How Blackjack and Stock Trading are Similar

How Blackjack and Stock Trading are Similar

By Katie Gomez

People have always compared the stock market to a casino, given they assume gambling and stock trading are essentially the same things. Although there are reasons why they differ, I will discuss the similarities between the stock market and the casino. After conducting some research comparing card games and stock trading, it appears blackjack shares the most similarities with trading. This week, I took time to brush up on my card skills by playing an online casino version of blackjack. I will review three significant similarities between the game and the market in this article.

Using logic and recognizing patterns

Like blackjack, the stock market can be unpredictable and partially based on luck. Moreover, just as successful traders don’t rely solely on luck, the best blackjack players learn skills that increase their chances of winning, like card counting. Players accused of card counting are essentially just being aware of the cards previously dealt and finding patterns, just as a trader looks at historical data to predict future movement. Stock traders recognize patterns, so they feel they have a better probability, the same as card players. The only difference is card counting is illegal to practice while identifying patterns is an admissible and powerful skill to learn as a trader.

Momentum

At the blackjack table, momentum is everything. People flock to your table when you are on a winning streak, and strangers cheer you on and start betting on your chances to win another round. Momentum is invisible, but everyone can sense it, whether at a round table playing cards or watching the market skyrocket. Momentum is no different in trading than in blackjack because it induces the same reactions in the players/traders. When traders see momentum in a stock, it looks like it will continue to increase forever, never coming down. Similarly, when a player has won the last 13 rounds of blackjack, they assume their streak will continue to run hot. This is when the trouble starts.

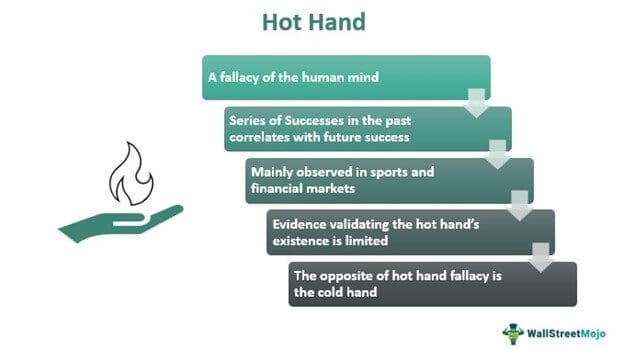

Psychologists initially studied momentum in card games and found the same results in basketball games. They labeled the results as the hot hand fallacy, wherein the player scoring 29 free throws in a row (hot hand) assumes he can make the 30th basket because that’s what happened so far. The problem here is that the player assumes future events will occur based on what has happened in the past; in other words, their logical brain has taken a hiatus, and they are running on pure emotion and adrenaline.

If they could slow down and think about it, they would realize that momentum must permanently cease at one point, and they have no way of knowing if the next hand could be the one to stop it or the 100th hand. However, they always assume that it will be later on down the line. That is why you’ll hear players say “just one last hand” about ten times because they can’t seem to walk away. Greed takes over and clouds reason and logic. The only way to get a player away from the table when they’re on a roll is the harsh reality of losing the next big hand.

I can attest to this feeling while playing blackjack. I chose to go all in when I had the most chips. Why would I risk the highest value I had yet? I could not provide a logical reason, all I knew was I wanted to double what I had, and I had won the last eight rounds in a row, so what makes nine any different? No one is immune to that feeling of greed and its power once it takes root.

