Maximizing Profits with AI-Powered Trading Tools

Maximizing Profits with AI-Powered Trading Tools

By Katie Gomez

Artificial Intelligence has made a name for itself in the last 20 years; from digital assistants like Siri to self-driving cars, the number of AI-powered solutions and innovations continues to rise. However, one of the most remarkable successes to date is the impact on stock trading. Stock trading is more accessible and straightforward than ever before, especially for beginners, with the help of AI trading software.

What is Trading AI?

Artificial intelligence has significantly impacted the stock market in the last decade and continues to prove its value for traders. Companies using AI-powered tools offer their clients innovation and opportunity, paving the way for the future. ‘Day Tradingz’ (2022) ranked Trades Ideas as #1 on their Top 5 list of Artificial Intelligence Stock Trading Software.

AI trading companies use various tools, such as machine learning and algorithmic predictions, which allow brokers to customize their exchanges and secure stocks. Additionally, traders can execute their features on ordinary PCs and networks (Powers, 2022). AI allows professional, advanced strategies to be applied easily by any trader, even beginners, which is a total game-changer. We no longer have to spend years of our lives studying the science behind the stock market/trading to find success; in other words, AI trading is a game-changer.

How can I maximize profits with AI?

Although there are several ways to maximize profits as a trader, AI trading is indisputably one of them. The profits induced by AI trading have skyrocketed in recent years, rising from $9.5 billion in 2018 to $22.6 billion in 2020, with an expected rate of an unimaginable increase of approximately $120 billion in 2025 (Datrics, 2020).

AI stock trading invites traders to maximize profits by increasing their research span. AI-powered trading tools use robot advisors to data mine (analyze millions of data points) to execute trades at more optimal price levels. Without AI, it would be impossible for traders to find data of that quantity, especially in so little time.

AI trading has revolutionized the market, viewed as one of the most proactive and efficient ways for traders to manage their trade risks and multiply their portfolio wealth. Traders can apply AI in many ways, using competent trading advisors and analytical software sold online or customized robots/apps for individual trading (Eknash, 2022). Another way traders can maximize their profits through AI trading is through predictive sentiment-based training, saving time and effort and giving them access to new data. These programs further search the web to include data from news and social media outlets in their analyses, making the collected data much more extensive than conventional technical analysis could perform (Datrics, 2020).

Other benefits of AI Trading

AI technology is proven to help traders maximize profits, but it could also help make us smarter. In addition to helping traders better understand and manage their risk, and reduce risk time, AI trading tools can help execute even more complex tasks:

- forecasting/pattern detection

- ease of automation

- higher quality representation of reports (reducing paperwork), increased accuracy

- heightened ability to respond to market changes.

Algorithmic trading vs. AI trading?

AI trading is similar to algorithmic trading. AI took algorithms one step further by integrating deep machine learning to evolve into a more powerful tool for traders—taking automation capabilities to a whole other level. While algorithmic trading revolves around the implementation of trading rules, AI relies on machine learning (learning the structure of the data and making predictions based on its findings). Therefore, AI trading makes it easier for all traders to learn, grow, and profit rapidly.

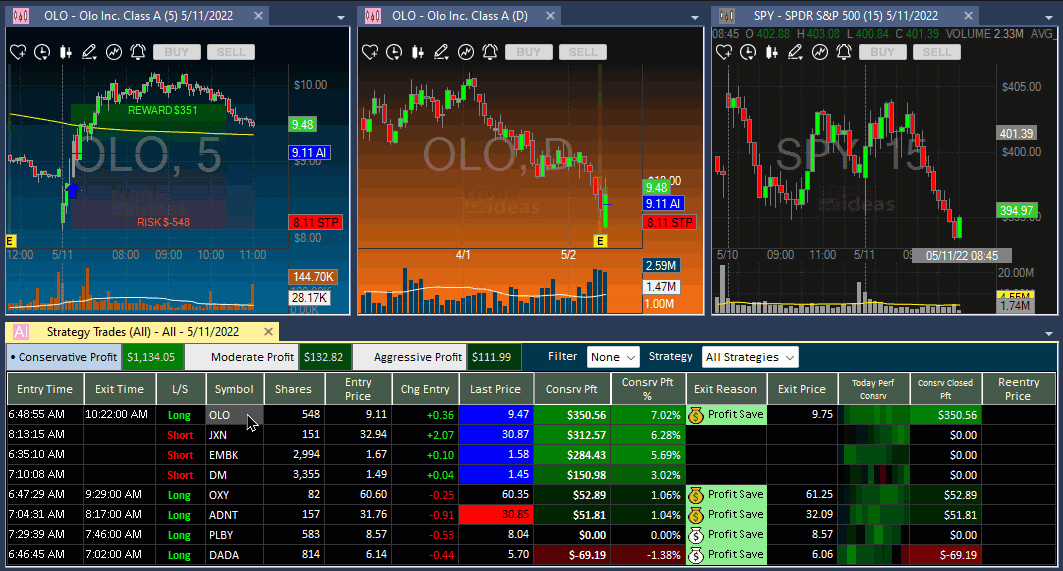

Trade Ideas AI

In the last decade, Trade Ideas has been an innovative company that has taken advantage of AI trading software’s benefits. Trade Ideas uses an AI-powered robot advisor and stock scanner for stock trading, opportunity detection, and backtesting. This AI trading software utilizes a variety of algorithms to help traders reach their potential, increase profits, and expedite progress.

‘Holly’ is a high-performing algorithm that relies heavily on its research and analysis process, considering factors such as long/short positions, fundamental and technical indicators, and various instruments to get the most extensive and comprehensive data set possible.

Conclusion

One of the most accurate slogans that could encompass this generation is “work smarter, not harder,” which AI perfectly delivers. AI trading has not made human traders redundant, but it has closed the gap between casual and professional traders. AI has ceased any advantage professional (day) traders once had over casual (retail) traders. Although AI has been around for a while, these changes are happening exponentially, meaning its role will continue to be more prevalent soon.

REFERENCES

Artificial Intelligence Stock Trading Software 2022: Top 5. daytradingz.com. (2022.). Retrieved December 21, 2022, from https://daytradingz.com/artificial-intelligence-stock-trading-software/

Ai in stock trading: What you need to know in 2020. AI in Stock Trading: What You Need to Know in 2020. (2020). Retrieved December 21, 2022, from https://datrics.ai/ai-in-stock-trading-what-you-need-to-know-in-2020

-, E., By, -, Aspioneer, E. W. & blogger at, Ekansh, Aspioneer, W. & blogger at, & -, E. (2022, May 17). How artificial intelligence trading is making stock market investors smarter. Aspioneer. Retrieved December 21, 2022, from https://aspioneer.com/how-artificial-intelligence-trading-is-making-stock-market-investors-smarter/

Powers, J. (2022.). How ai trading technology is making stock market investors smarter. Built In. Retrieved December 21, 2022, from https://builtin.com/artificial-intelligence/ai-trading-stock-market-tech