips and Analysis with Andy: Market Outlook and Key Setups for November

Trading Tips and Analysis with Andy: Market Outlook and Key Setups for November

Hello, fellow traders! This is Andy from Trade Ideas bringing you another Market Outlook and Key Setups update on this sunny Thursday, November 2. The market today is presenting a rather inviting landscape with several stocks gapping up nicely. But, as traders, caution is our best companion. I urge you to be very careful with these tempting situations and adopt a patient approach.

Key Tip: Keep patience as your anchor point in a market like this – let the price come to you or patiently look for the right setups.

So, let’s dive into some of the setups that caught my attention.

Earnings-Day Watchlist

One approach that often works well on days like this is to round up all the stocks which had their earnings released and put them into a watch list, preferably a digital one. If you are open to adding a dash of competition to your day, consider making it into a race where you can track which ones are poised to continue their upward momentum and which ones might retreat to fill the gap.

Here are some stocks that are part of my ‘Earnings-Day Watchlist’ today:

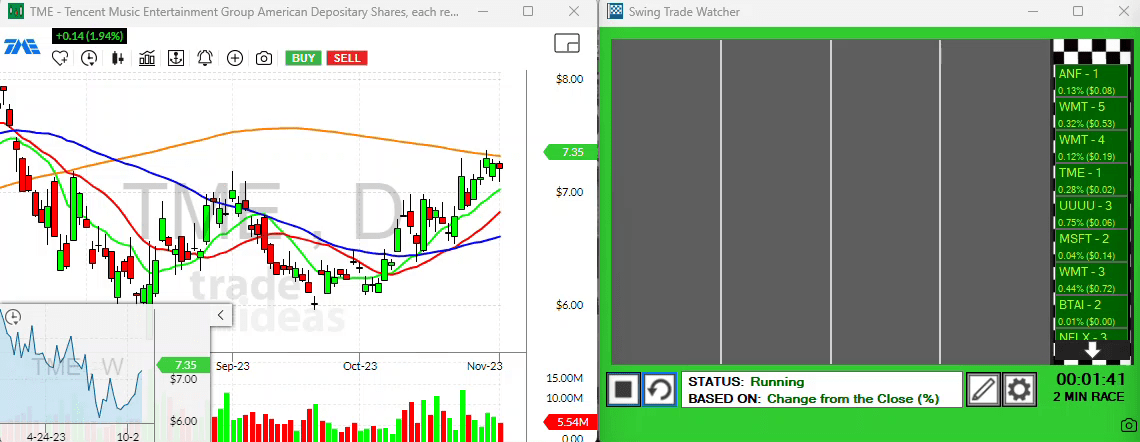

Tencent Music (TME)

TME has been on my radar for a while now. This China play is still setting up nicely. It seems to be gapping up right at its 200-day moving average, which might make an interesting play. I might have to make a move on this one pretty soon.

CrowdStrike

Next up is CrowdStrike. Even though it’s not an earnings play today, it’s previous earnings seem to have set it up for success. Now that it’s gapping up above all its moving averages, with the last one at 20, CrowdStrike has made its way onto my watchlist.

Other Observations and Setups

Apart from the earnings-day watchlist, here are some other setups that have caught my eye.

UUUU Uranium Stocks

UUUU made its way to my list yesterday as it’s setting up for a potential Go Pause mode. Uranium stocks have been strong, and if this particular one gets up and moves out of its range around 815, we might see an explosive move here.

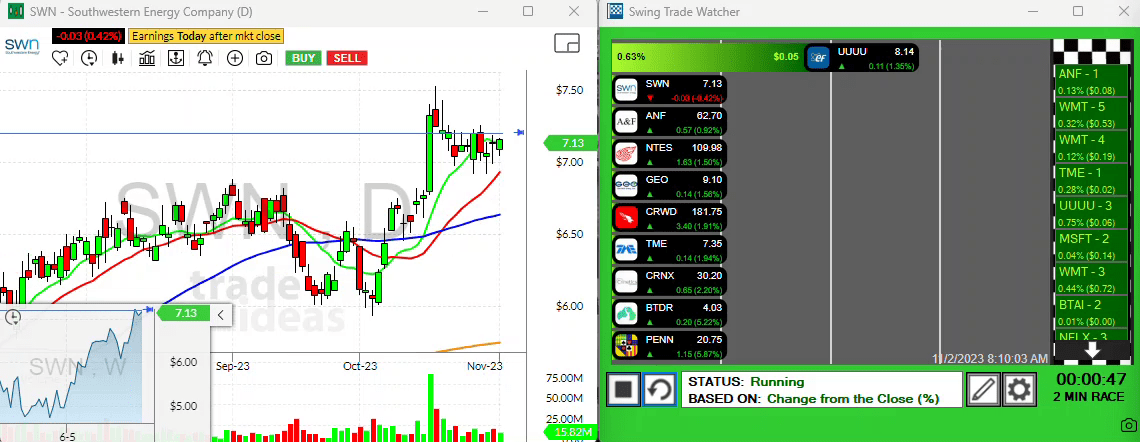

Southwestern Energy Company (SWN)

SWN has shown a strong move on volume and even though it might seem a bit messy, it is still setting itself up for a good move. A slight adjustment, maybe raising it a little bit, might be necessary.

CRNX

Crucially, CRNX caught my attention too. It’s been moving sideways for a while, demonstrating strength. If it manages to climb back above that 30, specifically 30,40 level, it could be an interesting opportunity.

And that’s about it for my observations today. My parting advice remains the same – keep it tight, be patient, and always wait for your price. Here’s to another great day of trading!