Traders Eye with Andy: Navigating the Market on October 12

Traders Eye with Andy: Navigating the Market on October 12

By Andy Lindloff

Hello, traders! Your old buddy Andy is here with your daily dose of trade ideas. As we peek at the stocking market on this lovely Thursday, October 12th, we’ve had quite a remarkable four days of action.

The Power of the SPY

Taking a glance at the SPY, it’s the bull market that keeps on giving. We’re recognizing an exciting upward trend that set tongues wagging amongst the most experienced traders and newcomers alike. Even though the 50-period moving average invites quite an appealing sense of destiny, it remains to see the true trajectory of the market.

One interesting thing to note is the slight gap up following the CPI number (don’t we all just love a good inflation metric), but let’s park that for now, shall we?

Stocks that cannot be Ignored

Now, my friends, let’s get down to some business. It’s time to explore the stocks making waves and those poised to generate top dollar.

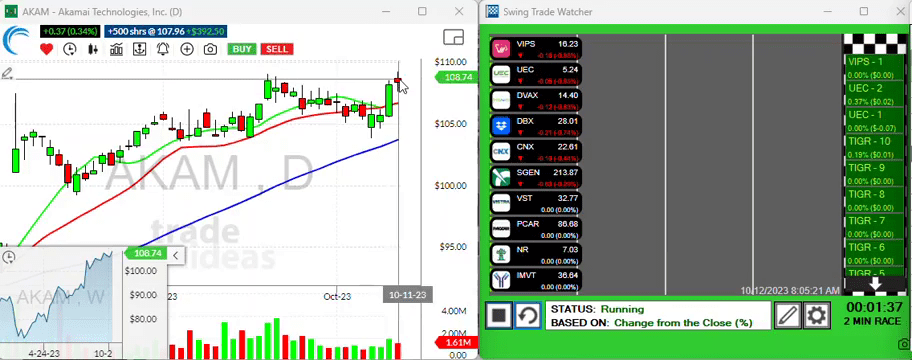

AKAMAI: Go Pause Go Effect

First up, we have Akamai. I’ve been vested in this for a couple of days now and it’s showing great promise. It’s exhibiting a phenomenon that I like to call the ‘Go Pause Go’ effect; this happens when the stock has a decent move, then experiences a doji day or a spinning top day, followed by the anticipation of continuation after that pause day. It’s kind of like watching a suspense-packed thriller – you know something huge is about to happen.

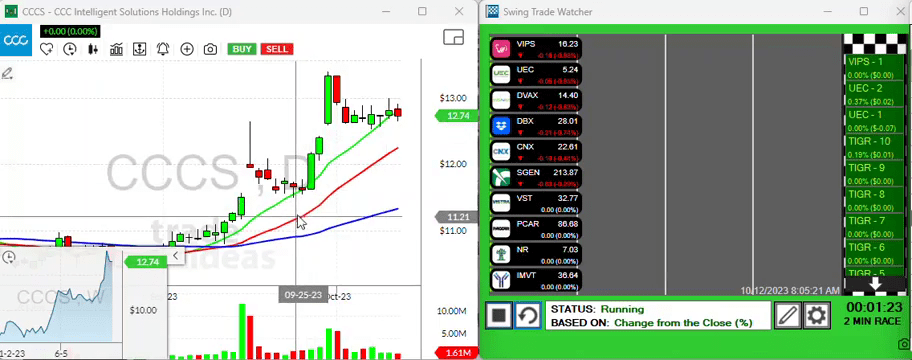

CCCS: The Volatile One

Next in line is CCCS. Yes, she can be a bit of a wild one, but I like how she’s clutching onto the ten-period moving average. Here’s a potential pro tip: Look out for a break above 13. Set up a little price alert there; who knows, it might give you a head start if it decides to break that limit.

LFMD: The Strong and Steady

LFMD is gapping up too, above a set benchmark. While I’d personally like to see it trade through, its chart is undeniably impressive featuring a lot of momentum behind it. Sure, there’s a bit of gap up and I, for one, won’t be chasing it in the pre-market or at the bell. But heck, if it carries on this way, it might just shatter the five-day, ten-day, or even the monthly high.

NEO: The China Contender

Last but not least, we have NEO. Here’s one for the China players out there. There’s something about its daily that I like. It potentially could take out the 925 level and give us some brilliant upward movement.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Phillip Fisher

A Word of Caution

Looking at DELTA, for those who like a bit of bottom fishing, they did declare their earnings this morning. It’s gapping up to a critical level, but tread with caution. The chart does not look pretty. However, if it does manage to soar above the 20-period moving average and overcome the resistance level, it could be in play. Remember, sensible investing means never risking more than you can afford to lose!

Wrapping up

And that, my friends, is it for the day, your inside track to the frenetic world of stocks on this Thursday, October 12th. From Akamai to CCCS, LFMD to NEO, and a word of caution on Delta, we have you covered.

Until we meet again tomorrow, here’s to profitable trading! Bye for now.