Closing October Trading: Insights and Stock Opportunities

Closing October Trading: Insights and Stock Opportunities

Hello, traders! This is Andy, and I’m back with another trading update. Today is October 30th, and it’s a Monday. With the month wrapping up, it’s high time we discussed how we can best end October on a positive note.

Admittedly, the past few weeks have been a little rough. We’ve seen the market struggle, but with a new day dawning, a glimmer of hope has appeared in the form of a slight ‘gap up’ this morning. We are currently teetering on a crucial support level in the S&P 500 (SPY); a relief bounce seems overdue. But in this unpredictable market, your guess is as good as mine. Despite the challenges, there are some promising stocks on the horizon that are worth taking a look at.

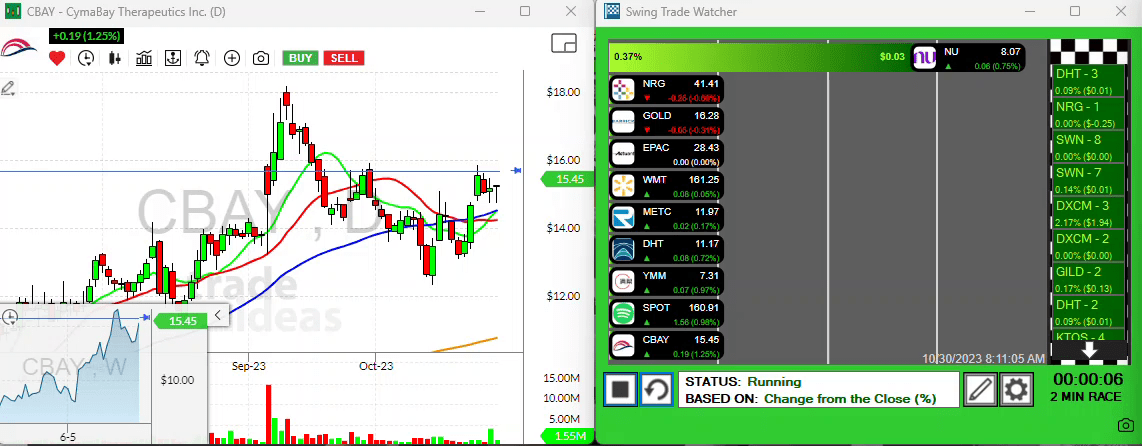

CBay Going Strong

First on my list of today’s stocks is CymaBay Therapeutics Inc. (CBAY). The company has been displaying some encouraging chart patterns.

Over the past couple of days, it’s been exhibiting a few consistent bottoming tails, suggesting that prices might soon be headed upwards. This company is trending above its key moving averages, hinting at a potential bullish reversal in the horizon. Now, whether that looks like the stock taking out Friday’s highs or merely gapping up to around the $15.75 mark, only time will tell. However, one thing’s for sure — CBAY is showing strong future prospects.

Freight, The High-Sailing Industry

Keeping the momentum rolling, we have DHT Holdings Inc. (DHT). As a part of the deep-sea freighting industry, DHT has been generating considerable interest.

The company’s stock price is currently floating near its monthly highs. DHT has showcased a commendable performance recently and other freighting companies are also worth keeping an eye on.

All Eyes on China: YMM and TME

Now let’s divert our gaze towards overseas markets, specifically China. Over the past five to six days, China has outperformed the U.S. A stock that caught my attention during this period is Full Truck Alliance Co. Ltd. (YMM).

YMM recently demonstrated an impressive volume bar, showing that the interest in this stock is increasing. Looking forward, a move above the $7.41 level could mean significant gains.

