Does the Chart Confirm the Story? Are You Wrong, or Are You Just Early?

Does the Chart Confirm the Story? Are You Wrong, or Are You Just Early?

Written by Katie Gomez

Most investors have stories behind an investment. Many people come to the stock market because they are set on making a profit from specific stocks or have certain companies in mind. However, just because we like to consume a company’s product does not mean the stock is a sound investment. It’s easy to convince ourselves to invest when it has strong fundamentals. But sometimes, we fail to see what supersedes the fundamentals—the technical data.

Bad timing can be detrimental to your portfolio if your timing is bad or if most of your portfolio’s funds are allocated in that company’s stock. Although you might be right about the company’s fundamentals, if the chart or technical data do not match, you may waste time and money.

Traders can be incredibly stubborn regarding their convictions. While confidence is admirable, avoiding what the chart says can be a painful experience. In other words, when the chart does not confirm the story, you are on a sinking ship.

The market doesn’t care about anyone’s opinion. You have to be willing to wait for the chart pattern (footprints in the sand) to tell you what the herd thinks and where the stock is headed. There are other factors that make a trade successful. Are traders feeling pessimistic or optimistic? Are the bears or the bulls leading? How is the economy looking? The market and traders have a symbiotic relationship, but getting on the same wavelength can sometimes takes time.

Correlation does not equal causation. You can’t assume one attribute will guarantee results; you must look at multiple factors to back your story. So how can you see when the chart confirms the story? Once the price turns back up, breaks the downtrend, and sits on moving averages, the volume comes in, and the price starts to move higher. Only then can you be sure that it is time and that the chart is now confirming the story. It is incredibly frustrating when you know you are right, and it is tempting to let your ego ride it out. Yet, the worst thing you can do is buy high, waiting for people to catch on.

