Golf & Trading

Golf & Trading

By Katie Gomez

If you are a golfer who dabbles in trading or a trader who likes to golf on the weekends, you should know how many similarities the two have. The trading gods and golf gods must be cousins because they have the same sense of humor that affects their discipline. In this post, I will go over some of the best similarities between the two.

First is the importance of practice. Both golfers and traders will highlight the importance of practicing to succeed. The only difference is golfers practice at the driving range or on the putting greens, and traders practice using simulators (paper-trading in the old days) before actually entering the market with real money. Additionally, golfers and traders will agree it is incredibly easier to find success during practice because the stakes are so low. In simulators, you will not lose actual money when you make mistakes, just as you will not tarnish your score in golf from the safety of the driving range mat.

The key is to enter the actual market (or golf course) with the same level-headed mindset you had when practicing. Although it may seem easier said than done, any player or trader can master this new mindset even when the stakes are high, all you have to do is learn to manage your emotions.

Golfers can attest that some of the best players are those with a zen nature, a calm mind, and a good attitude. The best golfers know how to control their emotions by detaching from the outcome. This same lesson applies to those trading stocks. If you can’t keep a level head, you’ll quickly lose both money and confidence. Sometimes you will hit a beautiful drive on the course, but then the wind takes it the wrong way. Or, just as you invest in the “right stock,” it takes a turn for the worse overnight. You must be willing to keep your composure when things like this test you.

Another similarity is finding your comfort zone. By comfort zone, I mean you must learn how you perform your best and play to your personality. For example, great golf players have their go-to shot (fade right, draw left, or a straight stinger). This same aspect applies to trading. A trader must decide which timeframe is best for them, whether it’s intraday, swing trading, or longer term. In any timeframe, you must find where you are most comfortable, then play around and find your sweet spot.

To succeed, you must know your strengths and weaknesses in the game of golf and the world of trading. Once you find that sweet spot, you start to enter a flow state, and the body becomes unconscious, allowing you to perform more intuitively, letting the overanalyzing mind and its feelings of overwhelm, anxiety, fear, and frustration wash away.

Risk management is a lesson you must learn to be a successful trader. If you are someone who struggles with knowing when they should or should not take risks, golf provides another great analogy. I want you to think of course management as managing the risks you take in your golf game, just as you do in the market. For example, if you have a near impossible shot, try switching your club to hit a layup instead of attempting to make it over the water. When the risk does not outweigh the reward, let it be.

If you want to be a successful trader, like golf, you must know how confident you are and what you are willing to risk. Another thing about course management is that you must be adaptable, just like in the stock market. You cannot control the conditions of the course. You must observe and adapt once you step foot on it. Traders know that the stock market is ever-changing, similar to the conditions of a golf course, and you must look alive and adapt just the same.

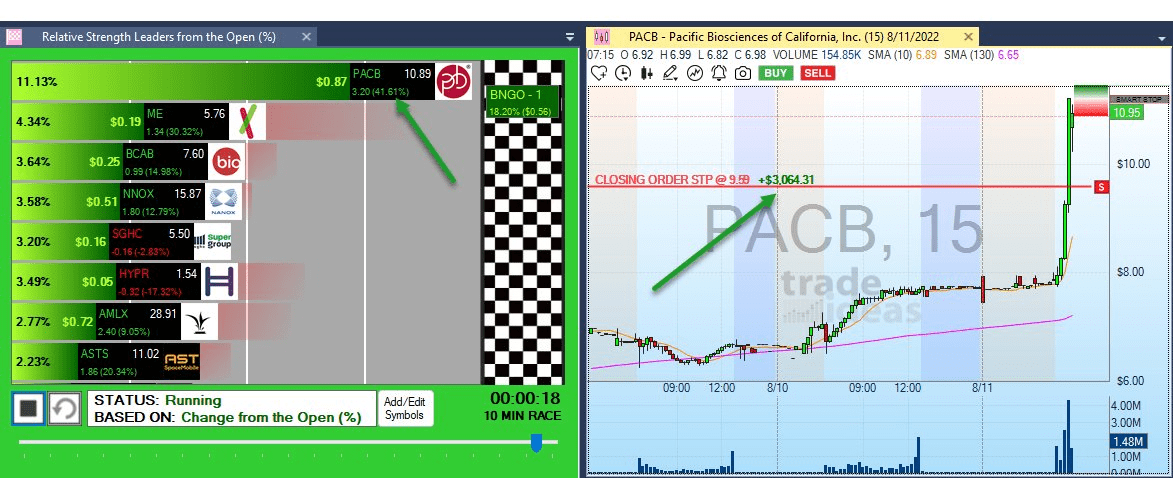

When you trade stocks, if you want to invest but are unsure, risk less of your money to start and watch the outcome. Using a tool like the Trade Ideas Stock Races will also help you increase those odds and lower your risk because you will know where the strength is in real-time. When you learn to play the odds and not act impulsively is when your mindset starts to change.

Finally, both golf and trading have cruel senses of humor, and partaking in either can sometimes break your spirit. Therefore, you must learn how to move on and release control. Golf and trading are not for the faint of heart; it all comes down to how quickly you can bounce back, taking calculated risks, and learning from your mistakes while keeping your cool. In golf, you must learn to accept bad bounces, and in the market, you must be willing to accept bad trades. It’s the game of life—take the good with the bad. If you are one to let trading or golf get the best of you, know that you are not alone, they are not easy activitie. That said, the more challenging the journey, the sweeter the reward.

In conclusion, if you are a trader and do not play golf, I recommend you try it. The game of golf is not only a perfect analogy to trading, it will offer you new opportunities to practice these skills away from your computer. The lessons from one will carry to the other, and the more you practice, the more automatic these habits will soon become. To recap, the five ways golf and trading are comparable are:

1.) practice is key

2.) keeping your cool and managing emotions

3.) playing to your personality & finding where you thrive

4.) risk management vs. course management

5.) accept you will have bad days and learn how to bounce back

Once you notice and apply these similarities, you can see that although challenging and frustrating, golf and trading can be incredibly fulfilling passions and even careers—if you can learn to play the right way.