How to Safeguard your Trade in a Downturn Market: Insider Tips from Andy at Trade Ideas

How to Safeguard your Trade in a Downturn Market: Insider Tips from Andy at Trade Ideas

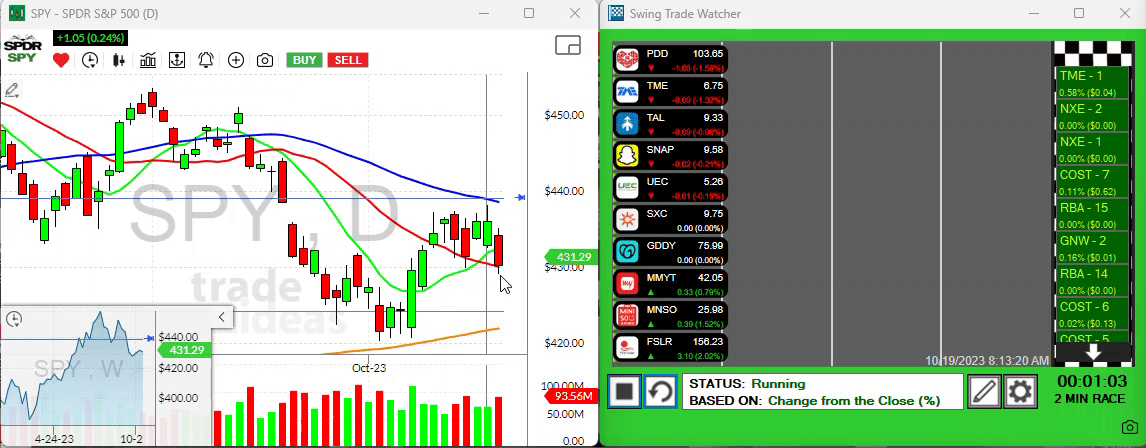

Hello traders, I’m Andy with Trade Ideas. Let’s discuss the market scenario that unfolded on October 19th, which happened to be a Thursday. The day was rather uninspiring, especially for the S&P 500 index which pointed comprehensively to a bear market. I’ll provide my analysis of the situation, give advice on how to protect your investments in these tough times, and throw light on a few stocks that are performing well against the odds. Let’s dive right in.

Navigating the Choppy Waters of the Stock Market

Looking at the diagram below, we notice that the market made a substantial drive downwards, momentarily touching the base of a five-day range before bouncing back a touch to close right at the 20 period moving average.

As the markets attempt a minor break upwards, it’s clear that we’re in a risky phase. Caution is the word of the day right now. If you choose to stay in cash, there is absolutely nothing wrong with that. In this uncertain climate, a 100% cash portfolio doesn’t seem like such a bad idea. However, if you do decide to participate in the trade, I’d advise going in with a small position size.

Resilient Stocks in a Downturn Market

Regardless of the general market drifting into a downtrend, some stocks are displaying remarkable resilience. We must keep in mind the overall market conditions when analyzing these stocks. Here are a few worth paying attention to:

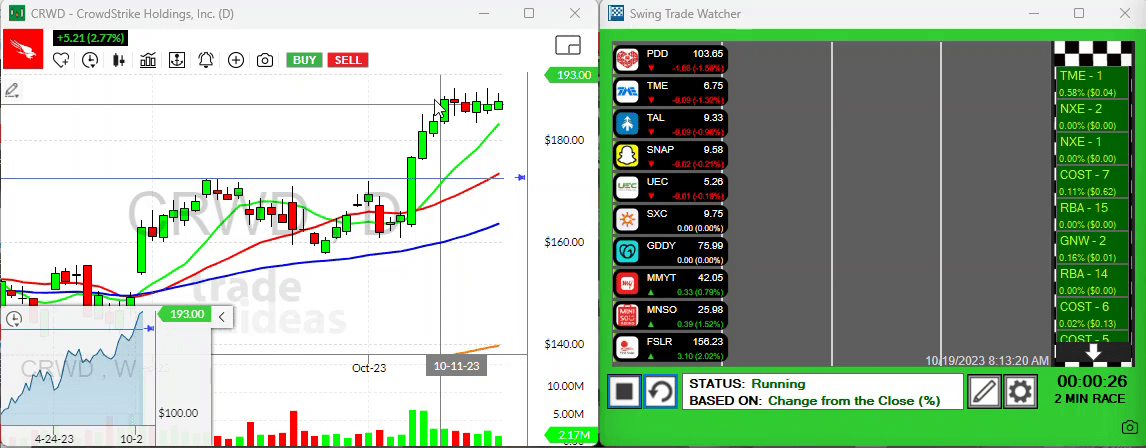

CrowdStrike

To begin with, CrowdStrike has a promising outlook. Though the details of its current upward gap aren’t clear, it’s safe to say that their display of strength signifies solid buying interest which is an encouraging signal given the market climate.

A word of caution here is to avoid the temptation of chasing in this market. Instead, allow for a pullback in this stock for potential entry points.

Snap

Snap is another stock to keep an eye on. The possibility of a pullback for an entry at the 50 period exists or if it breaks through the three-day high at the 975 level, it could signal a turning point.

Tencent Music (TIME)

Despite China markets taking a battering, a couple of stocks are holding their ground. One of them is Tencent Music retrospectively known as TIME. Their impressive pattern coupled with a nice volume bar in an ugly market is an indicator of strong potential. Although there’s a slight slump today due to the weakness in overseas markets, this is one to watch!

TAL

TAL, another veteran on our watchlist, has shown great resilience. I’ve traded TAL in the past, and though I’m currently not invested in it, it’s definitely one to keep an eye on from a longer-term perspective.

“Trading during a downtrend requires a mixture of patience, vigilance, and intuition. Knowing when to enter (or exit) the market can make the difference between significant gains and upsetting losses.”

And with that, it’s a wrap for today. Bear in mind, the scenario may change drastically in the coming days, so keeping a close watch on the market activities is paramount. If you’ve developed or come across some interesting trade ideas of your own, please feel free to share them. Till then, happy trading, and see you all tomorrow.