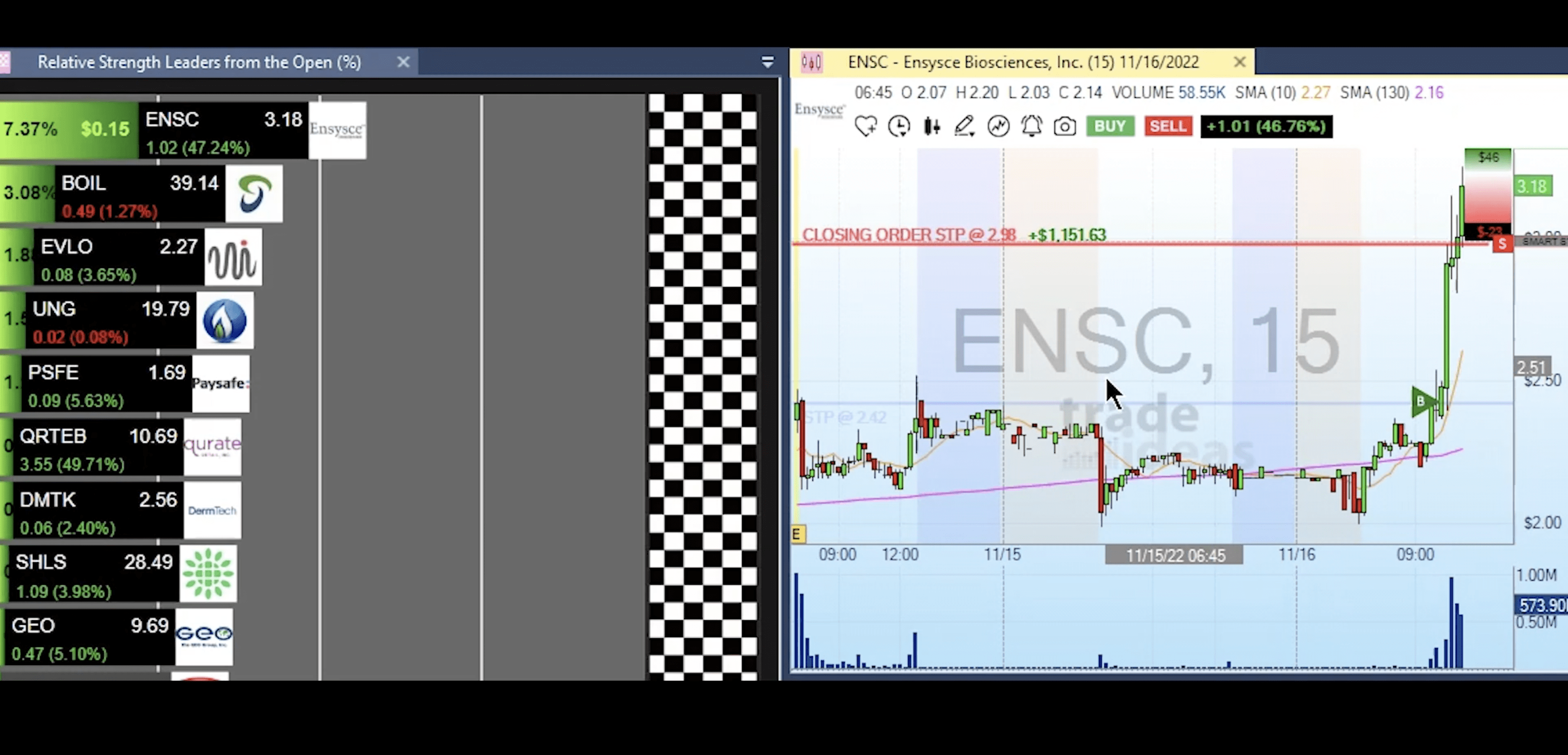

Traders are just as greedy as card players. While card players see momentum and assume they will keep winning hands, traders see momentum and think the stock will keep going up. Traders refuse to sell their position because they would be devastated if they sold too early, so they believe it will be more valuable to keep and sell at its highest; there is only one problem: we have no way of knowing what its highest will be.

Traders are intelligent and skillful. But once they see a stock with momentum, greed blinds them and they become simple-minded and think shortsighted. They become so confident and cocky that they become sloppy and complacent; this is when they start breaking their rules. Once their logic goes out the door, emotions take over, and traders know if there is one enemy to making intelligent trading decisions, it is human emotion.

You become complacent and comfortable when you think you have the game figured out, whether card playing or stock trading. That is the most vulnerable place you can be; it is here where the trading/gambling gods wait patiently to smack you back down to reality.

Momentum can be tricky and you have to keep your head screwed on straight by pausing and deciding to get out, or else you’ll fall victim to it repeatedly without even realizing it.

Visual Appeal & Aesthetic Attraction

Do you ever wonder why casinos are so bright? The bright logos on the slot machines, the colorful array of chips, the symmetry of roulette, or even the satisfying shuffle of a card deck are all intentional subconscious cues that make gambling seem more attractive, even sexy. People spend hours, days, and sometimes weeks in casinos because the design makes it hard to leave. Casinos can also distract players from the concept of time with the bright fluorescent lights and absence of windows. The main reason gambling is so enticing and hard to quit is due to the aesthetic and attraction to the visual.

In the digital generation, most types of gambling have transitioned to apps and websites so you can gamble from home. However, the apps have made it just as visually appealing as if you were playing in a real casino, maybe surpassing the real deal. For instance, in blackjack I played this week, I was unconsciously mesmerized by the fluttering of the cards, the confetti tossed as I won each round, the colorful assortment of chips, and even the symmetry of the cards as they flipped over. I played for almost an hour straight without even realizing it because I had become immersed in the visuals of a simple card game.

Overall, it was a seemingly effortless game to play. Unlike the real thing, I didn’t have to wait for a dealer to shuffle. I just pressed a button. I didn’t have to count my chips because the value was updated and displayed in the bottom corner. It was all incredibly satisfying. All I had to do was click a button. One round could be done in 10 seconds, satisfying that urge for immediate gratification and the shorter attention span we have developed.

On the other hand, stock trading has never been as popular because it doesn’t provide that same sense of excitement from visual appeal alone. In trading, you have to read charts that aren’t as colorful as the cards, you can’t make a trade as quickly as you would place a bet, and although the wins still evoke joy, they are not as visually pleasing as the online version. Of course, stock trading takes more brain power and may not be as visually appealing or immediately gratifying as blackjack. However, as we move into the digital age, we see things start to change as stock trading becomes more and more gamified each year.

Trade Ideas is moving swiftly in the direction of gamification with our innovative new attraction: stock racing. Stock racing is the future of trading because it is visually appealing, uniquely tailored to the individual playing, seamless in its transitions, and efficiently provides results. These stock races offer traders more clarity and efficiency when making trades and allow them to have more fun in the process.

Stock racing is the gamification of data typically found in top lists of ranked market data. So instead of scrolling through stock statistics, comparing, and making predictions, the algorithm does all of that for you. Once you set the parameters, the algorithm starts the race with up to 6 lanes and a colorful logo to display each stock. The race is created and completed within seconds, giving you real-time data to make your trades.

If you are attracted to the momentum, aesthetics, and cognitive thinking (pattern recognition) involved in gambling, you might be interested in trading. The new world of stock trading is more comparable to gambling than ever before, only with less risk for addiction. Stock trading is still risky, adrenaline-inducing, and intense, but it is still safer than gambling. Trading can give you a feeling of financial control and satisfy the urge to gamble outside the walls of a casino.