Trading Mind over Heart: P&L Strategies for Good Trading Decisions

Trading Mind over Heart: P&L Strategies for Good Trading Decisions

By Katie Gomez

The Profit and Loss (P&L) window is a double-edged sword for traders. While it’s a crucial tool for monitoring performance, fixating on it can lead to detrimental outcomes. In this article, we explore the significance of the P&L window, its impact on trading, and how to harness its power effectively.

From the perspective of investors and retail/swing traders, watching investments dwindle can be unsettling. Ignoring your P&L is equally harmful, potentially leading to financial distress. Hyper-fixation on the P&L window can trigger emotional decision-making, undermining logical strategies. To strike the right balance, traders must handle the P&L window judiciously.

Overemphasizing the dollar amount in the P&L window distorts your sense of progress and success, often focusing on losses (L) rather than gains. This can trigger a scarcity mindset and evoke fear, leading to impulsive and irrational decisions.

The Pros of the P&L Window:

- Real-Time Performance Tracking: Offers instant updates to facilitate timely decision-making.

- Clear Visualization of Gains and Losses: Provides a visual representation of your performance.

- Helps Set Realistic Targets: Allows for the establishment of profit and stop-loss levels.

- Identifies Winning and Losing Trades: Enables you to refine your strategy based on trade outcomes.

- Facilitates Tax Reporting: Aids in tax compliance by tracking capital gains and losses.

- Supports Risk Management: Evaluates the risk associated with trades.

The Cons of the P&L Window:

- Emotional Impact: Real-time profits or losses can trigger emotional responses and impulsive decisions.

- Potential for Overtrading: Continuous monitoring can lead to overtrading, increasing costs and risks.

- Short-Term Focus: May promote a short-term perspective, diverting attention from long-term goals.

Balancing and Navigating the P&L Window Effectively:

- Set Realistic Goals and Targets: Establish clear profit and stop-loss levels in advance and adhere to your plan.

- Use the P&L as a Learning Tool: Analyze past trades for insights to refine your strategy, but avoid over-focusing on it during trading.

- Avoid Overtrading: Define criteria for entering and exiting trades and resist impulsive decisions based on P&L fluctuations.

- Implement Proper Risk Management: Use stop-loss orders and align trades with your risk tolerance and portfolio strategy.

- Maintain a Long-Term Perspective: While valuable for short-term decisions, don’t lose sight of long-term goals.

- Regularly Review and Adjust: Periodically assess your performance and adjust your strategy based on P&L data, emphasizing logical decision-making.

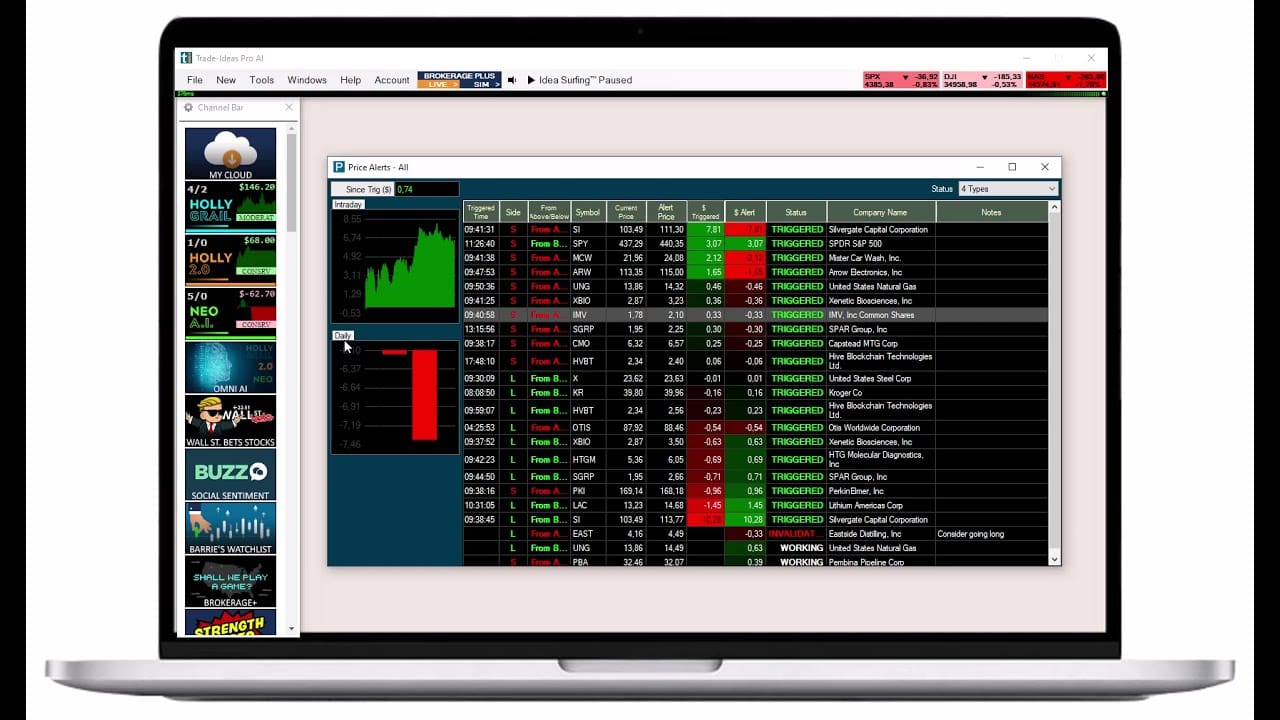

In conclusion, the P&L window is a valuable tool, but it should be used judiciously. It should not distract you during trading or lead to over-analysis. It should complement other analysis techniques for well-rounded, rational trading decisions. Overemphasizing your P&L and losses can distract you from market analysis and trigger emotional responses. For a successful trading experience, visit Trade Ideas and explore our user-friendly Brokerage Plus platform.