Capturing Alpha Amid a Turbulent Market: The Case Study of MNTS

Capturing Alpha Amid a Turbulent Market: The Case Study of MNTS

Hello folks! It’s Barrie Einarson back with another edition of “What Makes This Trade Great”. Today we’re diving into a case which is quite significant in recent trading scenarios – the story of ‘MNTS‘ and how it defies the downward market trend. Prior to proceeding, feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of 15% using promo code BARRIE15.

Observing the Current Market Trend

When we take a look at the S&P 500 Index, often simplified to ‘the spy’, it’s been going through a rough patch lately. The index has been hit hard since around 12:45 pm on a specific trading day.

The Unique Path of MNTS

Contrarily, let’s consider the journey of our star stock, ‘MNTS’ since that very time.

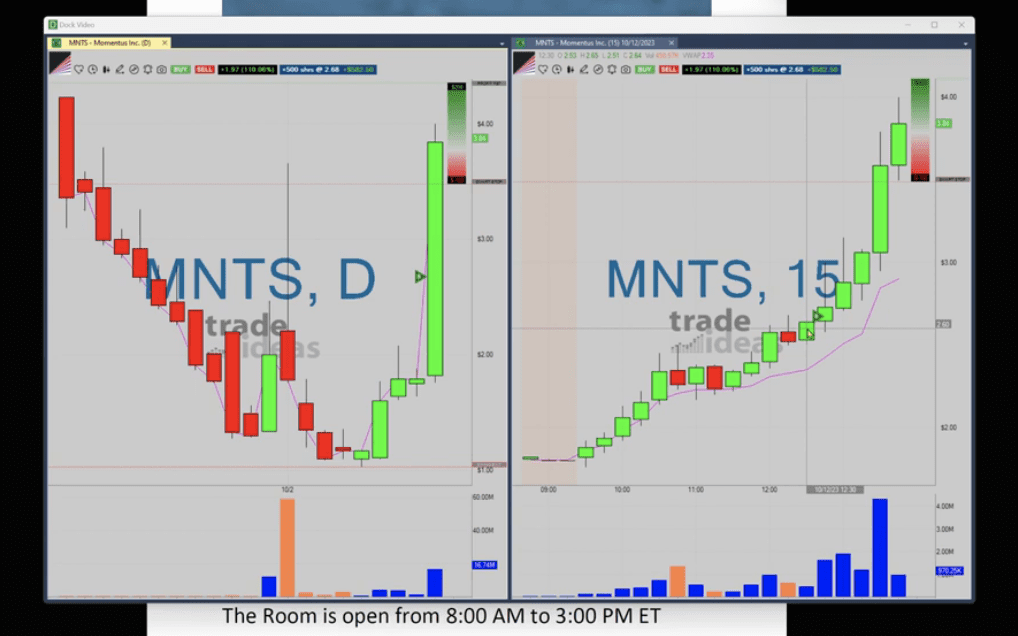

If we plot a line graph mapping the price of MNTS starting from 12:45, we’d observe a unique pattern – an upward spiralling trend. The stock seems to possess an apparent indifference towards the current, bleak trend in the spy, and in fact, it has been moving higher and higher.

This highlights one of the paramount parameters we, as traders, always aim to capture – alpha.

What Makes MNTS An ‘Alpha’ Stock?

Now, one might ask, “What exactly makes MNTS an alpha stock?”.

That’s a great question! Alpha stocks, by definition, are those that don’t necessarily conform to the rest of the market’s behaviour within reasonable limits and show a stark degree of independence from their sector’s general trend.

Isn’t that an accurate description of what MNTS has been doing recently?

Unfazed by the market downsides, MNTS continues to soar high despite the bearish sentiments. This makes it a classic example of an alpha stock that encapsulates the essence of resilient and independent growth.

Spotting Alpha with Momentum Scans

This profitable trend of MNTS came to light through momentum scans, a tool instrumental for identifying stocks with significant price momentum. This particular stock stood out in the occasion of a ten-day daily breakout scan, capturing swift upward movements.

Scans can be incredibly helpful in tracking trajectory of stocks and can provide those golden nuggets of alpha amidst volatile markets. Embracing these tools might significantly boost your trading stratagems and aid in intelligently placing your bets in the stock market.

Wrapping Up

There we have it – a compelling panorama of an alpha stock that pays deaf ears to the bearish market chatter. As traders, these are the kind of independent, high-performing stocks we strive to adjoin to our portfolios.

In conclusion, always remember – a choppy market can at times reveal diamonds in the rough, such as MNTS in our case. My hope is that this case study gives you good insights as you move forth in your trading journey.

Keep your eyes open, continue to scan the market, and you never know, you might stumble upon your own version of an Alpha stock!

On that note, it’s time for me to head back. Stay tuned for more trading tales and remember, there’s a world of opportunities out there in the financial market. Happy trading, and see you all tomorrow!