The Age of Uncertainty: Where is the market headed in 2023?

The Age of Uncertainty: Where is the market headed in 2023?

Written by Katie Gomez

Will the stock market go up in 2023? Will my stocks recover? When is the recession coming? These are all the unanswered questions investors continue to ask as if anyone knows the answer. 2022 was a rough year for many investors, but the stock market doesn’t backtrack. It can’t pause to make up for losses. All it does is move forward, just as investors must do.

Uncertainty is the enabler of this future fear-mongering. We are either kept in the dark or aware but left waiting in anticipation. I’m not sure which sounds worse. Even though we may have expectations of what’s to come, like a recession, we have yet to determine when it will debut. Either way, we are left waiting in limbo, unable to make riskier trades, wondering when or if the recession will hit.

Unfortunately, there is no crystal ball or psychic connection behind these predictions. All we can do is look to the past and try to make sense of its relationship to the future through patterns. Investors cling to predictions in an uncertain profession like stock trading, as it is the closest thing to the truth they can access.

All we can do in the wake of the new year and the coming recession is take a step back from current trades and regroup. Focusing on what we can control helps alleviate the fear and anxiety of what we can’t. We can better manage our financial future by preparing for the worst possible outcomes before the recession takes complete control over our accounts. A prediction will only be confirmed once it happens, but we should still prepare for it. With ⅔ of market researchers now forecasting an imminent recession, it’s clear that a recession is coming—it’s just unclear exactly when it’s coming.

Should I start preparing for a recession?

Big names like Jeff Bezos, Michael Burry, and Elon Musk have been more vocal with their current investment strategies, encouraging investors to start getting their affairs in order now to prepare for the recession. The consensus has been to save cash where you can, liquidate assets tied up in holdings, and avoid making significantly risky investments for the time being.

