The Worst Mistake a Stock Trader Can Make

The Worst Mistake a Stock Trader Can Make

Written by Katie Gomez

What to know BEFORE you put your money where your mouth is:

Did the rush of adrenaline lure you into the world of stock trading? Were you then humbled by the complexity of the market and discouraged from continuing? Well, you are not alone.

Thousands of people get enticed into entering the world of trading each year. From clickbait news to real anecdotes, the glamorous life of successful stock traders is intriguing. However the dazzling light dims as reality sets in, it only takes one fake tip or one wrong risk, and your hard-earned money is gone and your confidence shattered.

We live in a generation of impatient and hungry minds—we want it all right now. When instant success doesn’t occur, we label ourselves a failure and move on to our next endeavor. If this sounds like you and your experience with trading, forgive yourself. You do not have to quit trading, you do not have to risk more money, and you especially do not have to play the victim any longer. All you have to do is practice.

That brings us to our pick for the #1 mistake traders can make:

You invest your money into the market before you practice.

Consider yourself to be the average trader. You are not a bad trader, you’re just inexperienced. The average trader is not taking time to practice their skills by testing theories before investing their money.

Trading is a skill to develop, not a bet you can wager. If you want to stop blowing up your account every time you make a wrong choice, you have to commit to making this one change:

Start by investing a resource far more valuable than money: your time.

When you stop thinking of trading as gambling, you see it is just like any other skill. Given enough time and the right resources, trading is a skill we can harness and grow into a business. Like gambling, trading involves luck; but with the right tools, your chance of success is far greater than a hand of Blackjack. You have to be willing to work smarter, not harder.

Generally, a new trader will often have some beginner’s luck. This luck can lead to overconfidence, causing you to risk and lose your money. Inevitably, this loss can leave anyone feeling discouraged. This cycle humbles the new trader, leading to expensive lessons until they eventually decide to quit. Although no stock trader is immune to losing money, especially in the early stages, we should not be losing money as we learn.