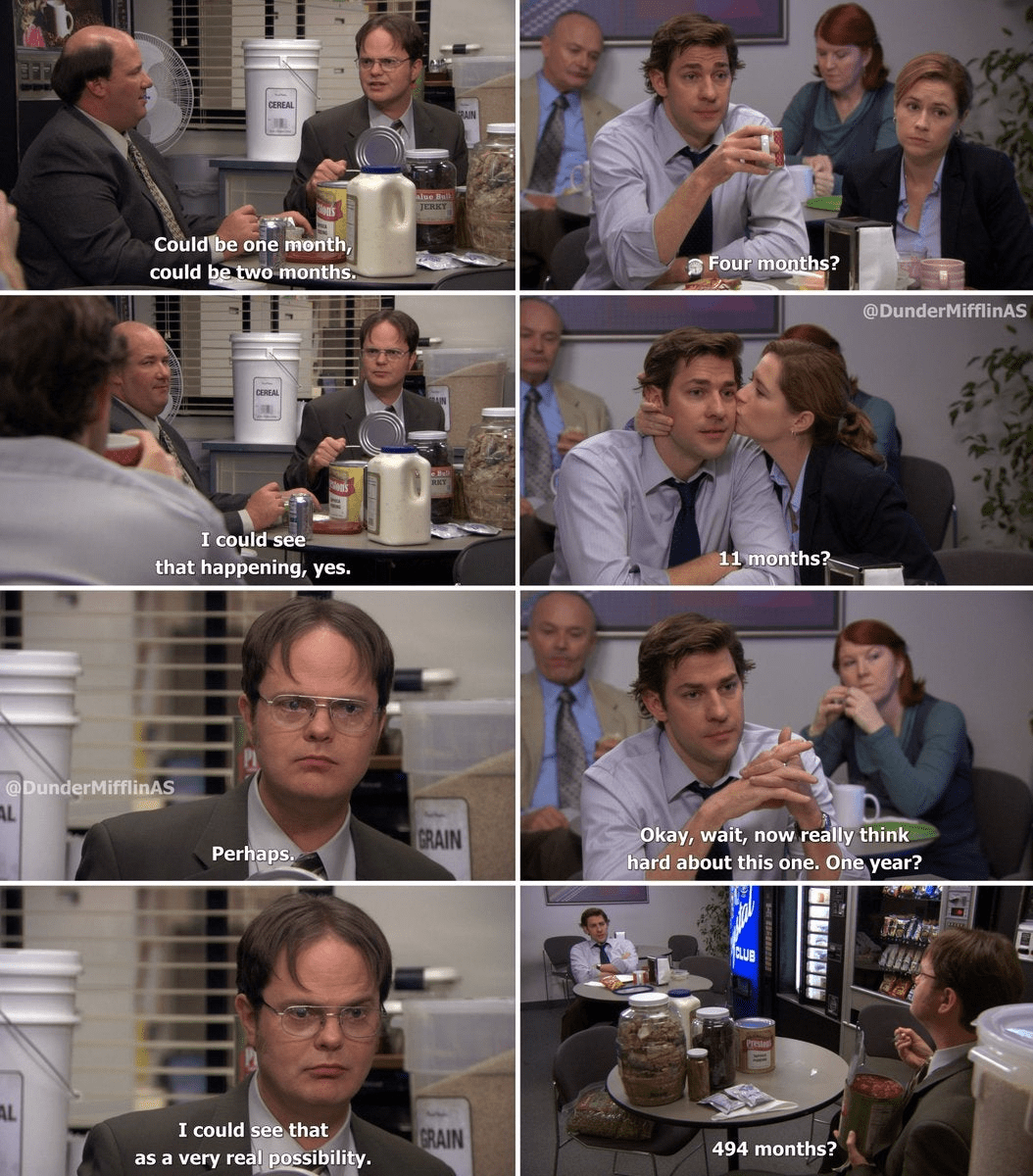

Are you willing to risk the funds while waiting another month, another year, or five years for the market to catch on? The market is always right, and you must learn to follow it and work with what’s happening in front of you instead of waiting for it to follow you.

The market doesn’t believe stories. It believes data and whatever the data is saying. Even though you worry that the stock will gap up the moment you sell, know that it’s okay to let it go because an even worse fate is that the stock will never catch on and you lose everything. That said, the only trader you can control is yourself. You are already waiting and losing money, and the odds are better that you will continue to lose money waiting than the stock miraculously shooting up overnight.

Of course, it will be painful to let go of the stock because you are not just letting go of money; you are letting go of the story. The ego behind the story, the reason you bought the stock, and told everyone else what you thought would happen. Although you think you are alone in this, every single trader has experienced this at least once. Hindsight almost always points to the regret of not selling when you could have just ripped off the bandaid and sold.

What if I can’t let go? If it’s impossible for you to let go, find a happy compromise and sell half. This way, you can still believe the story and be part of the journey. Plus, you’ll be able to sleep better at night knowing you’re better off investing less. If it continues to fall, sell half again until your investment eventually becomes so small it won’t hurt to sell all of it. The less money you risk, the more patience you can practice watching the stock’s price movement, so you can be ready in the wings to return to the game if things change.

Wait a few months and once the market starts to wise up and the chart starts to confirm the story you believed, you can invest more. Unfortunately, individual opinions can’t make prices move; the market holds all of the power. However, this shouldn’t deter you from doing your own research and following your instincts.

Many successful traders have experienced being early and profited, such as Michael Burry with the housing market. Being early isn’t a bad thing, it’s just risky and it takes conviction. It is also not wrong to believe in yourself and the companies that you stand behind. You just have to be willing to risk time and money.

In conclusion, if the chart does not confirm the story, your investments are built on a theory. You can’t expect anything from the market, but you can always hold on to hope. You just have to ask yourself if the price of hope is worth holding onto.

Visit Trade Ideas today for more insight from our experienced traders on how to time your trades and create better habits to transform your investments.