Traders Eye With Andy Market Analysis: Trading Ideas For October 16th

Traders Eye With Andy Market Analysis: Trading Ideas For October 16th

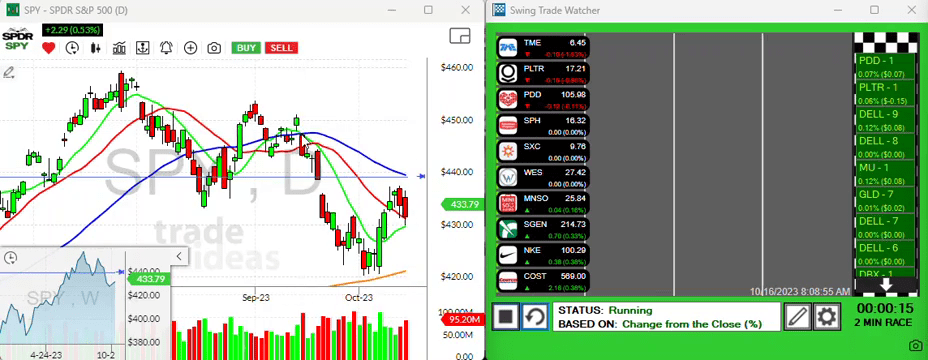

Hello, traders! This is an analysis update for Monday morning, October 16th. The S&P 500 (or ‘spy’ as we traders lovingly call it) occupies our focus, presenting us with some stimulating trading ideas.

Market Update: The S&P 500

The day begins with good news as the spy is gapping up right in the middle of the last Friday’s range. We find ourselves in somewhat uncharted territory, or as some might call it, ‘no man’s land’. A quick glimpse of the situation shows us balanced precariously in the range we’ve found ourselves in.

Interestingly, we’re poised above the ten and 20, but still nestled below the 50 period moving average. I know it can be demanding sometimes, but remember that holding cash can be a strategic position in trading.

“Cash can be a position – especially in uncertain times.”

Over the past weekend, I’ve held onto my cards, choosing not to make any weekend trades. Proactivity is key, but sometimes so is inactivity. It’s all about understanding when to make your move. Keep that in mind before plunging headfirst into the day’s trades.

Stocks Up For Review

While certain Chinese stocks have been pulling back fairly hard in recent days, a few are setting up and grabbing our attention.

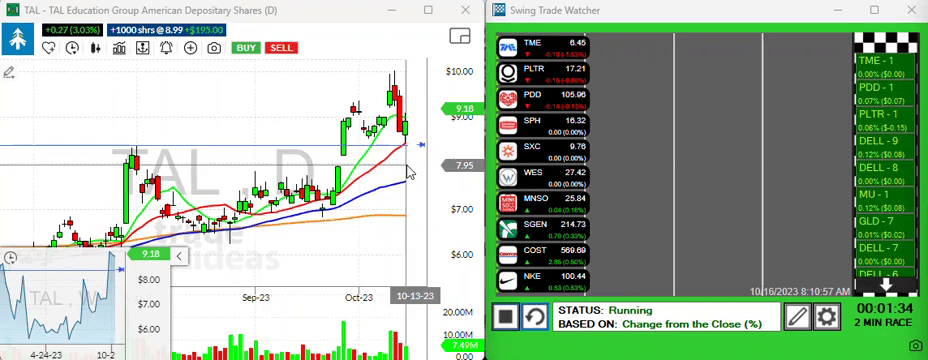

TAL Education Group (TAL)

First on our list is TAL Education Group (TAL). It has just bounced back from this point of previous resistance that has now turned into support. Furthermore, it is currently gapping up this morning above the ten-period moving average. It’s definitely a stock to keep an eye on.

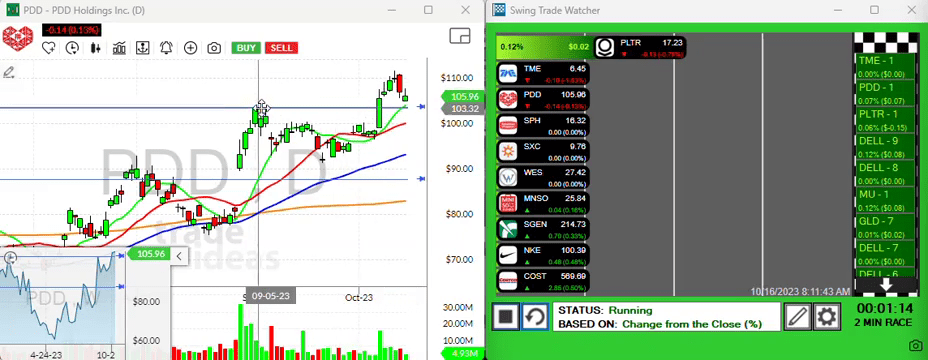

Pinduoduo Inc (PDD)

Next, we have Pinduoduo Inc (PDD). I must admit, I regret missing out on this one at the 100 point, where I had set an alert. Unfortunately, that ship sailed too early in the morning. That said, it seems to be pulling back now, which could present another investment opportunity.

It appears as though it might drop down to the support level, but it’s still a strong chart to consider.

Miniso Group Holding Ltd (MNSO)

We also have Miniso Group Holding (MNSO), which has been comfortably idling in its own niche, sitting above all its moving averages. It presents an exciting opportunity, especially if we see a break above, not necessarily the wick but these candle bodies.

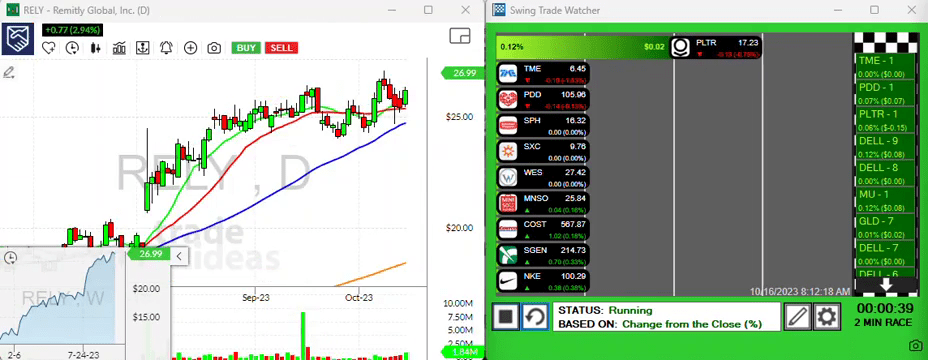

RELY

Let’s also take a quick look at. Its chart is a rather pleasing sight – not pulling back with the market. Despite the drop three days ago, it adeptly bounced right back up, and now seems eager to top out its previous high.

So, ensure you keep an eye out for it.

There are more on my radar, however, these were among the most interesting ones.

Wrapping Up

That’s the batch for today’s trading ideas. As always, keep yourself updated and prepared. The market is forever shifting and it is our duty to constantly adapt. With that, have an electrifying trading day and let’s regroup tomorrow! Adios.