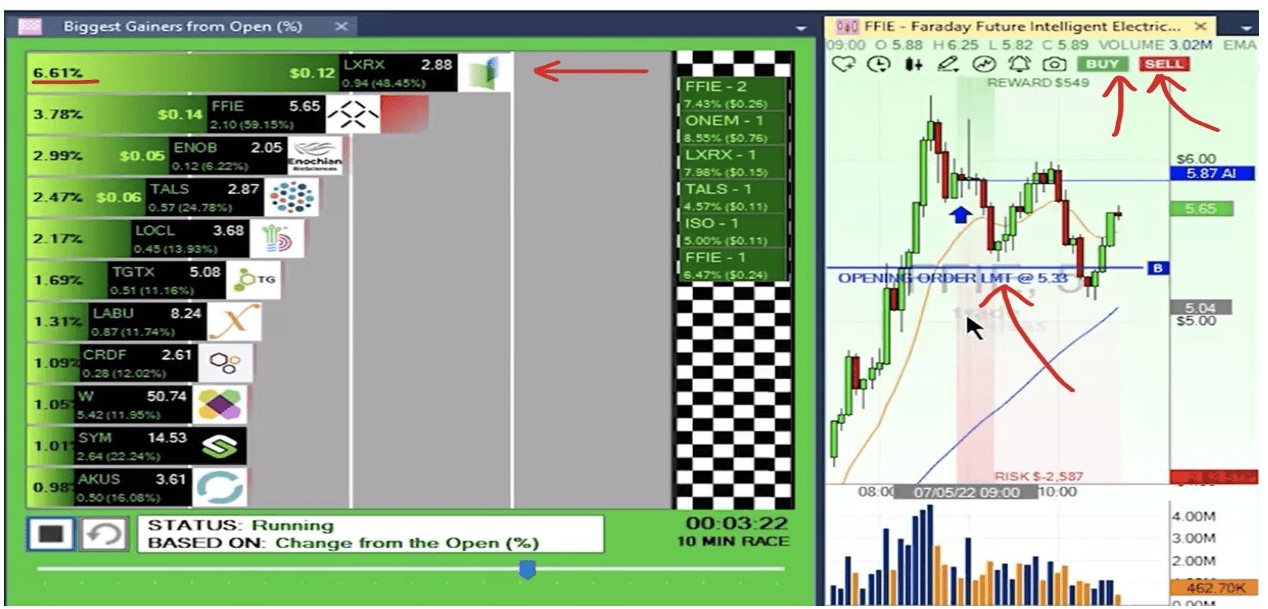

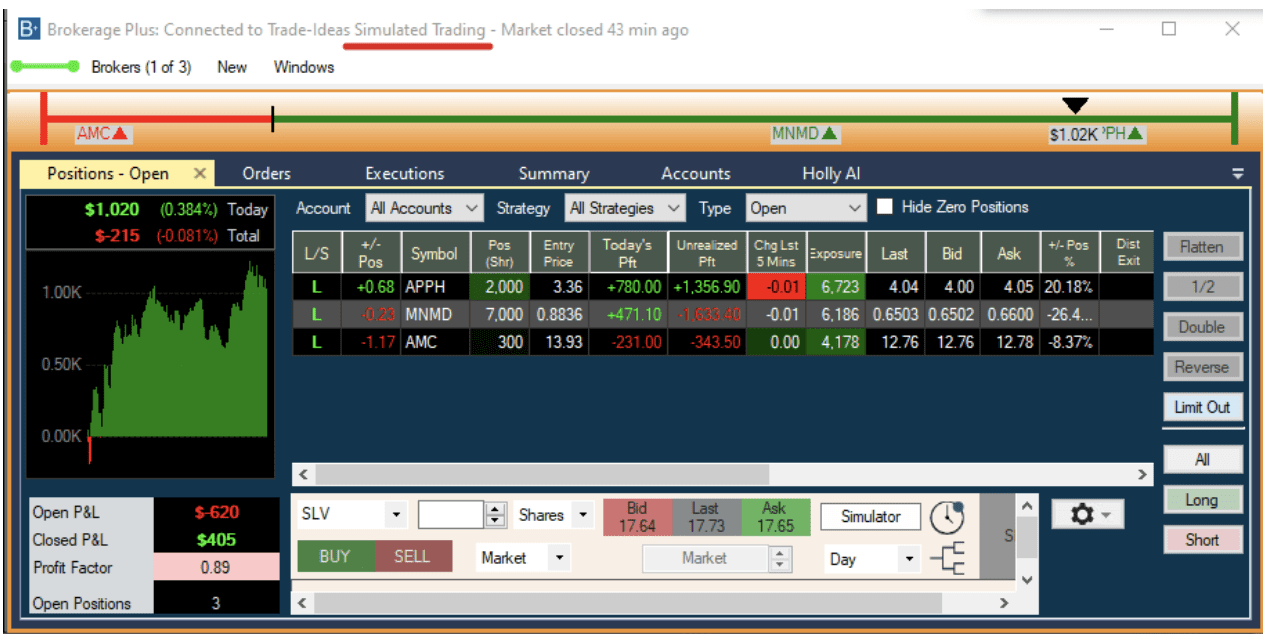

This idea inspired Trade Ideas to develop simulated trading, so you have a space to test your ideas without the risk of a monetary penalty. Just as a golfer needs to spend time at the driving range before he wagers bets at the club, a trader needs time to practice without investing real money. You work hard for your money, so why should you risk it on a whim? You should be testing all your ideas for free, without your back against the wall.

Another way to use this simulator is to imagine you are a scientist. Although, instead of testing your hypothesis in a lab to determine its validity, you will test your theory in a trading simulator before investing real money in the market.

The Trade-Ideas simulator takes the pressure off the situation and allows you to slow down and make wiser decisions. Without this added pressure, you are free to learn from your mistakes without the fear of losing a penny. This simulator also guarantees a way to learn and grow trading skills while saving you money. Every new trader makes mistakes, but that does not mean your mistakes have to cost you.

Here is one final message to the new traders who got knocked down too many times and are ready to give up: you have to understand that the stock market is not your enemy. It is your impatience and ego that you must conquer to succeed in this stomach-churning, erratic, and yet enchanting world of stock trading.