Archive for May 2012

Bleeding Edge Probability Analysis

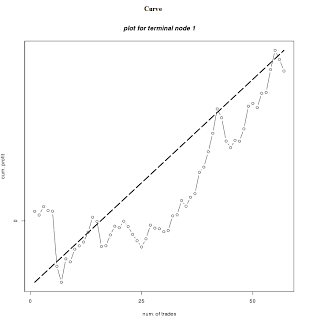

Bleeding Edge Probability Analysis In our previous post about the danger of pattern recognition, “Don’t be Fooled by Pattern Recognition”, we discussed some of the underlying problems associated with trying to discern probabilities by visually examining chart patterns. Pattern recognition is a subjective and very difficult investment/trading discipline to scale successfully. There are many reasons for this and we drew parallels…

Read MoreDon’t be Fooled by Pattern Recognition

The Lure of Pattern Recognition (Be Very Careful) Everyone who is in the market is looking to do the same thing, make money. Institutions and hedge funds call this “alpha”. The game of Making Money is a very competitive environment. When you place a trade you are competing with highly funded well staffed opponents. The efficient…

Read More