Traders Eye With Andy Trading Setups for October 18th

Traders Eye With Andy Trading Setups for October 18th

Hello traders, it’s October 18th, a beautiful Wednesday morning. Andy here with Trade Ideas and today we’re going to throw down on some of the most exciting trading setups I’m currently watching.

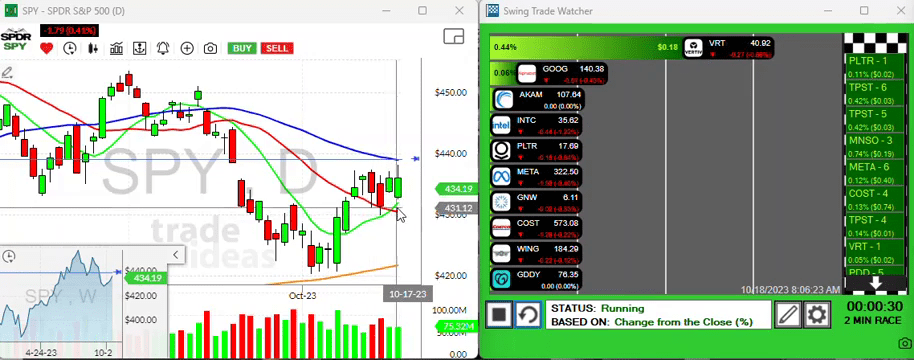

SPY Evaluation

Let’s begin with SPY (S&P 500 ETF). Being the renowned benchmark of the overall market, it’s an excellent place to start. Presently, the SPY is somewhat caught within the range that we’ve been observing for the prior days, gapping down slightly. Interestingly, we see an upward cross with the 10-period Moving Average exceeding the 20-period one — an indication that could potentially lead to a breakout scenario.

Stocks to Keep an Eye On

Moving on, let’s delve into my favourite stocks at the moment:

- SXC – Suncoak Energy: Currently trading above 10, which serves as a psychological level, pivot level, and some resistance. Indeed, this critical level makes SXC an intriguing prospect.

- GDD – GoDaddy: Showing solid consolidation patterns with a couple of nice green bars. Interestingly, it’s trading above its key moving averages presenting a promising setup for a further break out above the month’s high.

- RBA – Ritchie Bros Auctioneers Inc.: Exhibiting an attractive setup. Particularly, the 10-period moving average is sloping upwards. This upward momentum could potentially trigger a catapult through the existing resistance level.

Big Cap Tech Stocks

Let’s now turn our attention to a couple of remarkable big cap tech stocks, Google and Meta, which are steadfastly holding their ground in their respective niche sectors.

- Google: Successfully defending its 10-period moving average.

- Meta: Holding up impeccably as we’re approaching the earning seasons.

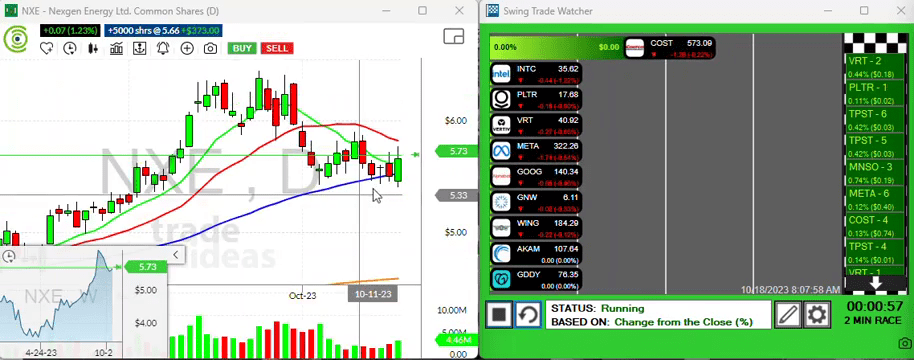

Special Mention: NXE

Lastly, as we’re nearing the end of this blog, it’s worth giving a special shout-out to NexGen Energy Ltd. (NXE). Gold and Silver, including the MVIS Global Junior Gold Miners Index ETF (GDX), were gapping up on that day, shining a light on NXE.

“This was actually the trade of the week. I bought this yesterday at 564. If it gets above its current level, it could be an interesting play.”

That’s all the trading setups for today. Remember, patience is key and it’s important to make informed decisions when taking positions.

Keep a close eye on these players and we’ll review how they have performed in tomorrow’s post. Until then, happy trading, and talk to you soon!

Disclaimer: This blog post is represented as general information only and is not intended as trading advice.