Trading Analysis and Ideas: November 1 Roundup

Trading Analysis and Ideas: November 1 Roundup

Hi traders! Andy here with Trade Ideas. Hope you’re having an exciting time riding the ups and downs of the market. Let’s kick off this November with some crucial insight on a few prominent tickers and overall market sentiment.

Market Largely Bullish, Some Hurdles Ahead

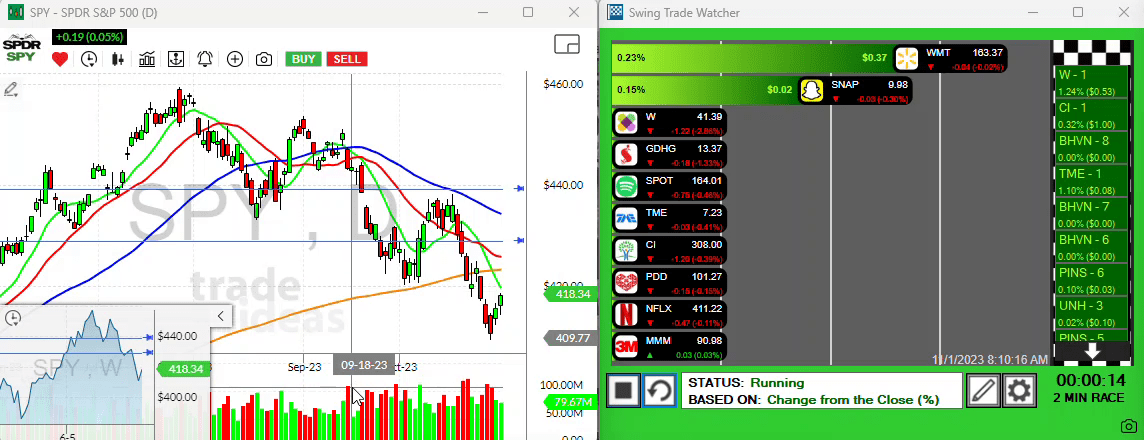

Looking at the S&P 500 Index, or the SPY as we love to call it, it’s been on the rise for the past couple of days. There are clear anticipations for a slight gap up this November 1 morning, perhaps an inevitable rendezvous with the 10-period moving average on the horizon. It’s worth noting that this moving average is on a downward slope.

A sustained upward trend in the coming days could give way to more constructive bullish price action but note that we’re coming out of a recent breakdown from the 420 pivot level. This level signifies a substantial pivot point for SPY, hence tread with caution.

“The first rule in trading: Wait for your pitch! Timing is everything.”

QQQ and IWM Showing Signs of Struggle

Shifting gears towards the QQQ and the IWM, we still see some struggles. But worry not, as turbulence often precedes tranquillity. Keep these on watch and let’s analyse some other setups.

Setups To Keep An Eye On

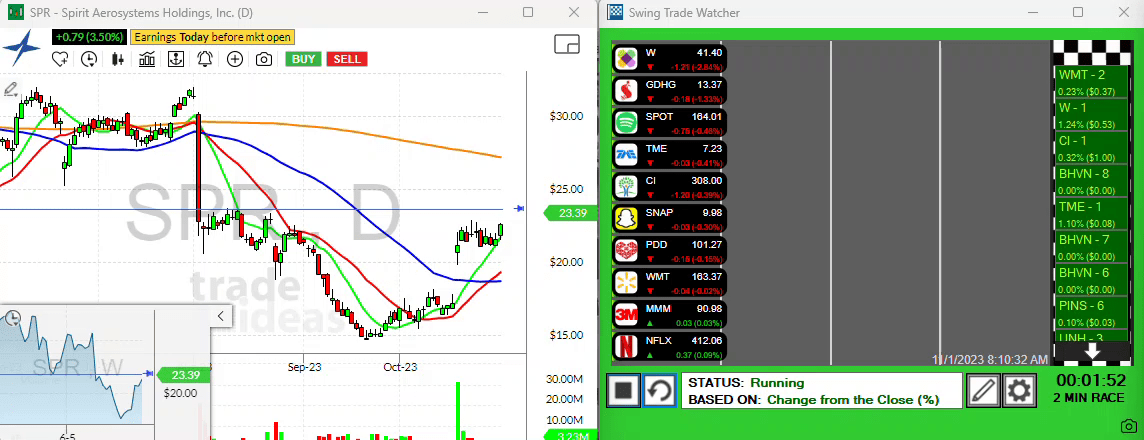

First on the list is the (SPR). This enticing ticker is currently in an earnings season and presents an interesting play. It’s notable that the SPR is gapping up right out of its present range. There’s a pivotal level at around 23.50 to keep an eye on, a breakout from which could mean smooth sailing up to the next high.

Next, let’s circle back to two big names – Microsoft (MSFT) and Netflix (NFLX).

MSFT showed impressive resilience after the recent earnings release, retesting its 20 and convincingly rebounding to stay above all its moving averages. If the broader market plays along, we could witness an extension of this upward momentum.

NFLX, similarly, paints a favorable setup by staying above all moving averages following its earnings announcement.

Remember, these big players tend to sway with the broader market trend, so always keep an eye on the macro sentiment.

Playing in Current Market conditions: PDD and UUUU

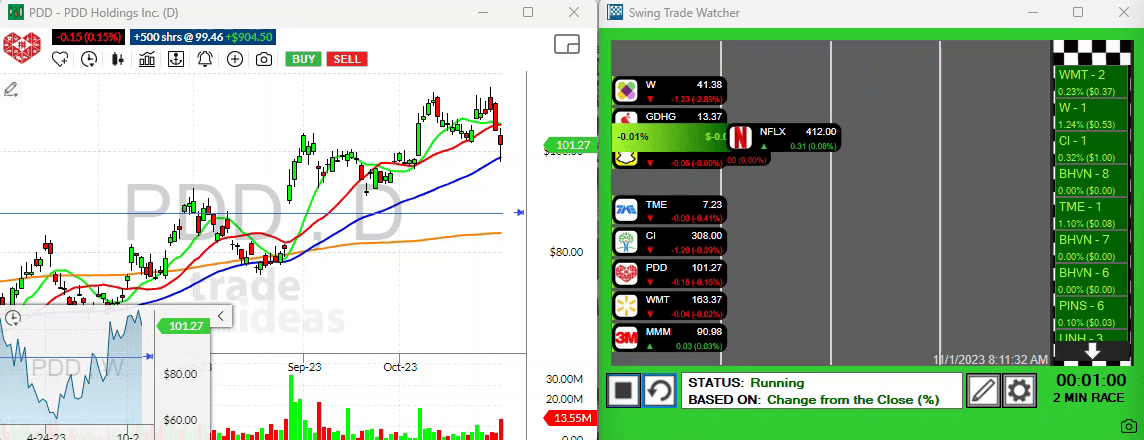

Now let me bring your attention to a less popular but appealing ticker – Pinduoduo (PDD). This plays into my philosophy of “waiting for my pitch”. On the last trading day, it retraced all the way to the 50-day moving average, presenting a perfect opportunity to pick up some shares.

And last but not least, the rare find of UUUU. This setup is looking all poised to impress. Should it break past the resistance around the 814-815 mark, we could be getting ready for a rewarding journey upwards.

Wrapping Up

Alright traders, that’s all we have for today! Remember, we’re all swimming in the same vast financial ocean. It’s volatile, unpredictable, but with the right strategy, it’s an exhilarating ride. Keep an eye on the setups we discussed and we’ll catch up again tomorrow.

Stay tuned, keep hustling!

Andy, signing off.