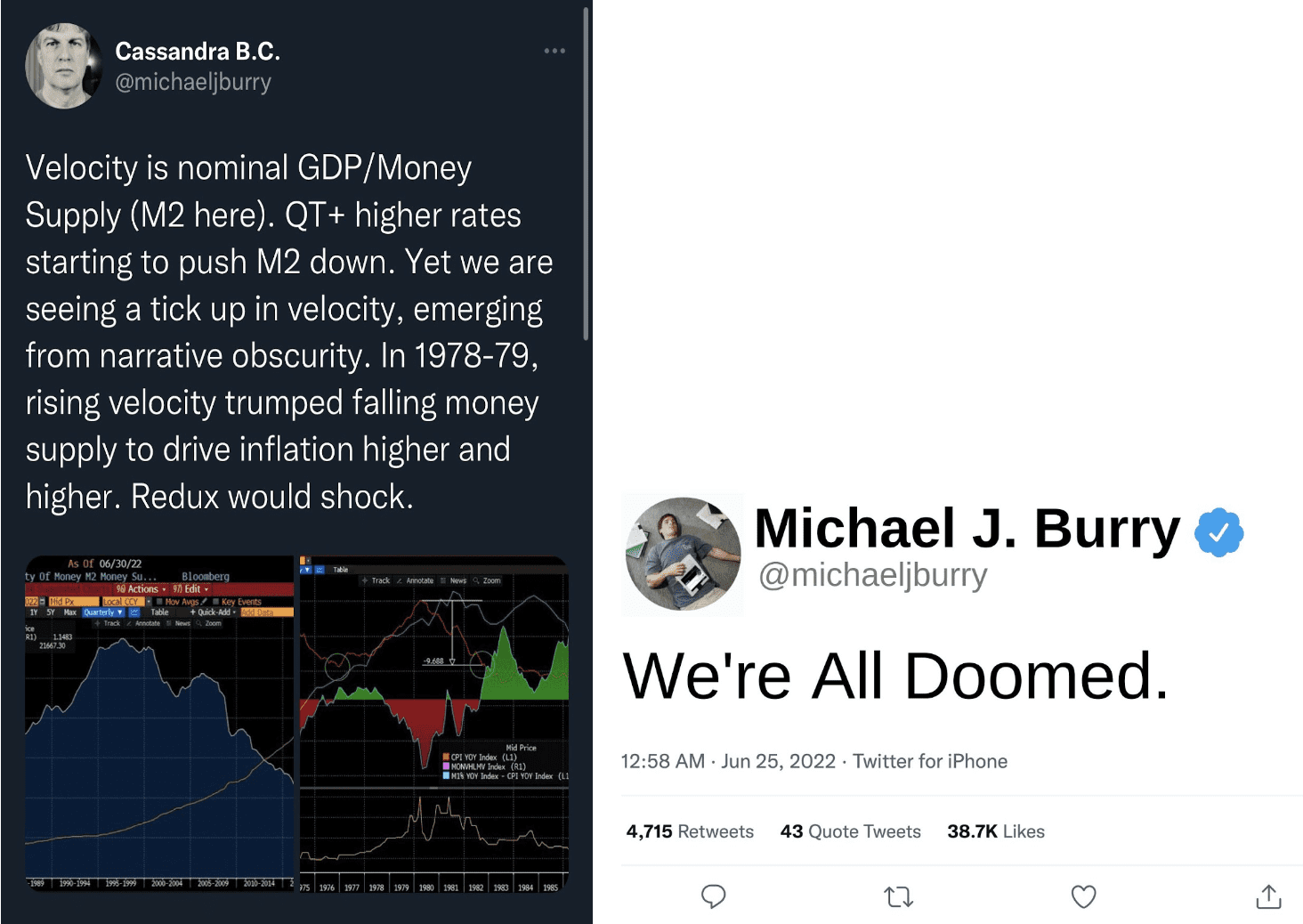

Investing legend Michael Burry is known as the closest thing stock traders have to a crystal ball, as he predicted the last two major crashes. Although some investors still label Burry a pessimistic conspiracy theorist, given his track record, it would be a safe bet to listen to what he says over any other market researcher.

Burry invites people to prepare for what may be the “crash of the century,” an exacerbated rerun of what happened in March 2020 after news of COVID spread and shut down the economy. The Federal Reserve printed $4.5 trillion to recover from this economic shutdown. This explains why we’ve seen everything from gas to grocery prices rise since the pandemic.

Burry claims that there will be another resurgence of inflation, similar to the pandemic and possibly even The Great Depression. This insane amount of printed money since 2020 has led to a dramatic increase in the overall volume of currency held by the public (M2 Money), causing cash and cash equivalents in the economy to balloon.

However, the influx of money isn’t the sole cause of this inflation. It also has to do with the velocity of money: the frequency at which one unit of currency purchases domestically produced goods and services within a specific timeframe. Michael Burry’s recent tweets include images of the Bloomberg Velocity Charts exemplifying an apparent decline in the velocity of money (since the 90s) and M2 money increasing rapidly in the same period. Additionally, this chart shows a recent slight decrease in M2 money, which would evoke hope for less inflation, but the uptick in velocity also currently brings us right back to where we started. These are the small things that only a few people like Burry have caught onto and begun acting on.

Although there will be some opportunity to arise from this recession for select stock pickers, the market will have to get worse before it can improve. It needs time to heal from all the damage done in the last few years.

Media outlets have tried to quell fear and panic by informing the public that a recession is not a cause for worry yet, as it is so far off in the future. However, according to Michael Burry, the recession is already here and we are in it. Stock traders know better than anyone that it’s become too late once the media starts talking about it. Therefore, it is in every investor’s best interest to start trading conservatively and sell all risky investments to prepare for the recession as if it is already here.

References

https://www.bankrate.com/investing/stock-market-outlook-2023/

https://www.thestreet.com/technology/big-short-michael-burry-makes-a-dire-prediction-for-2023

https://medium.com/yardcouch-com/michael-burrys-last-warning-the-upcoming-recession-and-h