Traders Eye With Andy Market Analysis: Opportunities Amid Uncertainty

Traders Eye With Andy Market Analysis: Opportunities Amid Uncertainty

Hello, traders! It’s Andy here with Trade Ideas. Today is Tuesday, October 17th, and I’m diving into the nitty-gritty of the current market situation.

We find ourselves in what I call ‘no man’s land’. You might be wondering what that means. Well, it’s a strange place where the markets don’t have a clear direction, and it can seem like there’s just not much happening. It’s not necessarily a bad thing. On the contrary, it’s the perfect occasion to take a step back, sit on your hands, and wait for the perfect pitch. However, today, I noticed we are gapping down, with the market opening below yesterday’s low. We’ll have to watch closely to see whether we remain within this tight, somewhat uninspiring range.

Exploring Innovative Opportunities

Despite the status quo uncertainty, I’ve spotted some promising opportunities worth exploring.

I mentioned $MNSO yesterday, and as I assess the market today, I find myself increasingly drawn to it. This is a China play tucked within a reasonably tight wedge. I’ll spare you the actual drawing; you’ll have to imagine it for now.

“Watch for maybe a three-day, four-day high there in that $MNSO.”

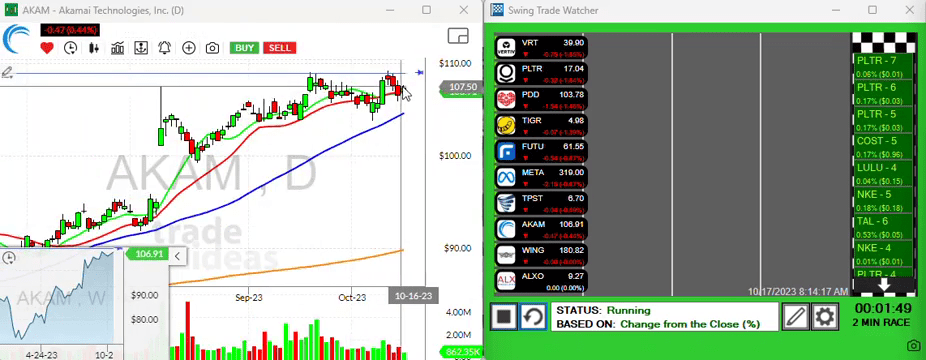

Another one that caught my eye is $AKAM. It’s been in a hold state, not really moving anywhere, but levitating slightly and complying exquisitely with a bullish pattern. So, keep an eye out for a possible three-day high.

Eyeing Pullbacks, Averaging, and Breakout Levels

Next on my radar is $PDD. I’m particularly intrigued by the potential for a pullback. If it happens to dip towards $100, back to its breakout level, it could present an optimal opportunity to step in and make a play. Undeniably, the prospect of catching something on its way down to the $100 level is tempting. I spotted a minor gap down today, which only adds to the appeal.

“Maybe just put you an alert down there…right around the $101 level.”

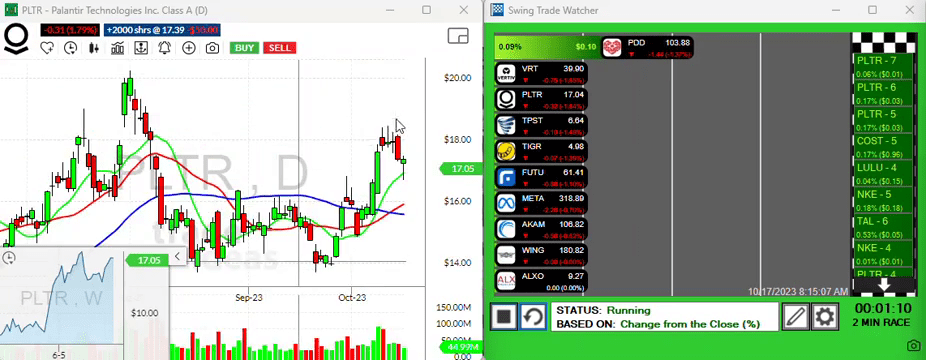

Finally, there’s $PLTR. If we examine its performance, it’s been consistently tottering above its moving averages, which places it atop our potential leader-board. Particularly, its tight tethering to the ten-period moving average from yesterday is compelling. However, it’s starting to gap down, inching ever so close to that level. It would be intriguing to see a break above yesterday’s high in $PLTR.

Wrapping it Up

Essentially, in times of market uncertainty, exercising caution is prudent. So, if you feel tempted to make a play, make sure to do so using small size starter positions. Keep it tight, folks.

That’s all for today. I’ll continue to bring you more insights about the market. Let’s see how the current situation unfolds.

Until then, have a successful trading day, and I look forward to our chat tomorrow. Farewell!