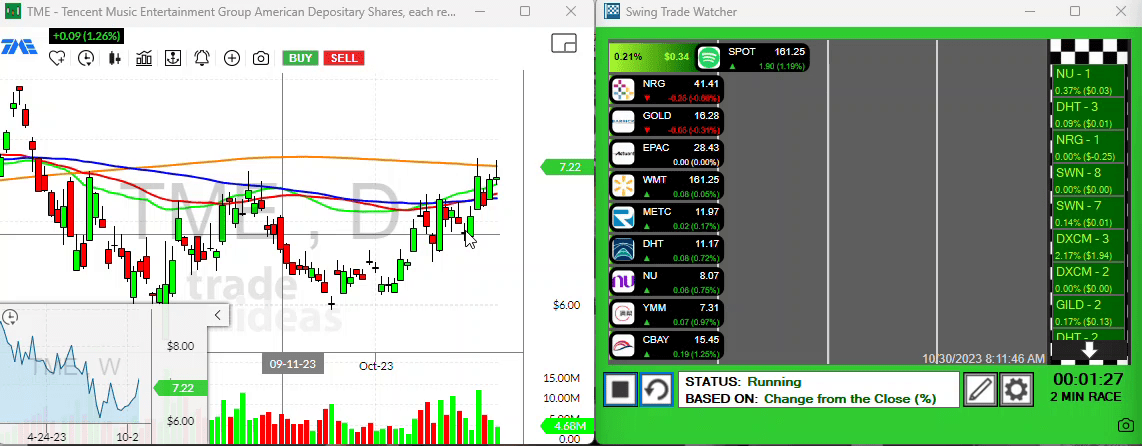

Next, we have Tencent Music Entertainment Group (TME), another Chinese company showing substantial promise.

There’s what appears to be a ‘goalpost’ formation in its chart, indicating possible volatility. If it manages to cross this goalpost and challenge its 20-day moving average, we can expect some profitable momentum. I’ve already set up a price alert for this eventuality, which seems to be a likely occurrence given TME’s relative strength.

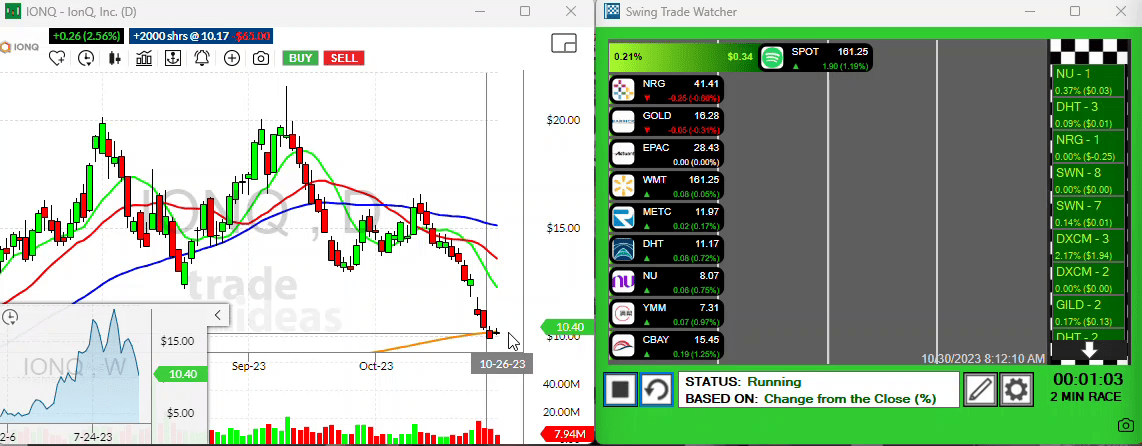

A Nibble for Bottom Fishers

For those who find allure in the thrill of ‘bottom fishing’, IonQ Inc. (IONQ) sits at the precipice of an enticing opportunity. Currently, the stock is hovering at the critical psychological $10 level, giving it a substantial support base as shown on its weekly chart. A three-day high in IONQ could set the stage for a much-needed relief bounce.

Trading can be a turbulent journey, but with careful monitoring and shrewd decision-making, there is a bounty of opportunities waiting to be harvested. Until we meet again, remember to keep your eyes on the charts, be patient, and always strive to make the most informed trades possible. Happy trading! See you tomorrow.